Preview: Due March 12 - U.S. February CPI - Stronger overall, core rate back to trend

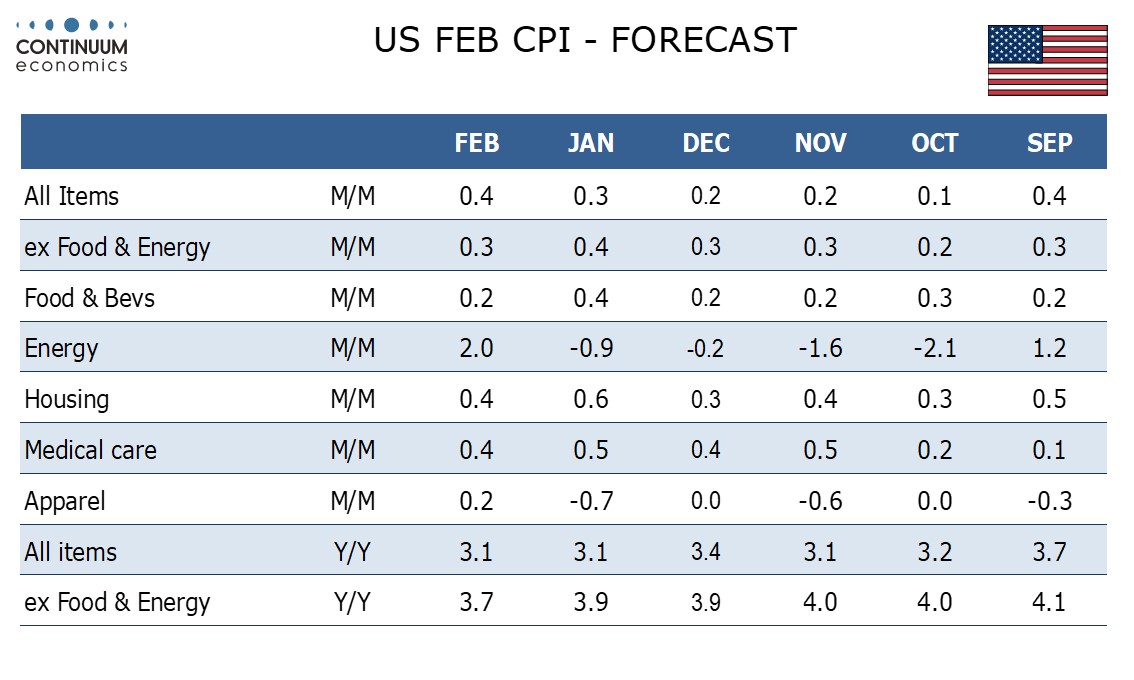

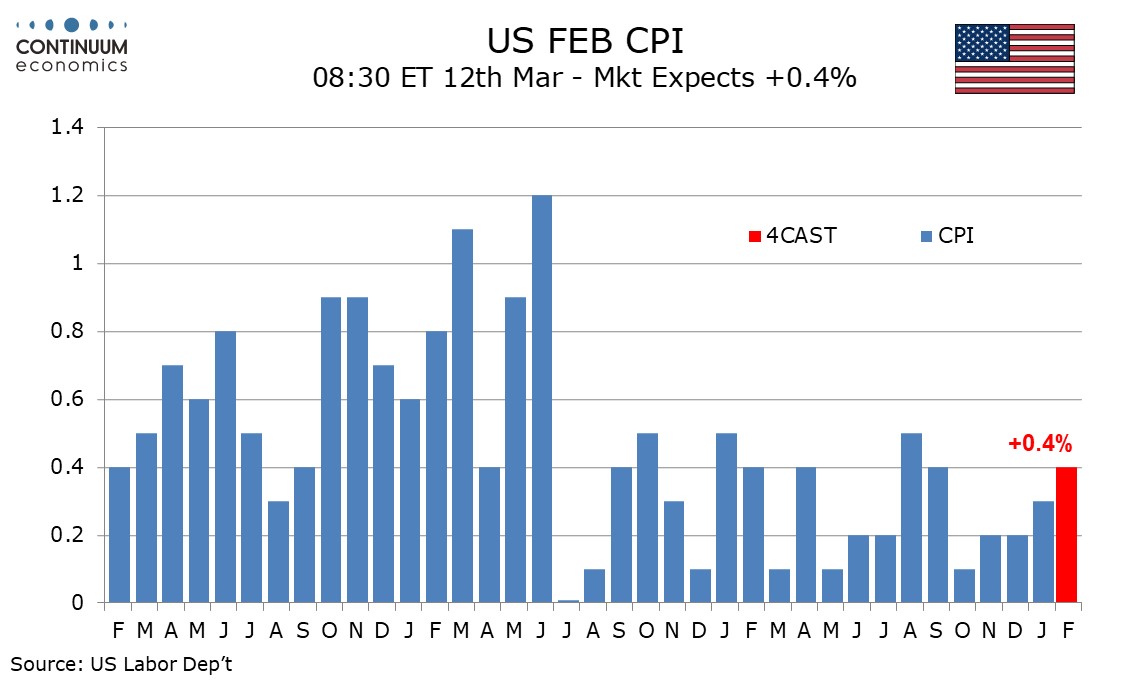

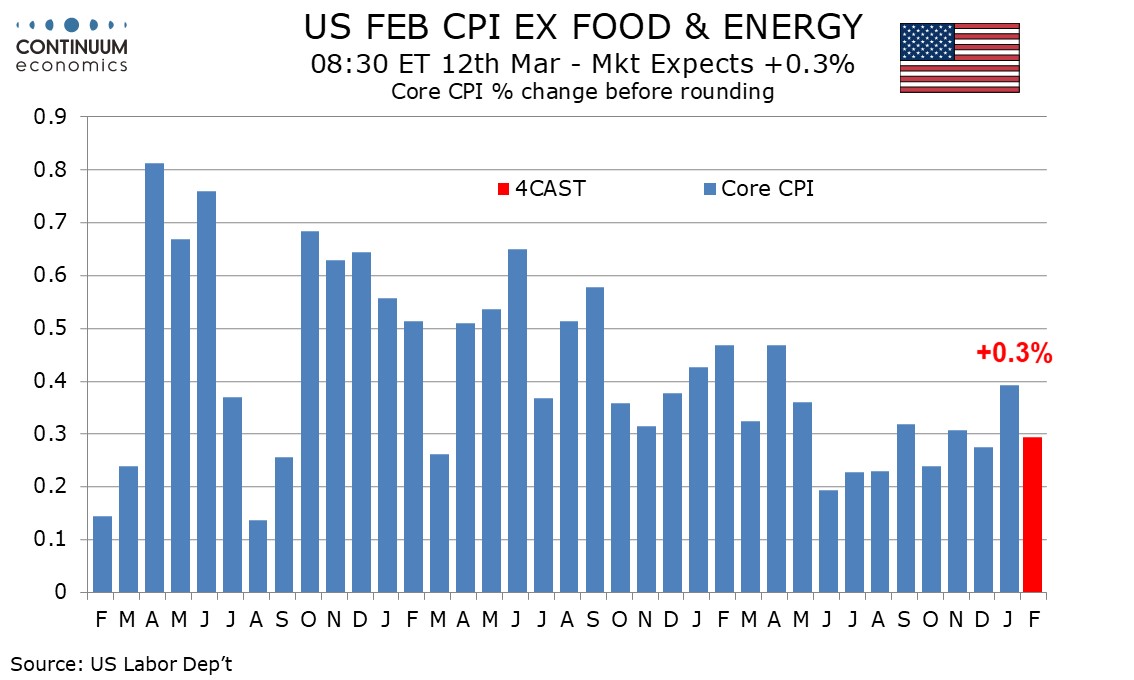

We expect February CPI to increase by 0.4%, which would be the strongest monthly increase since September, with a 0.3% increase ex food and energy, the latter a return to trend after a surprisingly strong 0.4% in January. Before rounding we expect February’s core CPI to rise by 0.29%.

January’s core CPI strength was led by services, with services ex energy surging by 0.7%, while commodities ex food and energy fell by 0.3%, led by a sharp fall in used autos. Weakness in commodities reflects improving supply while strength in services reflects strength in demand and possibly wages, though we expect many of the price hikes were one-time adjustments made at the start of the year. We do not expect a repeat in February, but we do not expect a correction below trend to follow the above trend month.

Core CPI trend slowed significantly in June which delivered the first of three straight 0.2% gains, but three of the final four months of 2023 delivered gains of 0.3% with the last 0.2% gain coming back in October. Unexpectedly strong GDP growth may be sustaining moderate inflationary pressures, which may take some time to ease in 2024. We expect most service components of February’s core CPI breakdown to be close to 0.2% though housing and medical care are likely to remain firm, if a little less so than in January. Commodities ae likely to be soft, though we doubt used autos will match a steep 3.4% January decline, and that reduces downside risk.

Gasoline is likely to reverse a January decline, leading a 2.0% increase in energy prices and pushing overall CPI above the core for the first time since September. We expect yr/yr CPI to be unchanged from January’s 3.1% overall but the ex food and energy pace to fall to 3.7% from 3.9%, reaching its slowest since April 2021.