Mexico GDP Review: 0.2% Growth but Still Subpar

INEGI released Mexico's Preliminary GDP for Q1 2024, showing 0.2% growth, slightly above expectations. Annual GDP slowed to 2.0% from 2.8% in Q4 2023. The economy is losing momentum due to tight monetary policy and weakened U.S. demand. Agriculture contracted by 1.1%, Industry by 0.4%, while Services grew 0.7%. Forecasts suggest a H2 rebound with moderated monetary policy and government-led construction projects. However, supply-related agricultural price hikes may pose inflationary challenges.

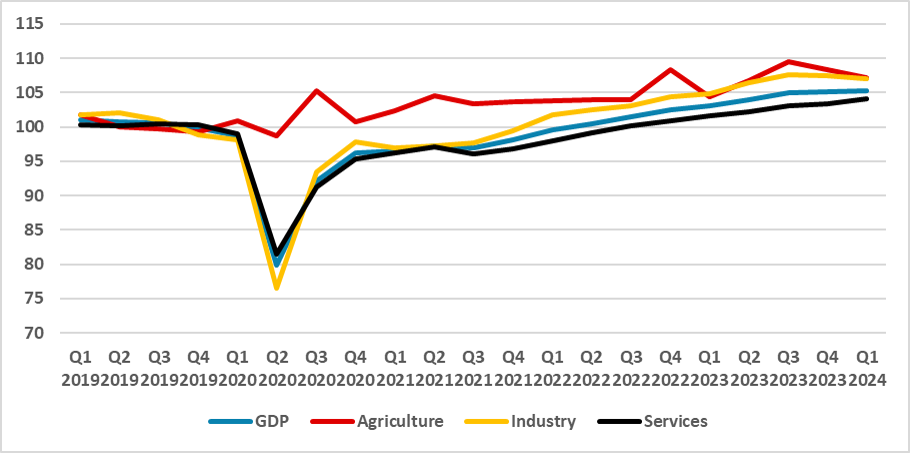

Figure 1: Mexico’s GDP (2019=100, Seasonally Adjusted)

Source: INEGI

The Mexico Statistics Institute (INEGI) has released the Preliminary GDP for the first quarter of 2024. The figures show that the Mexican economy has grown by 0.2%, a bit above market expectations (0.1%), according to the Bloomberg Survey and our forecast (0%). On an annual basis, GDP growth decelerated to 2.0% from 2.8% in the last quarter of 2023. However, the picture it paints does not change our previous view much. The Mexican economy is finally losing some momentum after two years of strong growth, a consequence of tight monetary policy, weakening demand from the U.S., and the ending of the recovery of the services sector.

Looking at the specific numbers, the Agricultural sector has seen the biggest drop, contracting by 1.1% in the first quarter. The Industry sector has contracted by 0.4%, we believe influenced by the contraction in manufacturing, with lower exports to the U.S., and Construction, which is reducing its activity in the latest months. Some good news could be seen in the Services sector, which actually grew by 0.7%. It is possible that the services sector will start to show some deceleration in the next quarter in response to weakening demand, both internally and externally.

Looking forward, some revisions to growth forecasts in Mexico are likely to be made. We believe this stagnation is likely to revert in the second half of the year as less tight monetary policy starts to feed through and additional construction projects pushed by the government kick in. For the central bank, we believe weaker economic activity is likely to diminish the output gap, which is now positive, moving closer to a zero-gap. However, the rise in agricultural goods due to supply problems could indeed cause some inflationary issues. We believe Banxico will continue to cut rates but at a moderate pace, which means keeping the current 25bps we have seen so far.