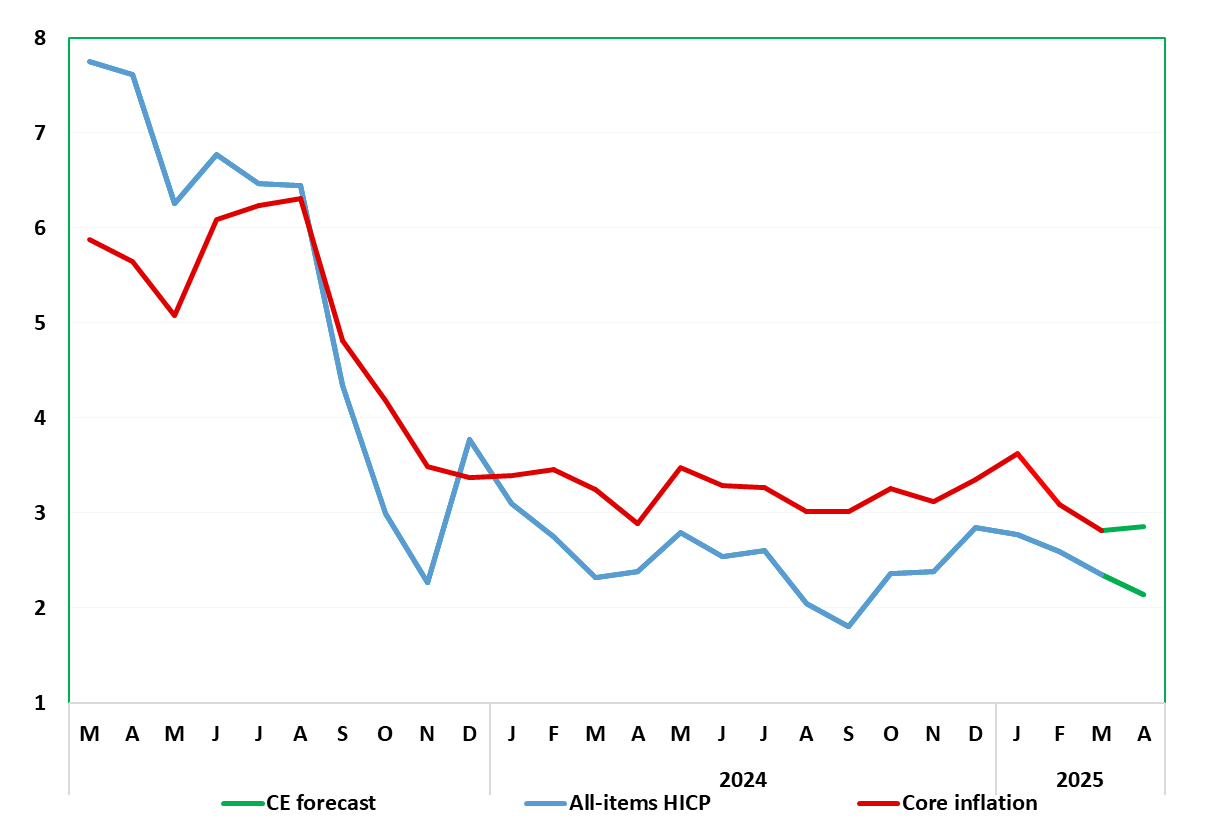

German Data Preview (Apr 30): Lower Headline Amid Stable Services Inflation?

Germany’s disinflation process continues, but there had been signs that the downtrend was flattening out but this changed somewhat in February and again in the March. Indeed, HICP inflation fell back from 2.6% to 2.3% in March, this despite a pick-up in food inflation in both months. Notably the March outcome is the third lowest reading in this down-cycle, with only the two on target outcomes in late summer below. Moreover, perhaps clearer disinflation news was evident in the where the core which fell back 0.2 ppt while services eased 0.4 ppt to cycle-low - both of the latter are for the CPI measure. Moreover, adjusted m/m data also show some fresh downtick in core rates. Lower fuel prices should see the headline fall further in April preliminary numbers to an eleven month low of 2.1% but with stable services and core readings anticipated. The late Easter does pose some upside risks, however.

Figure 1: German HICP Inflation Almost Back to Target?

Source: German Federal Stats Office, % chg y/y

March’s surprisingly large decline in headline HICP inflation reflected both lower energy and core price pressures, the latter partly driven by services inflation down to 4.1%, an 11-mth low, this probably at least due to lower contributions from package holiday prices. As for April more falls in fuel prices will be the main factor, this coming alongside the late Easter posing some upside risks, again to food inflation.

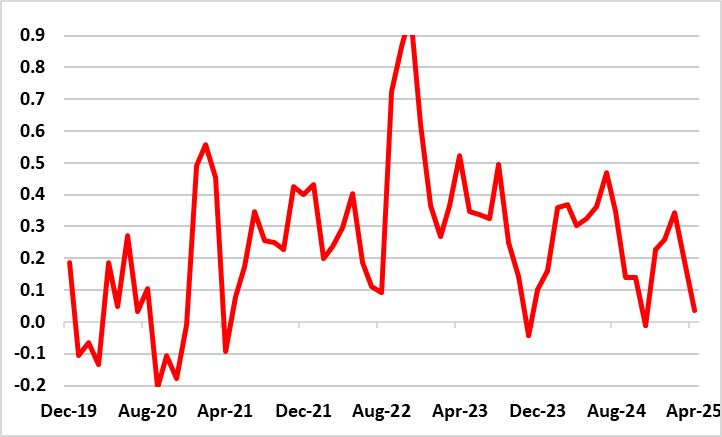

Looking ahead, we see price gains trending further down and the headline reading dipping below the 2% mark by the summer amid lower contributions from services and energy, the later mainly fuel prices. The disinflation process is perhaps more visible in seasonally adjusted core data where the 3-mth average m/m rate sits nearer zero (Figure 2).

Figure 2: Adjusted Core Rate Weaker?

Source: German Federal Stats Office, CE, % chg m/m adjusted and smoothed