USD, JPY, AUD, CHF flows: Risk recovery overnight

High yielders gain and safe havens dip on risk reocvery overnight, but JPY likely to be resilient

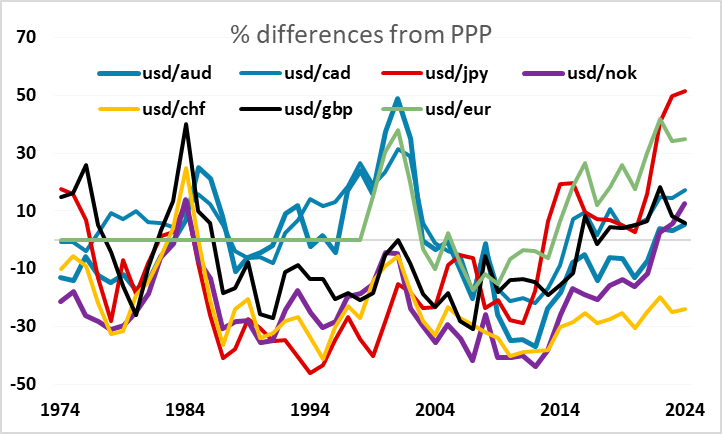

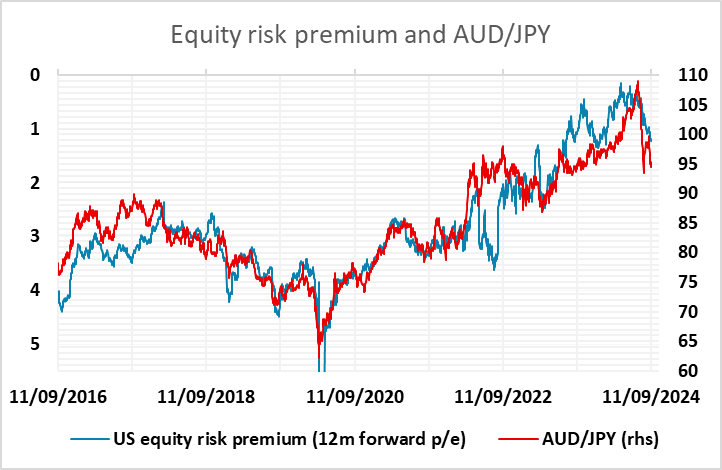

We have seen a risk recovery overnight led by the US tech sector with Nvidia shares rising 8%, and that has allowed USD/JPY, AUD/USD and EUR/CHF to rally. While we do see potential for US equities to continue to correct lower given the slowdown and high valuations, we would expect the correction to be slow and subject to substantial periodic recoveries as the US economy’s slowdown remains quite modest. These risk recoveries can be expected to impact all the risk sensitive pairs in the short run, but we would note that USD/JPY remains very clearly overvalued from a long term perspective, while the USD is less substantially out of line elsewhere (although EUR/USD also looks significantly cheap). The comments from the BoJ’s Tamura overnight, suggesting the Japanese policy rate is heading to 1% or above, also suggests the JPY will continue its recent recovery, with the market currently sill only pricing the policy rate at 0.5% by the end of 2025.