Preview: Due August 15 - U.S. July Retail Sales - Autos to correct higher, core sales to correct lower

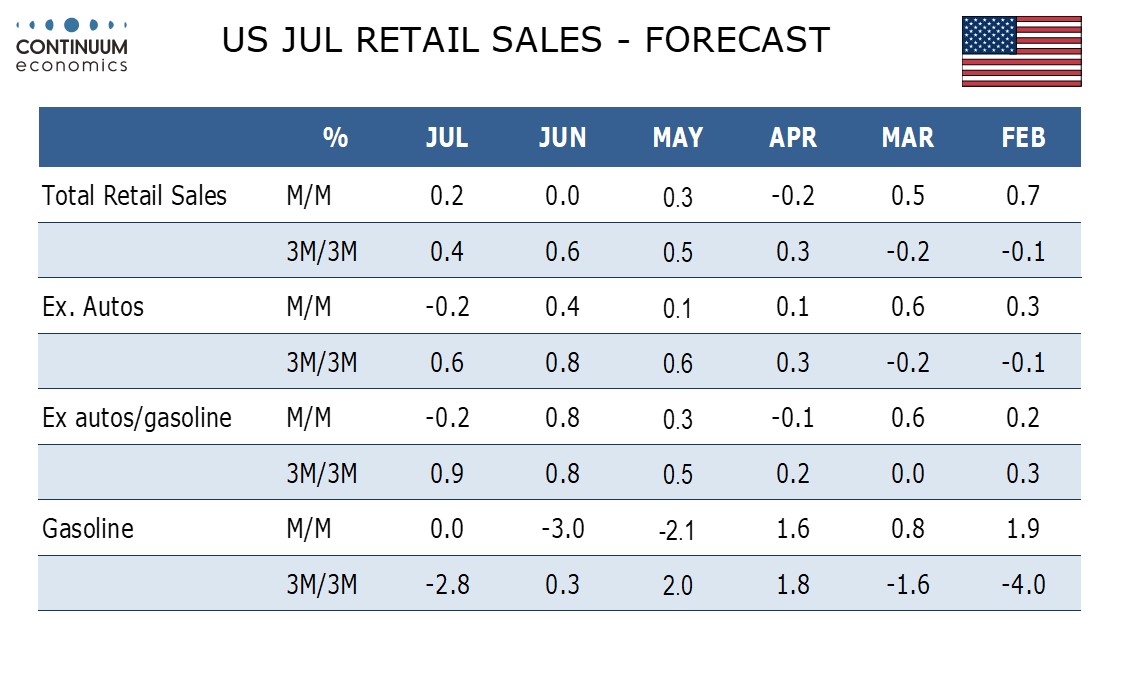

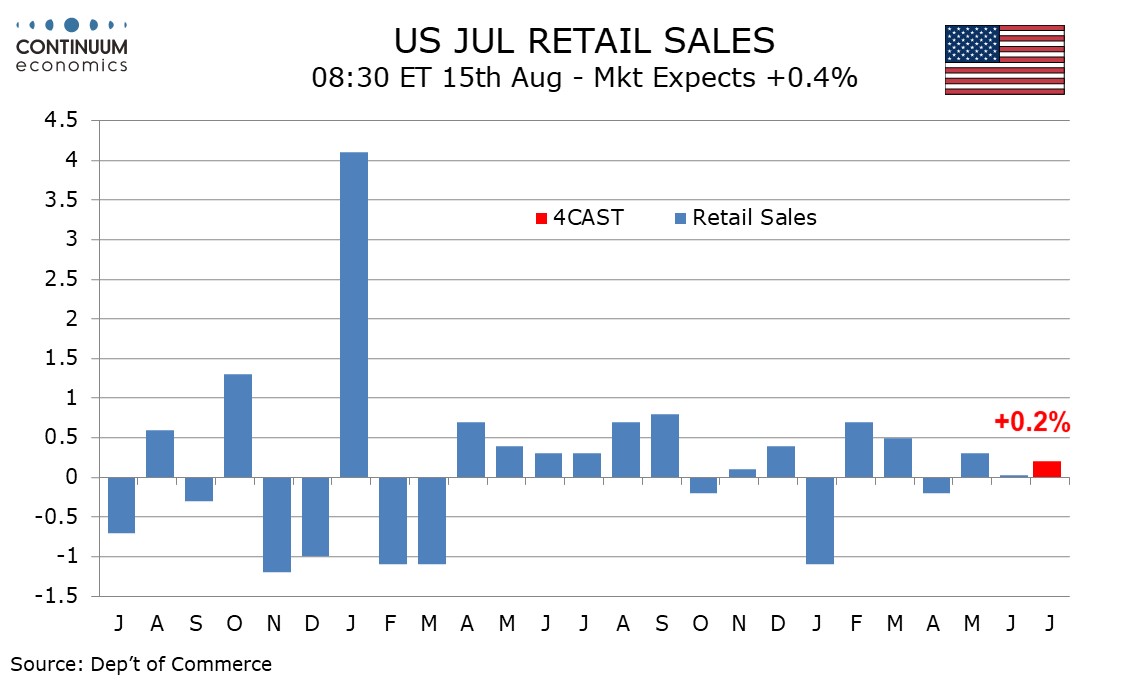

We expect a 0.2% increase in July retail sales after a flat June, but 0.2% declines both ex autos and ex autos and gasoline. While auto sales picked up from June weakness sales ex auto and gasoline are likely to correct from surprising June strength, while gasoline prices are likely to be near neutral.

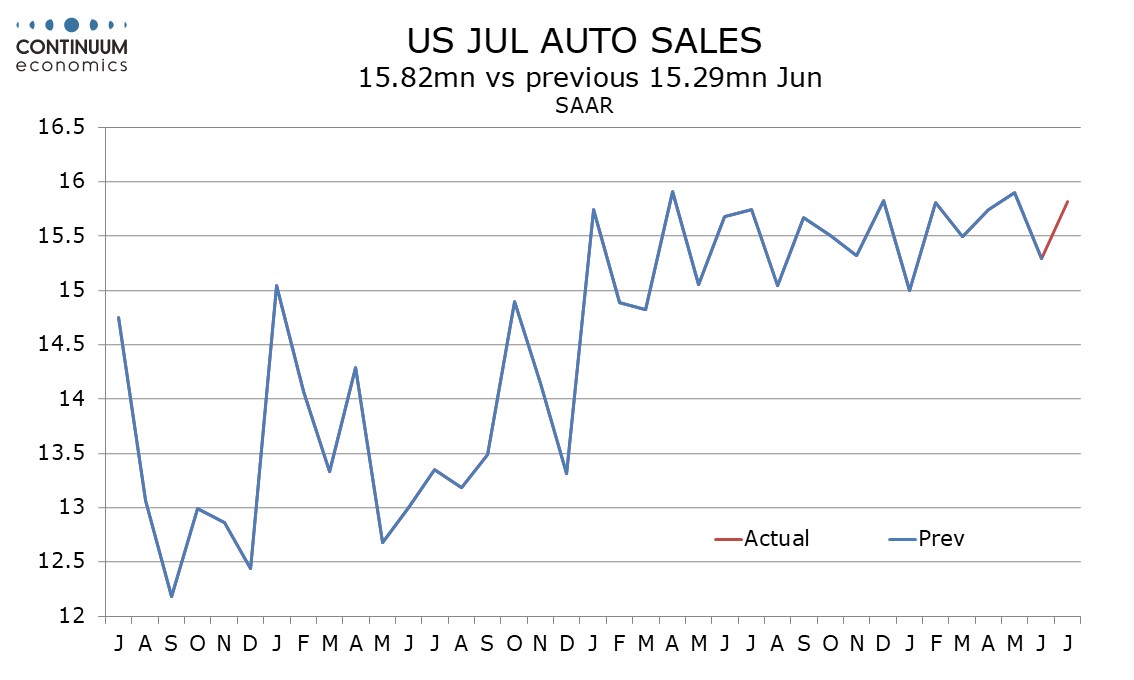

Auto sales slipped in June due to temporary problems with computer software. Auto sales recovered in July but in simply returning to near May’s level rather than following a below trend month with an above trend one the industry data failed to meet expectations.

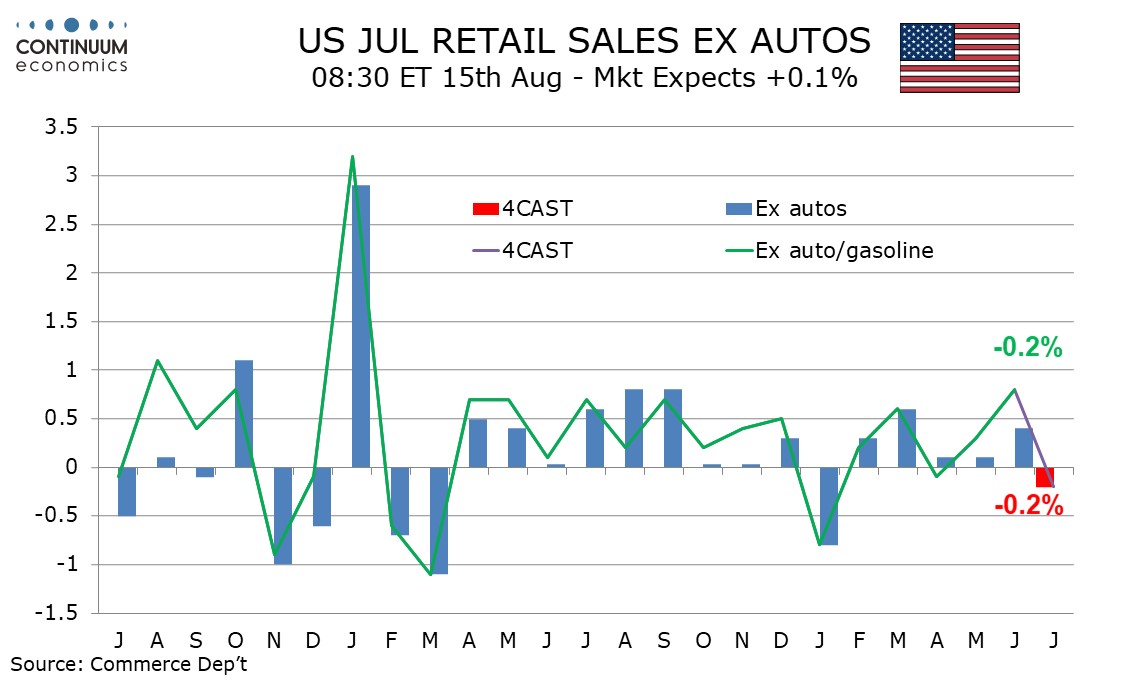

Sales ex autos and gasoline were surprisingly strong in June with a rise of 0.8% and July looks vulnerable to a correction lower. The last strong month, a 0.6% increase in March, was followed by a 0.1% decline in April, and we expect an even stronger June gain to be followed by a 0.2% July decline.

Q2 strength in consumer spending continued to outperform growth in real disposable income which makes it difficult to sustain. A subdued July non-farm payroll suggests little growth in real disposable income, though retail data in the non-farm payroll detail was fairly neutral.

Q2 strength in consumer spending continued to outperform growth in real disposable income which makes it difficult to sustain. A subdued July non-farm payroll suggests little growth in real disposable income, though retail data in the non-farm payroll detail was fairly neutral.

June sales increased by 0.4% ex autos, only half the pace ex autos and gasoline restrained by a significant dip in gasoline due to price declines. Gasoline prices look unlikely to have a significant impact in July’s report.