USD, EUR, JPY, AUD flows: USD slightly lower post-FOMC

USD slips lower post-FOMC. Scope for modest JPY recovery on crosses

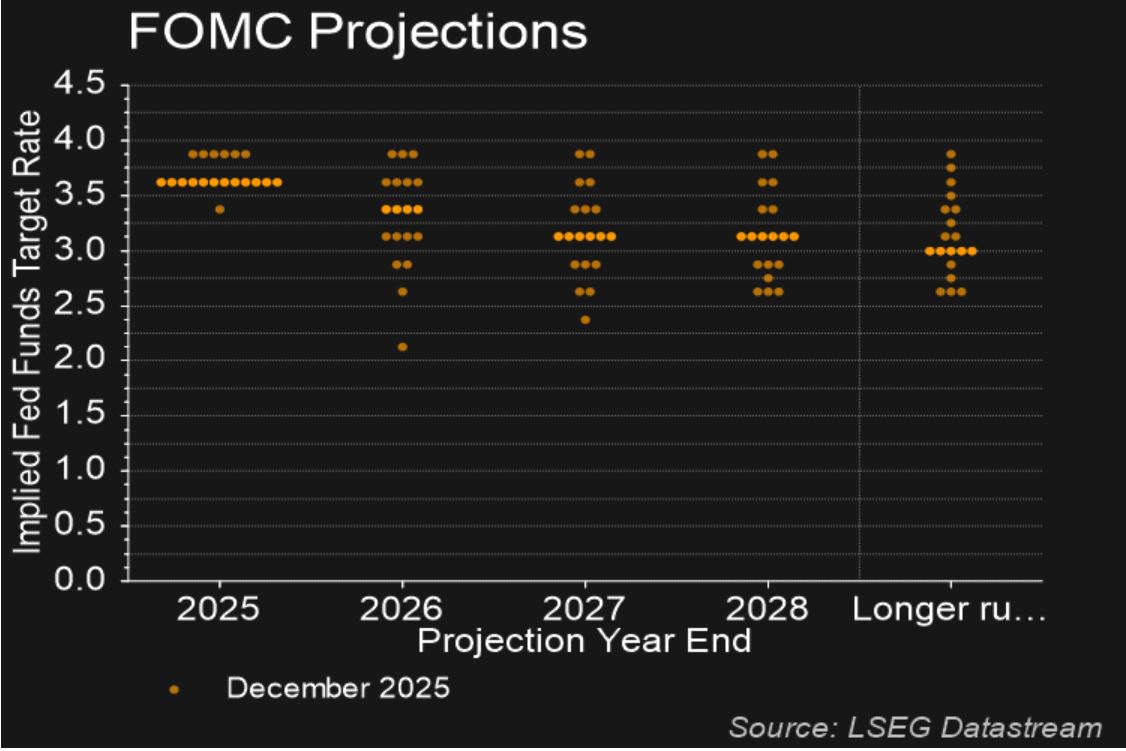

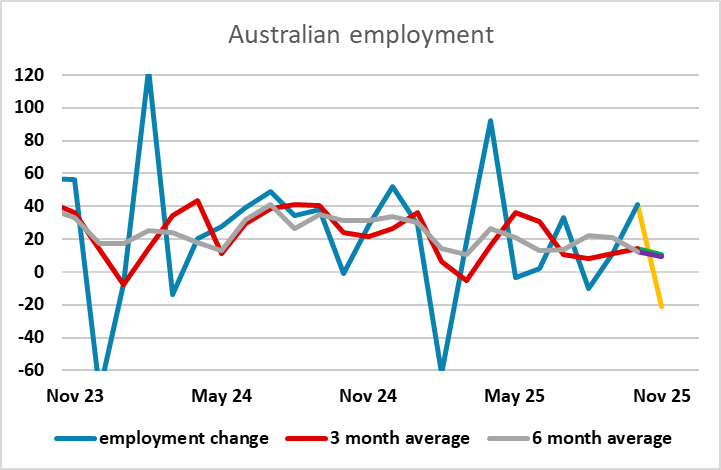

The FOMC produced no real surprises, with the 25bp cut coming as expected with dissents in both directions and Powell suggesting a near term pause, although there was still a bias to ease. The dots continue to indicate that the median FOMC member only sees one more cut in 2026 as opposed to the two (and a bit) priced into the market, but this was also the case in September. US yields actually edged a little lower after the meeting, and the USD has similarly dipped, with little movement in the crosses save for the AUD which has slipped back after a weaker than expected Australian employment report.

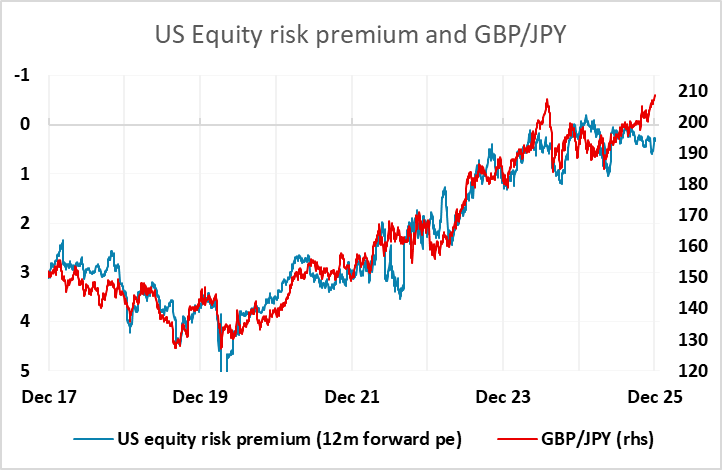

However, US yields are a little lower and equities have also dipped overnight because of some concern around Oracle’s AI business, both of which suggest some rise in equity risk premia, and this should be mildly supportive for the JPY on the crosses. EUR/JPY is hovering close to the all time high printed on Tuesday, and should fall back away from there near term, although we still see BoJ intervention as likely to be necessary to turn the JPY trend longer term.