Bank of Canada Minutes Detail Inflationary Concerns

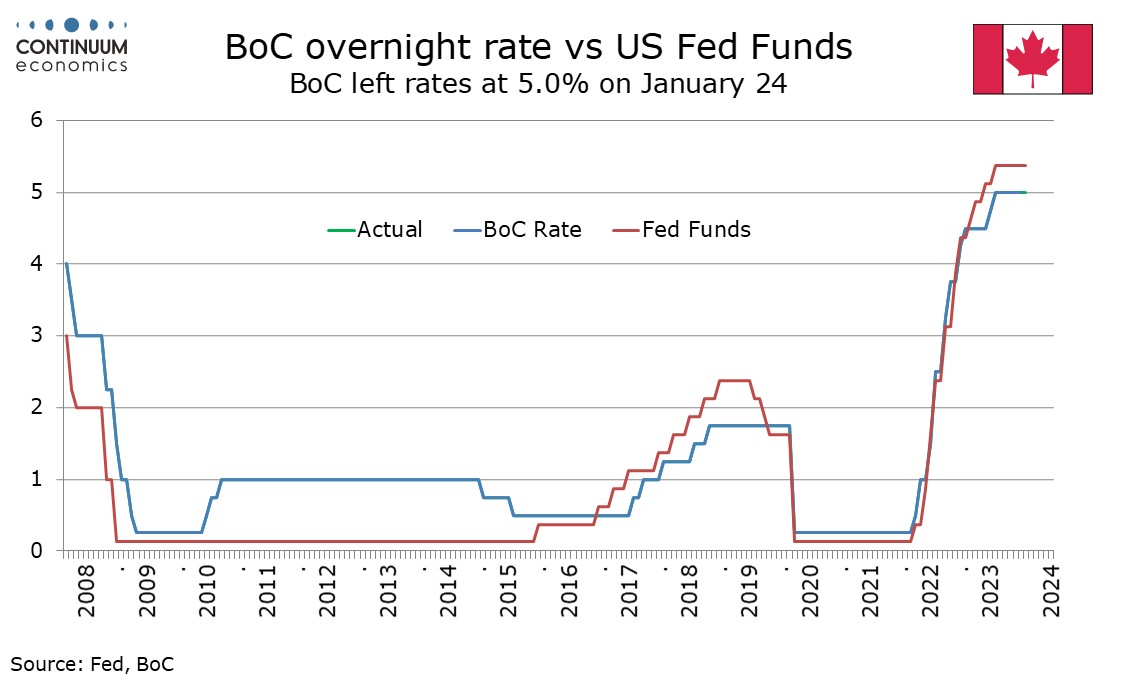

The Bank of Canada’s minutes from January 24 show significant concern about the persistence of inflation, despite seeing the economy as having moved into excess supply due to slowing demand. This leaves the BoC unsure about when to cut rates, though further increases now look unlikely.

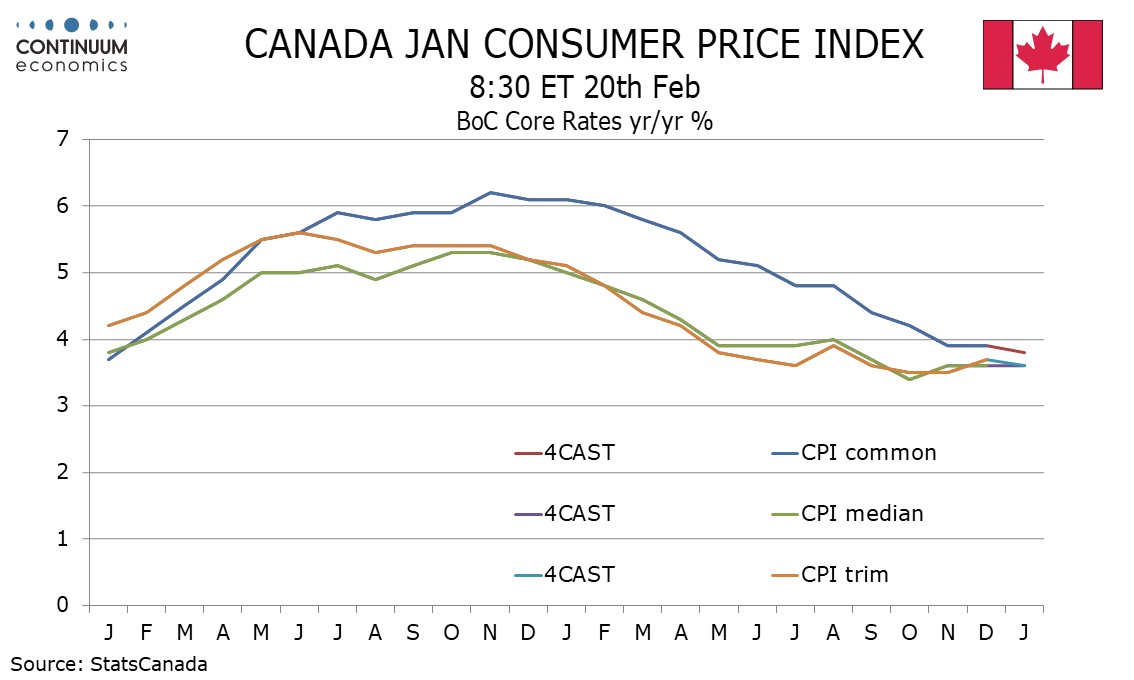

The minutes note broad based wage growth of around 4-5% which was seen potentially holding inflation up unless productivity was exceptionally strong. Members expected wage growth to moderate gradually in an economy with more supply than demand. Inflation was discussed in detail, with just over half of the CPI components seen growing by more than 3% (the BoC’s target is 2%). While shelter remains the single biggest contributor to above target inflation, it is far from the full story. Still, members expressed concern that shelter would continue to keep inflation elevated with a potential upside risk being a stronger than expected rebound in the housing market in the spring of 2024. The BoC is not looking at inflation excluding shelter to assess underlying price pressures.

The first half of 2024 was seen showing continued weakness in economic growth and inflation remaining around 3%, with growth picking up in the second half of the year and inflation gradually falling to reach the 2% target in 2025. Risks were seen on both sides, with the potential for monetary policy to have a greater impact on consumer spending than expected causing a marked contraction in activity, but also inflation proving more persistent than expected. While future rate hikes were not ruled out, members agreed that future discussion would shift to how long to keep the rate at 5%. This will be data dependent. Price data will be the most important, but a growing likelihood hat Q4 2023 GDP will exceed a flat forecast made by the BoC is a further argument against any rush into easing beyond the inflation concerns outlined in the minutes.