GBP flows: Little reaction to Dhingra speech, but...

Arch-MPC dove Swati Dhingra has made predictably dovish comments in her latest speech. Little GBP impact, but GBP risks are on the downside given current market pricing

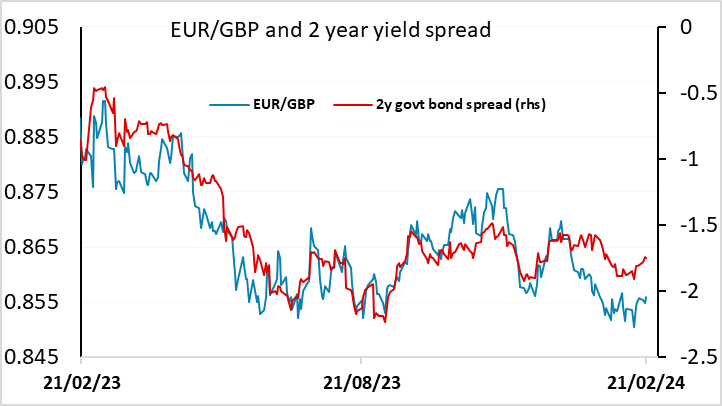

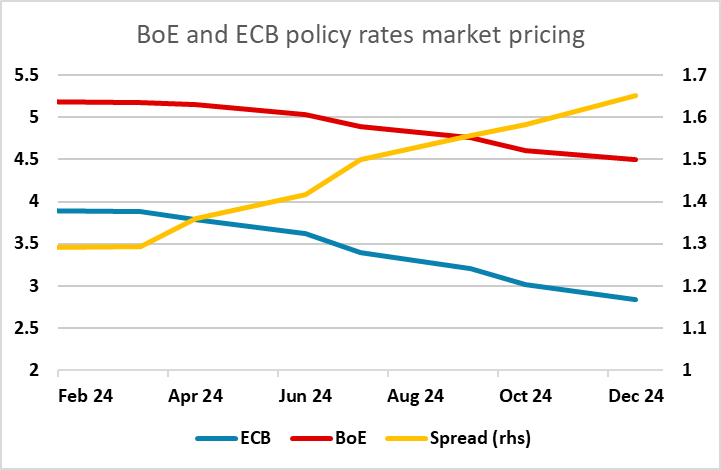

There’s nothing particularly surprising in the speech from BoE MPC member Dhingra, who is the arch-dove on the committee. She notes that “waiting for lagging indicators of domestic relative price growth to fall sharply before reducing rates comes with a cost of foregone improvements in living standards”. This is hardly surprising from someone who already voted for a cut in rates last month. It is clear she will vote for a cut again in March, but there is little realistic chance of anyone else joining her. However, the comments from governor Bailey yesterday, despite being upbeat on growth, did suggests the possibility that a cut could come as early as May, in indicating that he MPC did not need to wait until inflation had fallen below target to cut. In practice, CPI may well drop below 2% in the April data, but this will not be released until after the May meeting. Much will depend on the data between now and then, but we still see a good chance of a rate cut in May, which is currently only priced as a 20% chance. This suggests downside risks for GBP, as there is scope for UK yields to fall, and yield spreads already suggest some upside risk for EUR/GBP.