UK CPI Inflation Review: Headline and Core Fail to Fall?

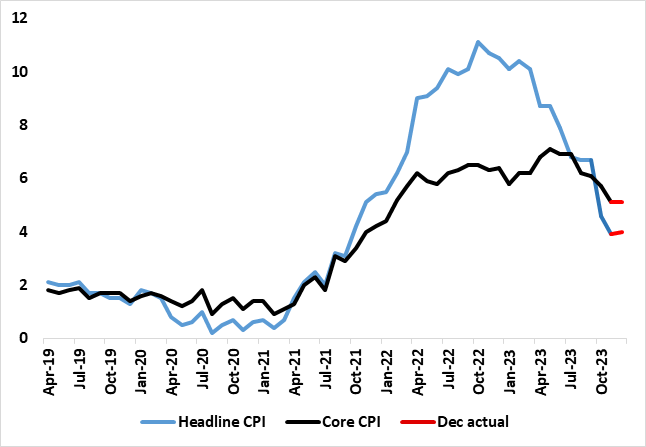

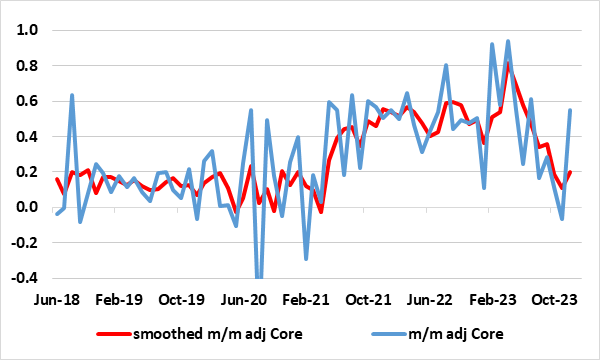

Superimposed over both upside and downside surprises, UK headline and core inflation have been on a clear downward trajectory in the last few months the former having peaked above 10% in February and the latter at 7.1% In May. However, this trend surprisingly stalled in December as the headline rate rose a notch to 4.0%, up from a 27-month low of 3.9%, the first rise in 10 months (Figure 1) and where remained at 5.1%, still a 23-month low. The data came alongside clearly soft PPI data at least for manufacturing but where services PPI edged up to 3.6%. The headline rate is still some 0.6% ppt below formal BoE thinking but is clearly a disappointment, not least as half of the 12 main components saw a fresh pick-up and where our estimate of the seasonally adjusted data (Figure 2) saw something of a reversal of the hitherto clear disinflation core trend seen in previous months. The CPI data are perturbing for the BoE hawks but come alongside wages data softness which the BoE majority may view as tempering its worries about persistent price pressures, especially if also presented on such an adjusted m/m basis.

Figure 1: Headline and Core Inflation Drop Stalls

Source: ONS, Continuum Economics

The government has made much of the fact that CPI inflation slowed to 4.6% y/y in October 2023, down from 6.7% in September and thus has more than halved from its peak of over 11% a year ago. The drop has little to do with government action, the very opposite. Instead, both supply (we think predominantly) and demand (to a lesser extent) factors are reining in price and cost pressures and more broadly so. Indeed, the recent rise in tobacco duty very much contributed to the surprise rise in the headline rate in December

As for these latest numbers, CPI inflation rose by 4.0% in the 12 months to December 2023, up from 3.9% in November, and the first time the rate has increased since February 2023. On a monthly basis, CPI rose by 0.4% in December 2023, the same rate as in December 2022. The largest upward contribution to the monthly change in CPI annual rates came from alcohol and tobacco while the largest downward contribution came from food and non-alcoholic beverages. Core CPI (excluding energy, food, alcohol and tobacco) rose by 5.1% in the 12 months to December 2023, the same rate as in November; the CPI goods annual rate slowed from 2.0% to 1.9%, while the CPI services annual rate increased from 6.3% to 6.4%.

Figure 2: Adjusted Core CPI Pressures Edge Higher?

Source: ONS, Continuum Economics, smoothed is 3 mth mov avg

All of this is likely to perturb the BoE, albeit still calmed by as various alternative y/y measures of core and underlying inflation have started to fall and where seasonally adjusted core prices have eased further. However, recent months suggest that this slowing in core adjusted inflation has not intensified, instead with recent underlying inflation remaining close to target on a smoothed m/m adjusted basis but has edged higher of late (Figure 2). But headline inflation is still running near zero on this adjusted basis. Regardless, it may be that (apparently ebbing) economy risks are now taking precedence for the MPC majority but where some on the MPC want to see evidence that wage inflation is abating and this does seem to be forthcoming. We still see BE rate cuts starting before mid-year.