USD flows: USD softer after employment data

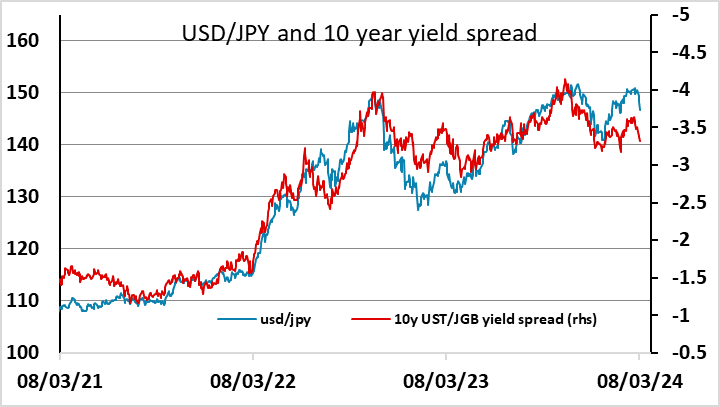

US labour market data seen as slightly weaker, with strong February employmet offset buy downward revisions to previous months, weaker earnings data and higher unemplyoment. USD/JPY continues to look the most vulnerable.

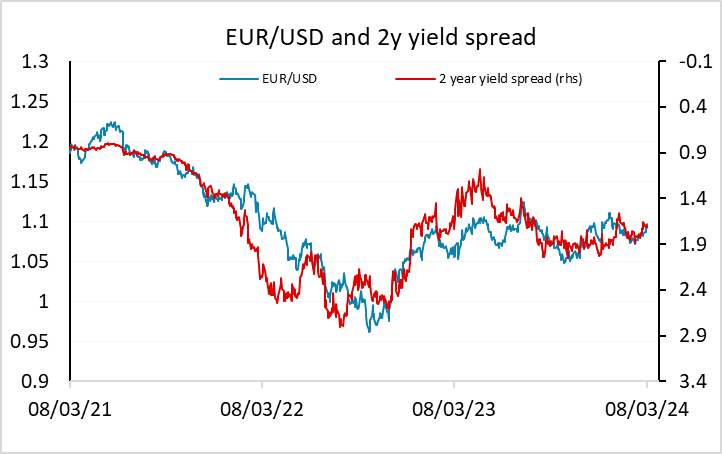

A mixed but mildly soft February employment report, with strong February payroll growth, once again substantially exceeding consensus at 275k, but with the last two months showing substantial downward revisions. Average hourly earnings at 0.1% were weaker than expected, and there was also a downward revision to the January rise to 0.5% from 0.6%. The unemployment rate also unexpectedly rose to 3.9%, reflecting a big decline in employment in the household survey. The market is seeing the data as mildly dovish, with US yields and the USD a little lower, but we would see the strength of payrolls as significant, and would argue that the market is probably overpricing the likely scale of Fed cuts this year, with 3 rate cuts more likely than the 4 priced in. Nevertheless, USD/JPY in particular still looks to have downside potential, as yields in Europe are following the US lower. 146 in USD/JPY and 1.10 in EUR/USD may be effective barriers for today.

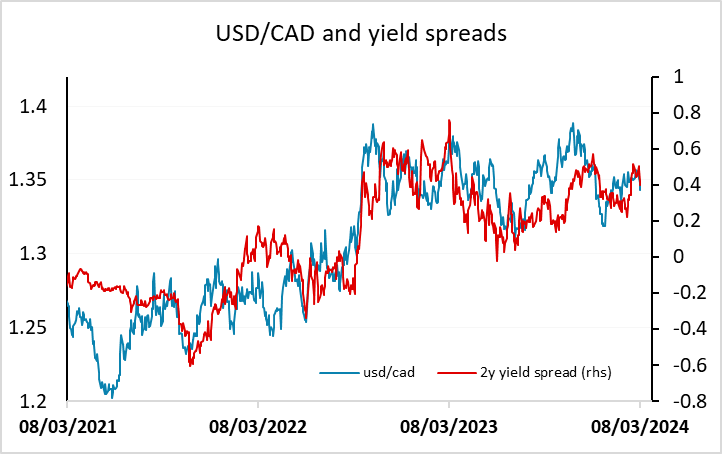

Canadian data was also on the strong side of expectations for employment growth at 40.7k, with full time even stronger at 70.6k. However, hourly wage growth fell back to 49% from 5.3%, which the BoC may see as positive from an inflation standpoint. Front end CAD yields have also dropped, so we doubt we will see much more CAD strength from here.