JPY flows: JPY stays soft as S&P hits new highs

JPY weakness on the crosses continues to be connected to strong US equity performance.

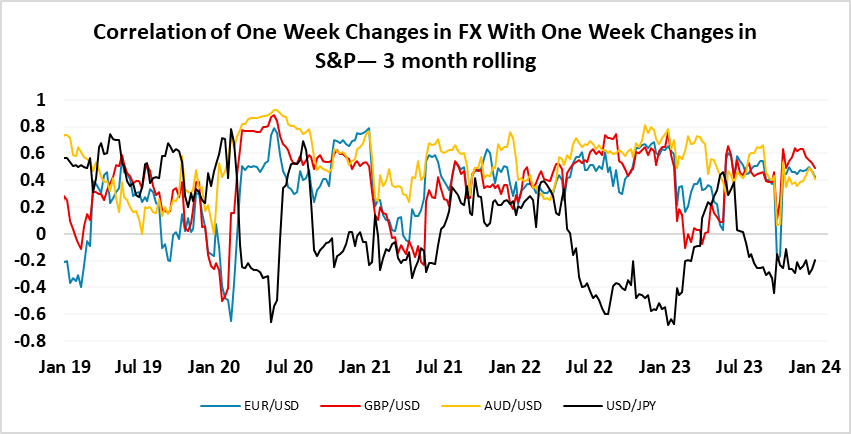

Very little on Monday’s calendar with no major FX changes from Friday. However, the S&P made a new all time high late on Friday, and the positive equity sentiment is keeping the JPY on the back foot. CAD/JPY broke to its highest since November late on Friday, and the JPY remains generally soft on the crosses on the back of the stronger equity market. Equity strength continues to be USD negative, with the riskier currencies retaining a consistent positive correlation with the S&P, while the USD/JPY correlation is much weaker.

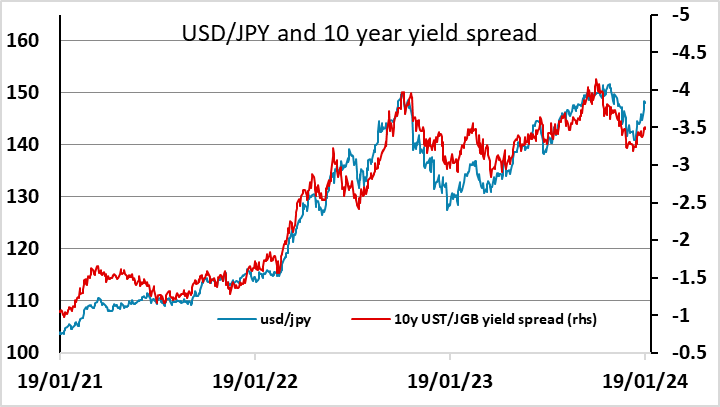

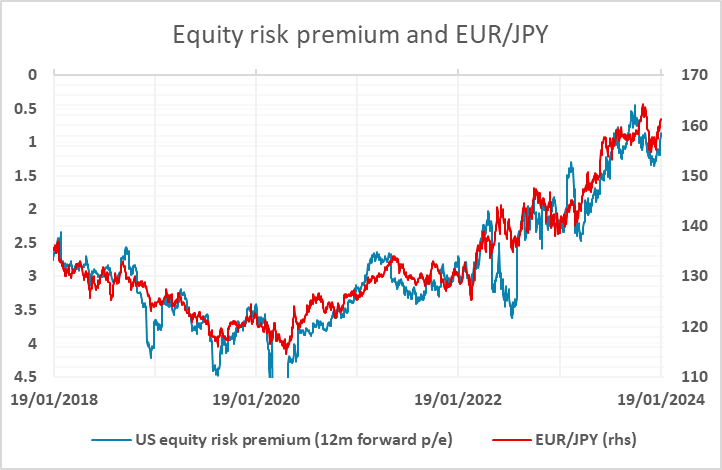

USD/JPY continues to move ahead of the correlation with yield spreads, suggesting some of the weakness is equity related JPY cross selling. We remain sceptical at the upside scope for the S&P medium term, as the low level of equity risk premia and full employment level in the US are hard to square. There simply isn’t likely to be unusually high US corporate earnings growth in this environment. So we see the JPY as undervalued here, but there is nothing on today’s calendar to change the current sentiment.