USD, JPY flows: JPY weakness the main FX impact of the 50bp Fed cut

USD/JPY was higher after the Fed rate cut, with US yields and equities both rising. Other currencies were little changed against the USD

The Fed decision to cut rates by 50bps was greeted by a positive equity market reaction and a rise in both US yields and equities. The market had seen a 50bp cut as the most likely scenario going into the meeting after recent press comments, despite a big majority of economists looking for a 25bp move. Other than the 50bp headline move, there was nothing particularly surprising in the decision. Two more 25bp cuts are now expected over the rest of the year, but the expected terminal rate remains little changed near 3% and we have reduced our expectation for 2025 cuts slightly to 125bps from 150bps to account for the fast start.

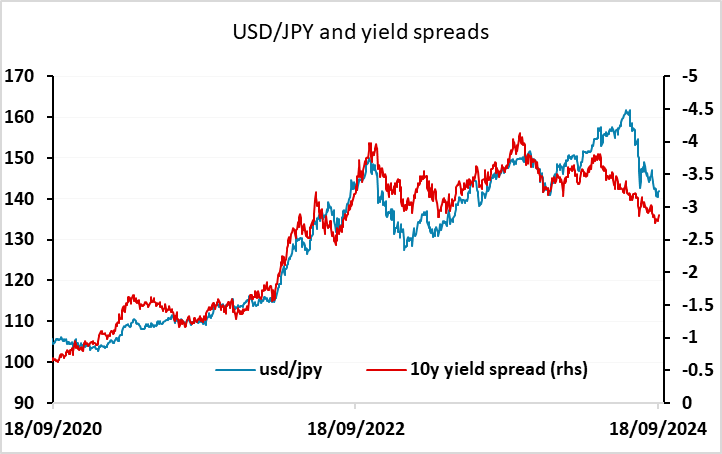

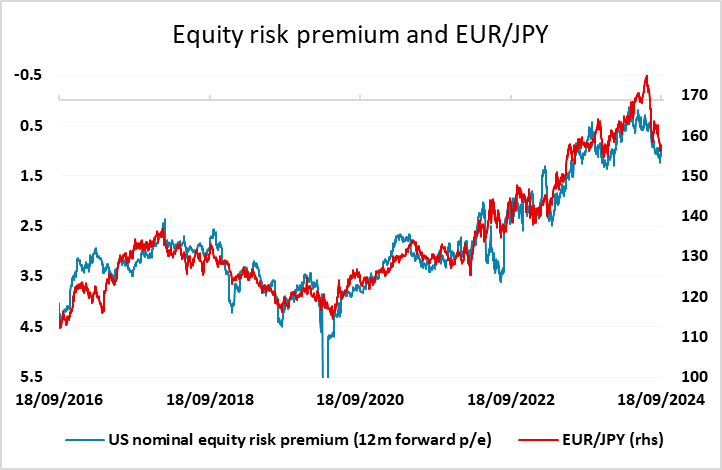

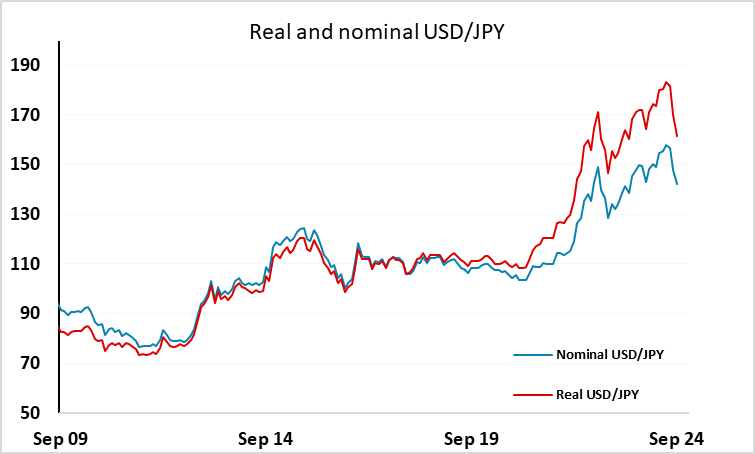

The rise in yields looks like a classic “sell on the news” reaction, with nothing much in the decision to justify higher yields. The fact that equities also rise means that the equity risk premium fell quite significantly, and this is supportive of JPY weakness on the crosses. Higher US yields also support JPY weakness against the USD, and these were the main FX moves in response to the decision. But even with higher US yields spreads still suggest USD/JPY has scope to move back below 140. The decline in the equity risk premium makes EUR/JPY looks closer to fair value based on the historic nominal correlation. But we would also emphasise that looking just at nominal values underestimates the potential for JPY recovery, as the real JPY has fallen 12% more than the nominal JPY in the last 5 years. While there may be some further modest scope for a JPY correction lower after recent gains, equities look stretched at the new highs reached overnight, and we wouldn’t expect an advance in USD/JPY beyond 145. Longer term, we still expect substantial JPY gains.

Other currencies were largely unaffected by the decision, with EUR, GBP and CAD all essentially unchanged against the USD, and AUD only stronger following the Australian employment numbers overnight.