JPY flows: New JPY lows after BoJ meeting

There was no indication of further imminent tightening from the BoJ, and this led to new JPY lows. But US yields continue to be the main driver of JPY weakness, and overnight JPY decline may consequently be overdone

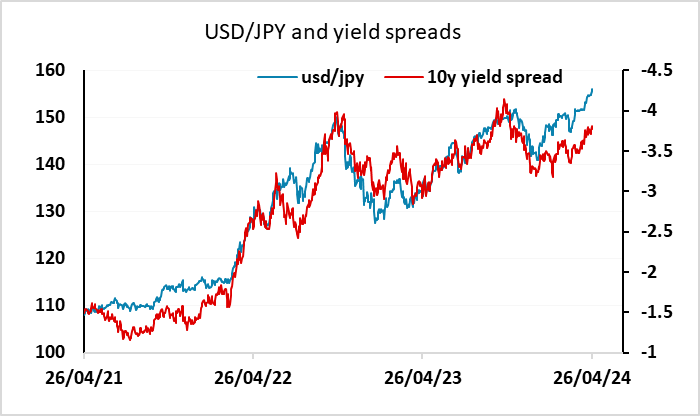

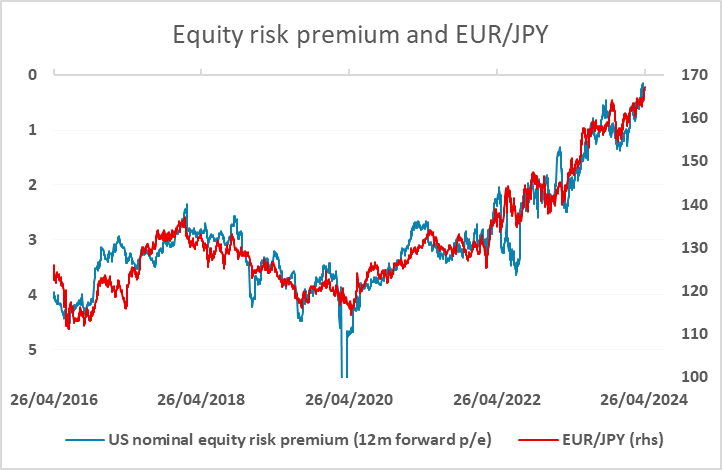

The BoJ meeting overnight contained few surprises, with no indication of any imminent tightening in policy. This was enough to push USD/JPY to new 34 year highs above 156 and EUR/JPY to new 16 year highs above 167.50. But we would argue that BoJ policy is almost irrelevant when it comes to the JPY downtrend we have seen in the last 3 years. Whether looking at yield spreads or risk premia, both of which could be seen as causes of JPY weakness, the main driver is not Japanese rates or yields, but US yields and US equities.

US yields are actually slightly lower overnight, and 10 year JGB yields are slightly higher, so there is little case for USD/JPY to be higher based on yield spread moves. However, with equities firm equity risk premia are little changed, and this is still the main driver of JPY weakness, with JPY crosses remaining closely tied to the decline in risk premia we have seen in recent years.

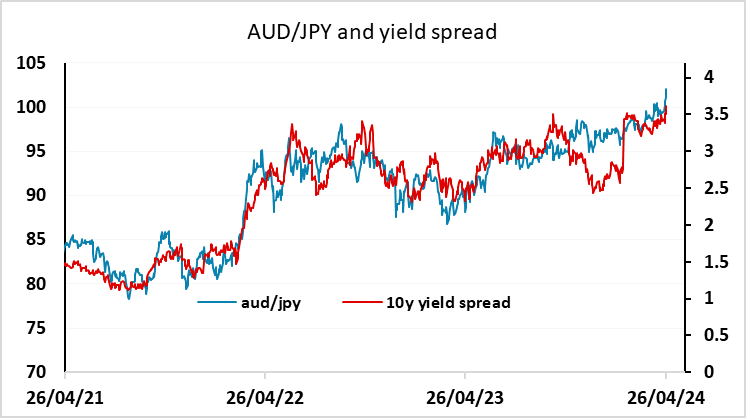

AUD/JPY has hit new 10 year highs, helped by a generally stronger AUD as well as a weaker JPY, with the AUD helped by positive equity market moves and higher yields. However, AUD/JPY, which has up to now held close to yield spread moves, is starting to look overdone relative to yield spreads.

So far, there has been no BoJ intervention to halt JPY weakness since October 2022. There were more warnings overnight from Finance Minister Suzuki but verbal intervention is now being ignored. We do see a risk of action today or, more likely, early on Monday, if JPY weakness continues, and this could have a short term impact, but in the end a turn in JPY weakness is only likely to come about when we see US yields fall and equity risk premia rise.