USD, EUR, JPY, AUD flows: USD stays firm

USD gains continue but stretched against AUD and JPY

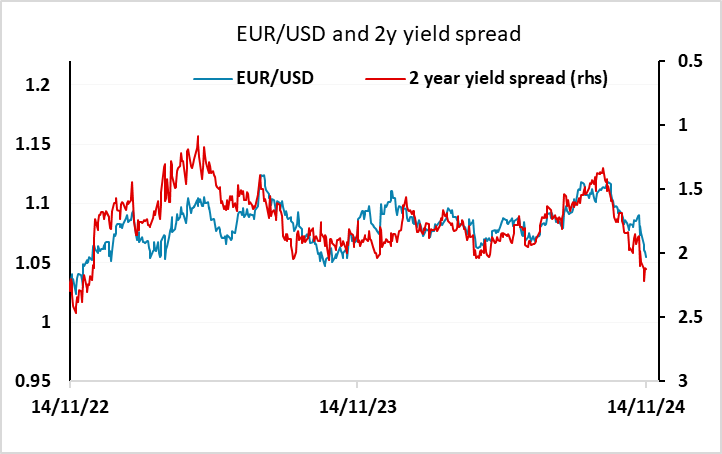

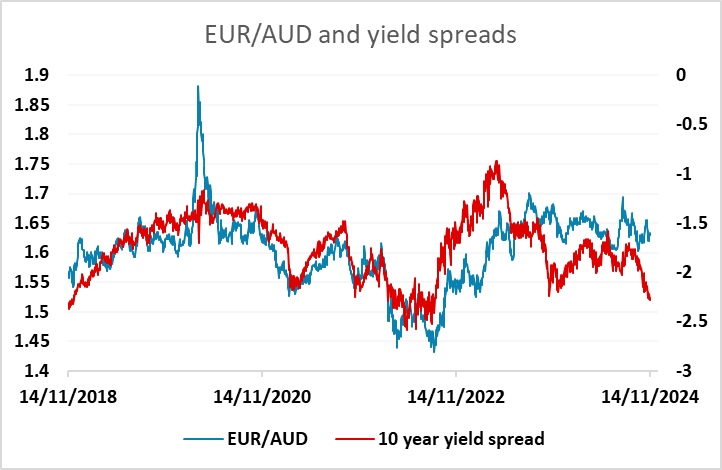

The USD continued to advance overnight, once again driven by rising US yields. However, the rise in US yields was broadly matched elsewhere, so there hasn’t been a great deal of movement in yield spreads. The biggest losers overnight were the AUD and JPY, with the AUD slipping steadily lower after the Australian employment report, which showed a modestly lower than expected rise in employment. However, the data was not notably weak, and the AUD’s weakness looks to be more related to concerns about the impact of higher US tariffs on China in particular and world trade in general. Nevertheless, yield spreads suggest the AUD is cheap both against the USD and on the crosses, and EUR/AUD in particular looks to have downside risks.

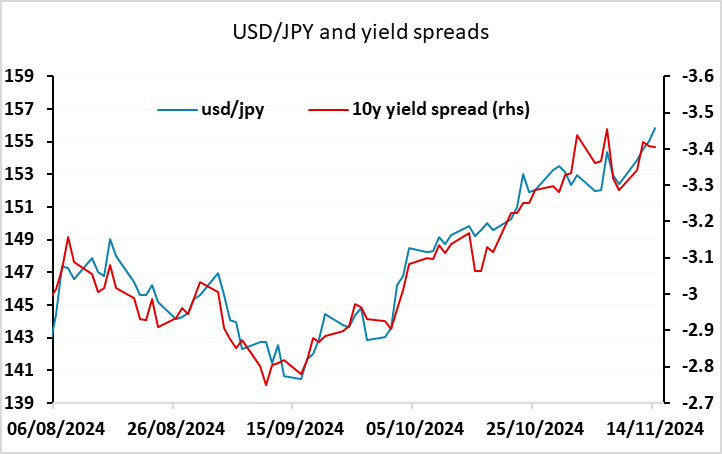

JPY weakness looks to be partly momentum driven and partly a result of a lack of pushback from the Japanese authorities. While JGB yields have risen with US yields, we haven’t heard much concern out of Japan about JPY weakness, except for some comments from the previous FX “diplomat” Kanda. But yield spreads suggest the USD/JPY move is overdone above 156, and we are approaching a big retracement level at 156.67, so we would see the main risks for the JPY as on the upside from here in anything other than the short term.