Due to Risks, CBRT Continued Easing Cycle with 100 Bps Cut on January 22

Bottom Line: As we expected, Central Bank of Turkiye (CBRT) reduced the policy rate to 37% during the MPC meeting on January 22, indicating a cautious progress since a slower rate cut than December. With the bank committed to disinflation towards its 5% target, CBRT will likely proceed carefully on interest-rate adjustments on a meeting-by-meeting basis in 2026 given risks such as deteriorated inflation expectations and pricing behaviour coupled with unpredictable outlook for the global economy. Our end-year key rate prediction remains at 29.0% for 2026.

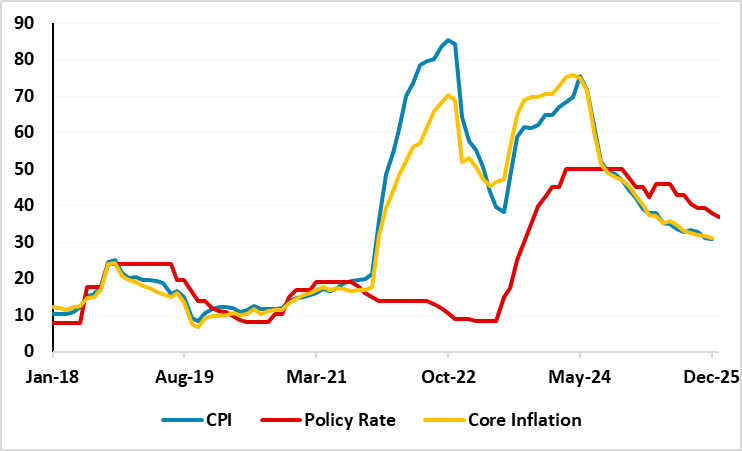

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – January 2026

Source: Continuum Economics

As the deceleration trend in inflation continued moderately in December supported by lagged impacts of previous monetary tightening, tighter fiscal measures and relative TRY stability, CBRT reduced the policy rate to 37% during the MPC meeting on January 22, indicating a cautious progress since a slower rate cut than December. (Note: Inflation print stood at 30.9% y/y in December driven by food, housing and education price. Monthly inflation stayed below 1% in December hitting 0.89%, and annual core inflation edged down to 31.1% from 31.7% the prior month, marking the lowest reading in four years). It is important noting that leading indicators suggest monthly consumer inflation has firmed in January driven by food prices, and that could be the reason why CBRT took a cautious stance.

In its written statement, the CBRT stressed that tight monetary policy will be maintained until price stability is achieved, and warned that inflation expectations and pricing behaviour still pose risks to the disinflation process. The CBRT indicated that the Monetary Policy Committee will make its policy decisions so as to create the monetary and financial conditions necessary to reach the 5% inflation target in the medium term, adding that decisions will remain predictable, data-driven and transparent.

CBRT Governor Karahan, in a recent presentation to investors, also mentioned that the next two months' readings might be noisy but suggested that lower inertia in services would support disinflation.

With the bank committed to disinflation towards its 5% target, we think CBRT will have to proceed carefully on interest-rate adjustments on a meeting-by-meeting basis in 2026 given risks such as sticky services prices coupled with unpredictable outlook for the global economy. We think upside surprises in food and energy prices and any accelerated TRY depreciation could derail recovery.

Our end-year key rate prediction remains at 29.0% for 2026 while stubborn inflation will limit the size of the cuts. We feel Mth/Mth inflation readings will continue to be key as CBRT will want to avoid reigniting inflation with too aggressive rate normalization until CBRT fully contains the inflation.