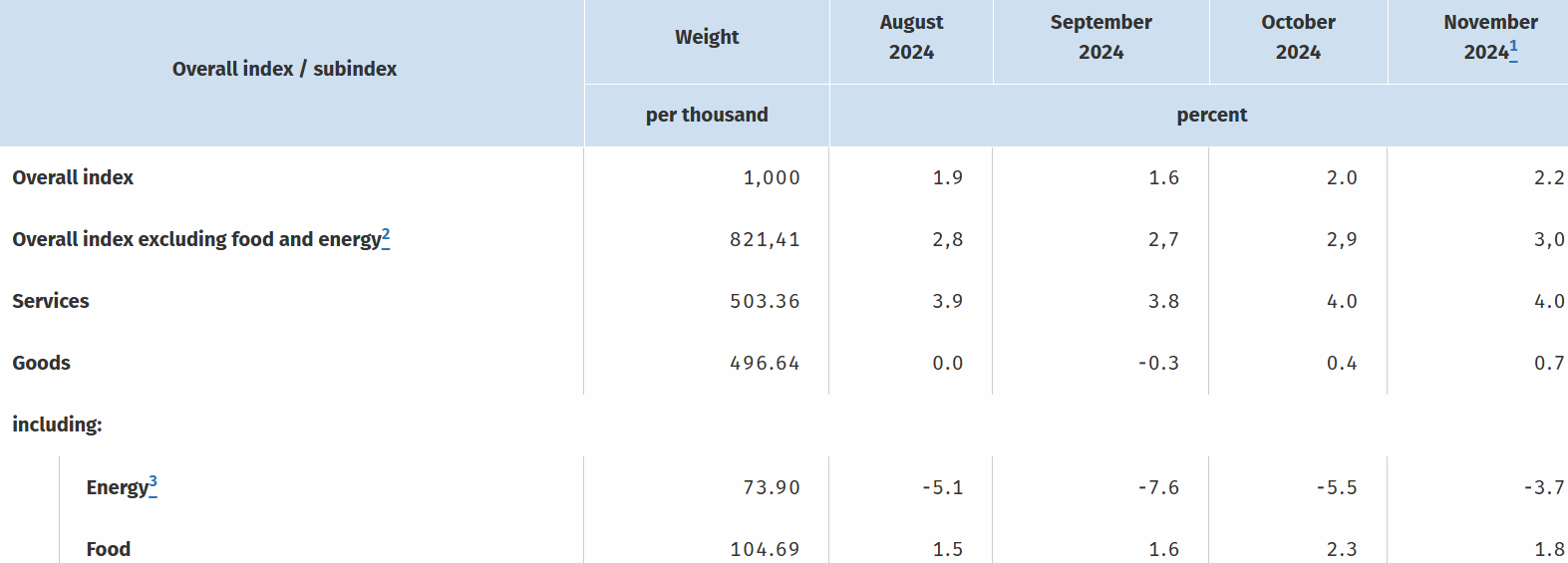

German Data Review: Services Inflation Persists?

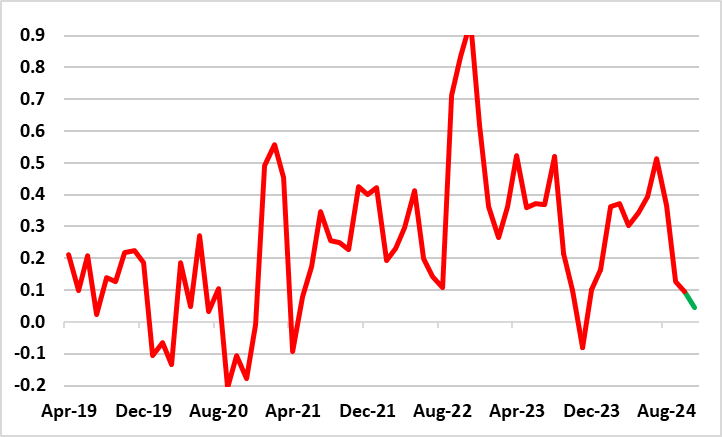

Germany’s disinflation process continues, albeit with the y/y HICP headline stable at 2.4% in the preliminary November estimate, lower than widely expected, but where the CPI counterpart rose 0.2 ppt to 2.2%. This was again in spite of apparently stable or resilient services inflation (Figure 1) which continued to and where there were further, but more modest energy base effects. As a result, the core HICP rate may have remained at 3.3% despite a notch uptick on a CPI basis but still with friendly short-term price dynamics (Figure 2)! Spanish CPI data point to easier core pressures that may surface in the EZ HICP data due tomorrow. As for the latter, the EZ headline HICP rate may edge up a notch or two in November – most likely to 2.1%, but with the core staying put.

Figure 1: Services Inflation Persistence Evident Still?

Source: German Federal Stats Office

While a further rise in the next month beckons, again due to energy base effects, survey data are pointing not only to more real economy weakness but significant falls in cost and output price pressures.

Figure 2: Adjusted Core Rate Still Falling?

Source: German Federal Stats Office, CE, % chg m/m adjusted and smoothed

Regardless, looking ahead, the core disinflation trend is seen continuing, mainly due to slower core goods and energy prices. Even so, while headline inflation is now at 2% it may perk back even above 2.5% by end-year due to energy base effects. The ECB will have to take note although the hawks on the Council will point to still apparently resilient services inflation, but where the doves may counter by pointing to recent much softer real economy signals. Indeed, PMI survey data pointed to both weaker cost pressures and activity signs. Regardless, there are still more signs of weaker underlying price pressures, most notably in more short-term data, ie less affected by base effects. Indeed, core pressures on this basis are consistent with below-target inflation (Figure 2).