USD. CAD flows: US employment report slightly softer, Canadian report in line

USD edges lower after employment report

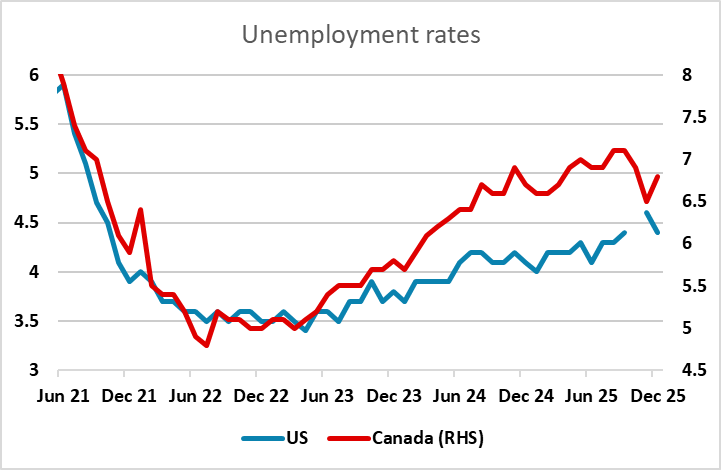

Both the USA and Canadian employment reports have come in broadly in line with expectations for the latest month, but the US has seen significant downward revisions to previous months. While the gain in US non-farm payrolls was only a little less than expected at 50k in December, the October decline was revised to 173k from 105k and the November gain to 56k from 64k. While the downward revision related mostly to the private sector, the big decline was due to government jobs (DOGE). But the US unemployment rate fell more than expected to 4.4%. The data is net weaker than expected, but only justifies a small USD decline. From a big picture perspective, the employment data continues to show very little net gain suggesting growth is at or below trend, which might be seen as a little disappointing given equity market valuations, but for now expect only modest impact.

On the Canadian side, the employment gain as a little greater than expected at 8.2k, but the unemployment rate rose a little more than expected to 6.8%, and shouldn’t have a significant impact.