USD, EUR, JPY, AUD, CAD flows: PMIs awaited, AUD and CAD rallies look fragile

PMIs awaited with mild downside bias for European currencies. AUD and CAD gains looks suspect given yield spread picture

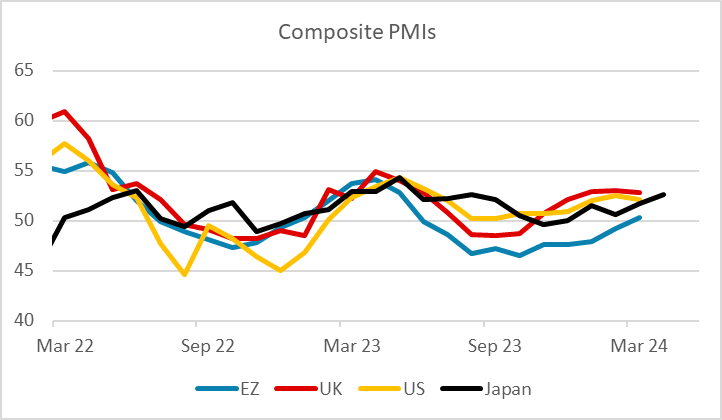

A quiet overnight session has seen USD/JPY manage another new marginal 34 year high at 154.83 before slipping back to 154.75 where it traded through most of yesterday. EUR/USD has started the European session on the back foot, slipping around 15 pips lower in early trade, although without an obvious trigger. The focus today will be on the PMI numbers, particularly in Europe. The largely ignored Japanese PMIs overnight came in stronger than expected, but these have limited correlation with European and US numbers. There is probably more risk that the market prices in more ECB and BoE easing on weak data than there is that they price in less easing on strong data, but there is likely to be a knee-jerk reaction either way.

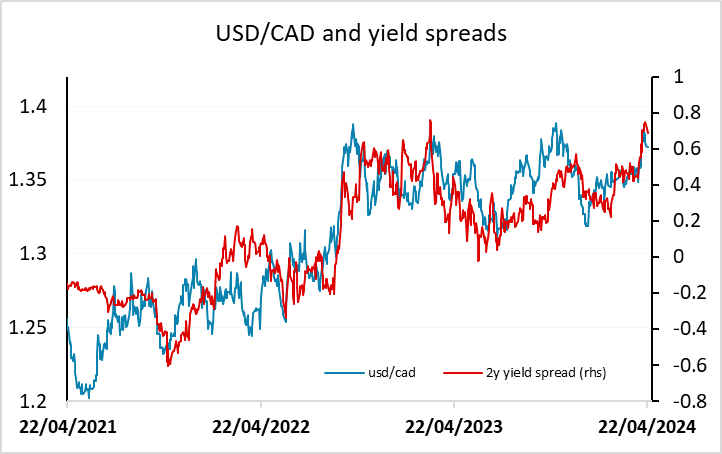

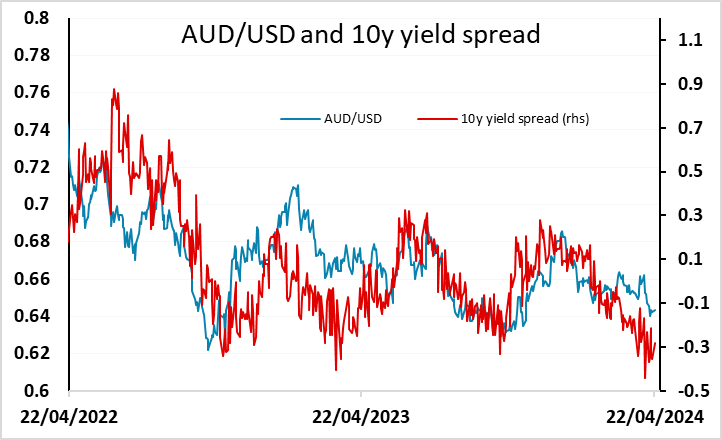

Commodity currencies managed some gains in the US afternoon session on the back of better equity market performance, but upside looks quite limited with both AUD ad CAD outperforming their yield spread relationships with the USD. We would also see some risks to equities after the Wall street Journal reported that US is drafting sanctions threaten to cut some Chinese banks off from global financial system, so we would see downside risks to the commodity currencies here, with the exception of the NOK which continues to look undervalued.