AUD, JPY, SEK flows: AUD firm, JPY weak, SEK down slightly

AUD benefits from strong CPI, JPY remains under pressure in risk positive trading, SEK reocvery moderated by higher unemployment

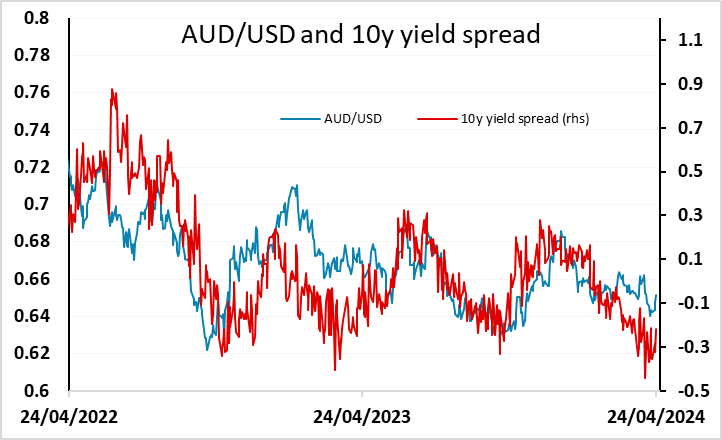

Riskier currencies continued to perform well overnight, with the AUD in particular doing well after stronger than expected Australian Q1 CPI. This had the effect of completely eliminating market expectations of RBA easing this year. The curve now looks for rates to remain unchanged through the year. AUD yields are higher along the whole curve, but even so, yield spreads with the USD are not suggesting further significant AUD gains at this point. The recovery in risk and the rise in AUD yields ought to mean that the low end of the range below 0.64 is now out of reach for the foreseeable future, but it is still likely to require lower yields in the US if AUD/USD is to press towards this month’s highs above 0.66. For now, a mild upside bias should persist, but we are likely to remain closer to 0.65 than 0.66.

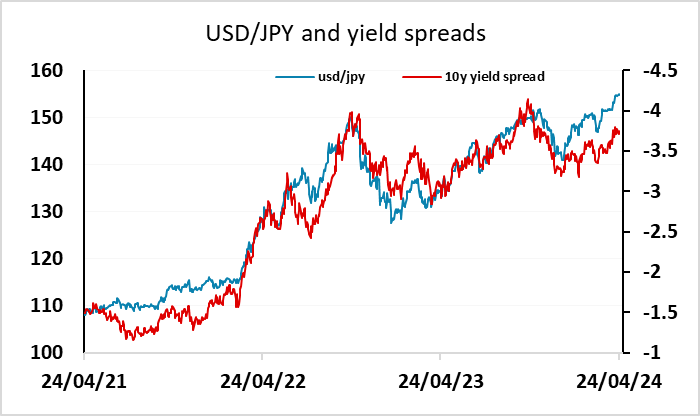

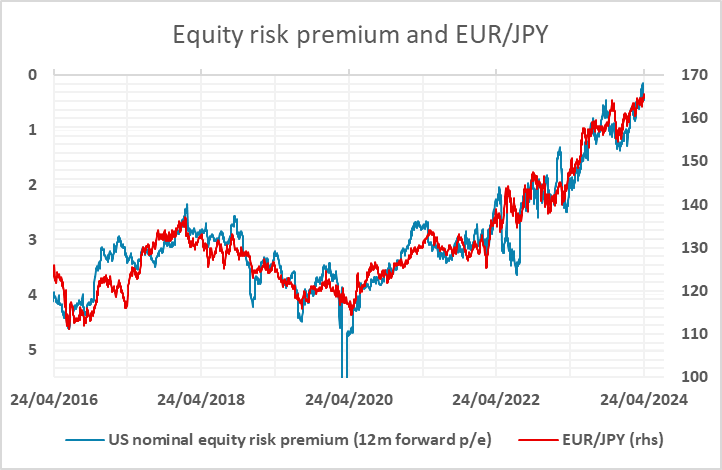

The risk positive tone maintained the downward pressure on the JPY overnight, and USD/JPY has hit another 34 year high at 154.94 this morning. We are definitely getting close to intervention levels here, with the rise in USD/JPY and EUR/JPY coming at the same time, and not being supported by yield spreads or even any significant decline in equity risk premia, with the US risk premium somewhat above where it was a week ago. We would be wary if we see a break above 155 in USD/JPY.

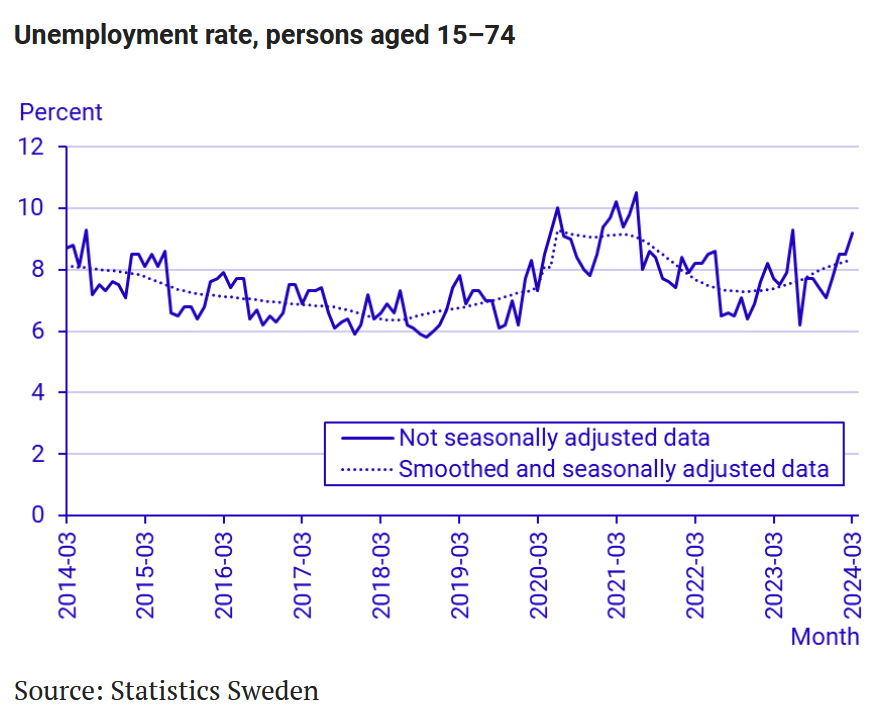

This morning we have had Swedish unemployment data which has come in above expectations at 8.3% on a smoothed, seasonally adjusted basis. This has sent EUR/SEK slightly higher, but the reaction is modest and the scandis are also benefiting from the more risk positive tone and the better European data yesterday.