USD, EUR, AUD, JPY, CHF flows: Mild risk positive tone on Fed, Ukraine

JPY and CHF weaker, EUR firmer. More risk positive tone on Ukraine peace and Fed easing hopes. AUD upside potential

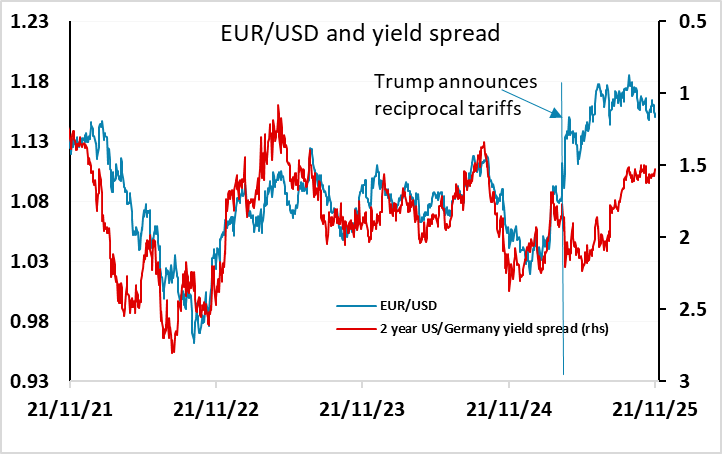

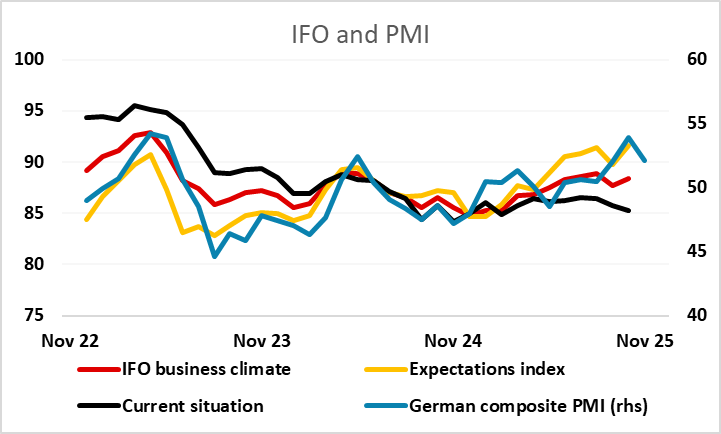

A fairly quiet overnight session with Japan closed for Labor day, but there is a mild risk positive tone as equities gapped higher at the Asian open, helped by hopes of a Ukraine peace deal and some increased expectations of a Fed cut in December. The JPY and CHF weakened in Asia, and the EUR is slightly firmer, but there hasn’t been much action in the commodity currencies. The German IFO survey this morning will gain some attention, but seems unlikely to have a big impact. The IFO has moved fairly closely with the PMI in recent months, albeit slightly underperforming but the dip in the PMI in November from higher levels suggests something fairly flat in the IFO. But the EUR may gain some support from optimism about a Ukraine peace deal, even though this still seems to be some way away from completion.

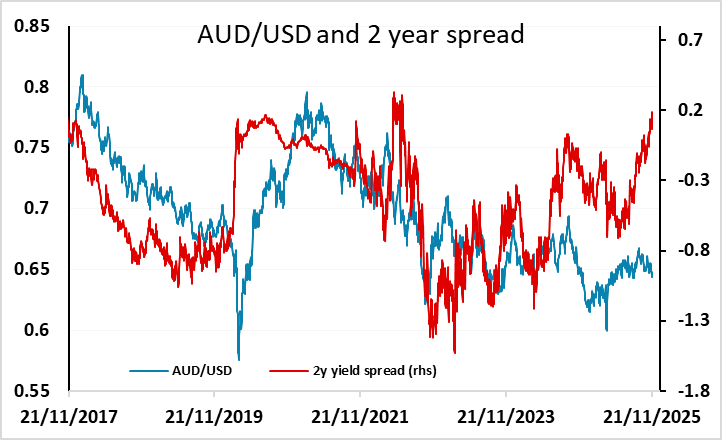

Increased expectations of a Fed ease in December have been based on dovish comments on Friday from New York Fed president Williams who tends to vote with the consensus. The market has moved to price a December cut as a 60% chance from 40% earlier last week, and this expectation ought to be USD negative across the board. AUD/USD continues to look attractive in a more risk positive environment with good support on the 0.64 handle and yield spreads that point significantly higher.