USD, EUR, JPY flows: USD gains broadly after drop in claims

Anoth drop in claims supports US yields and the USD - JPY the most vulnerable

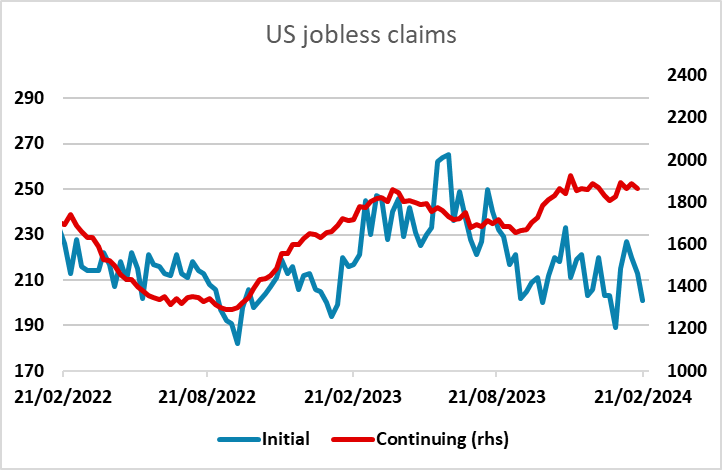

More strong US labour market data, with initial and continuing claims both dropping in what is the survey week for the employment report, making it all the more significant. Front end US yields, which were already higher on the day, have extended gains, and the US has also made general gains.

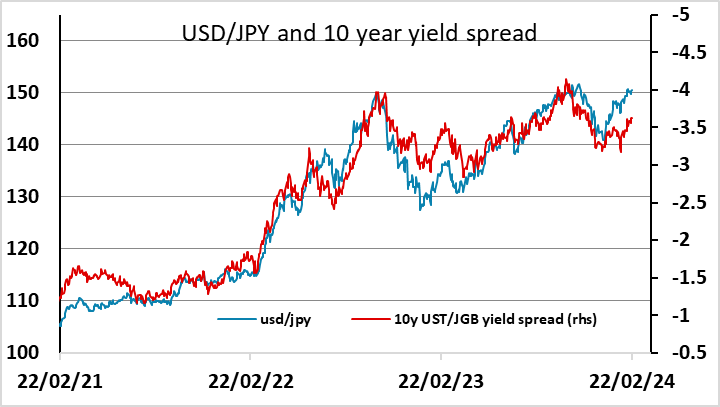

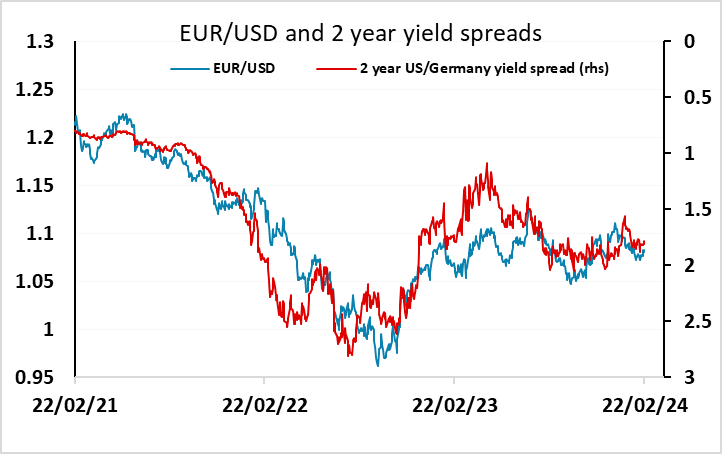

However, on the day there is little change in EUR/USD front end yield spreads, so the data looks unlikely to have much impact on EURUSD, and should have the most sustained impact on USD/JPY. Even though USD/JPY is already stretched compared to yield spreads, further US yield rises will support USD gains on the day, and with resilience in equities will also mean further declines in equity risk premia, signalling JPY weakness on the crosses. Last week’s USS/JPY high at 150.88 will be in the market’s sights.