EUR, AUD, JPY flows: Quiet markets but EUR may be vulnerable on the crosses

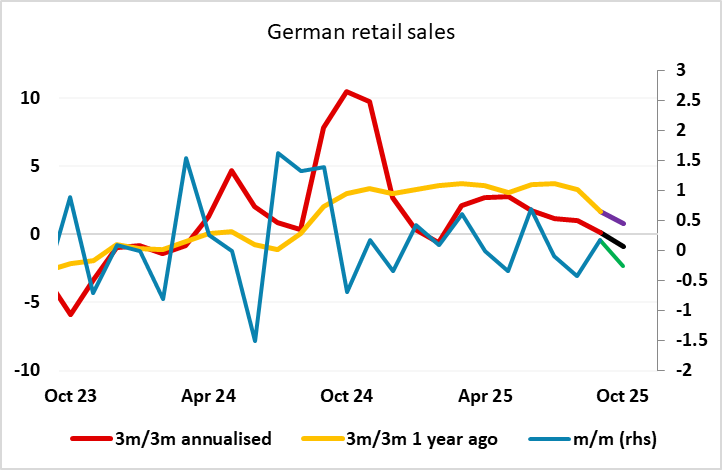

German retail sales a touch softer, some downside risks for the EUR on the crosses

A fairly quiet FX market overnight but a mild risk negative tone due to reports that Chinese property developer Vanke has sought a delay of payment for its onshore bond and S&P cut Vanke to CCC-. The impact on Chinese equities was small and quite short-lived but AUD/USD dropped around 10 pips and most of the riskier currencies were slightly softer.

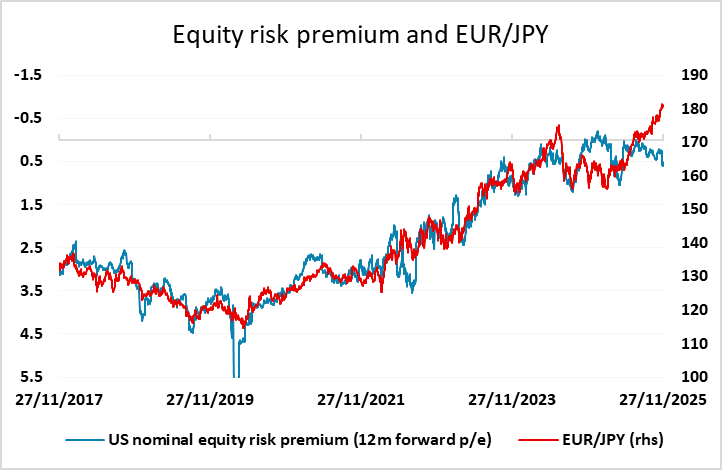

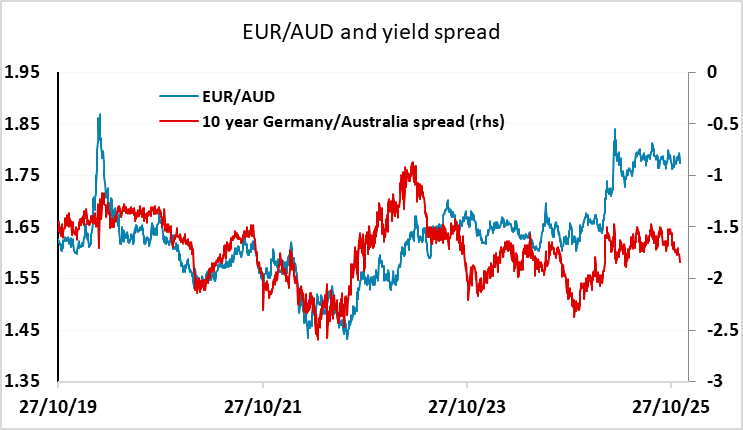

This morning sees German retail sales come in a little on the weak side, and the underlying trend looks to be softening in recent months. The ECB remains very neutral and won’t immediately be affected by such data, but the general trend in the Eurozone s towards slight softening in the numbers. We see preliminary November CPI data from France, Spain and Germany today which could add to a modest case for a lean towards easing being the next ECB move. The EUR remains very range-bound 1.14-1.18, and with the Fed still on an easing path, we wouldn’t see a lot of downside, but there is much mire case for other currencies to rally against the USD based on yield spreads, notably AUD and JPY, so the EUR could start to suffer on the crosses.