Published: 2025-10-14T12:49:34.000Z

USD flows: Little impact from NFIB, but...

1

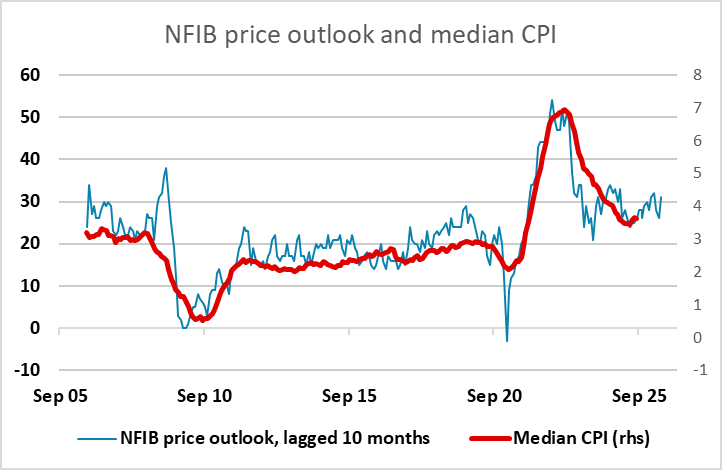

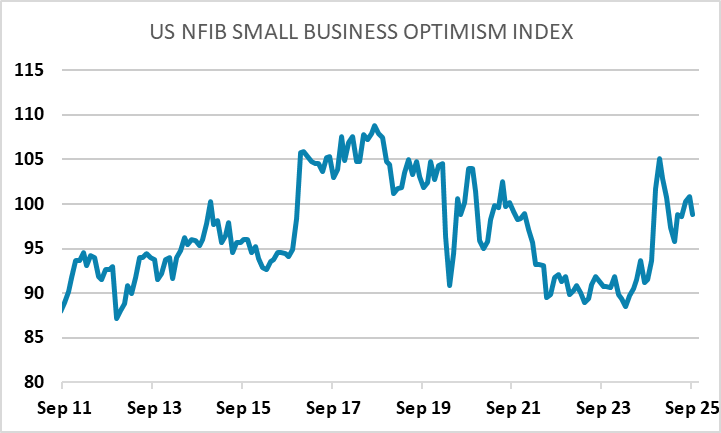

NFIB survey weaker, but price index higher

The NFIB survey wasn’t sufficiently different from expectations to have any notable market impact. The activity index was a little weaker than expected, but within recent ranges. The price index was a little higher, and may be a concern for the Fed as it does tend to lead (median) CPI by around 10 months. Recent reading have suggested there is little further downside for CPI, and this may discourage Fed hawks from future rate cuts. Disappointment at the lack of rate cuts might be the biggest risk for the equity market going forward, but would likely be mildly USD positive, particularly against the riskier currencies.