Preview: Due February 28 - U.S. January Personal Income and Spending - Core PCE Prices to underperform Core CPI

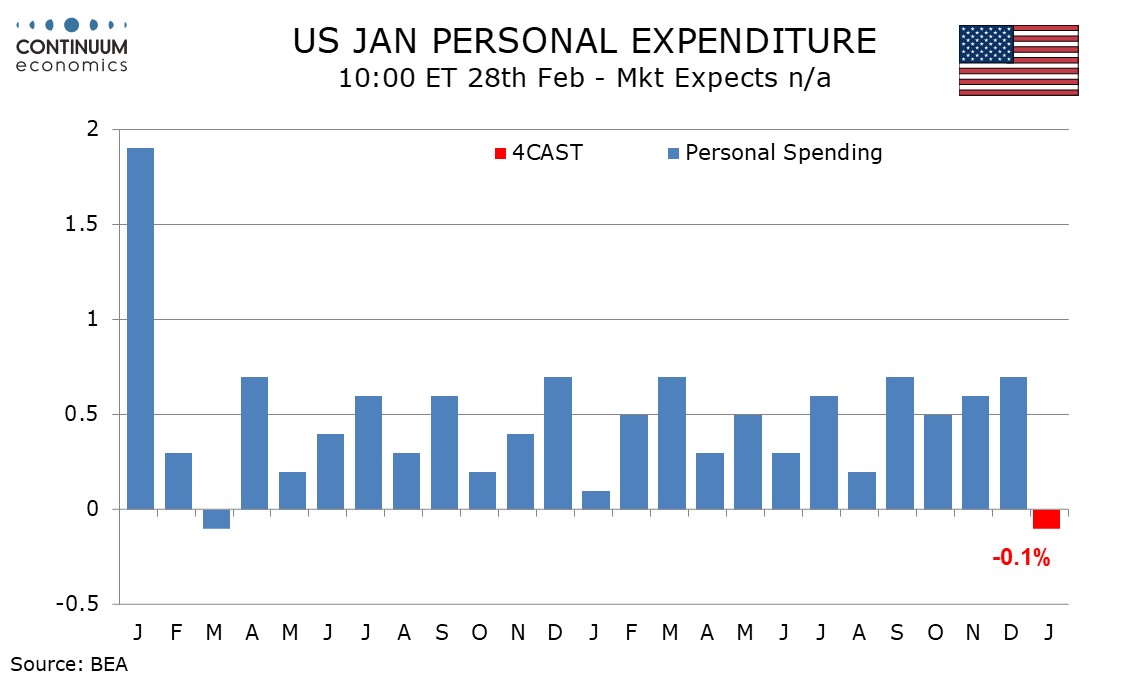

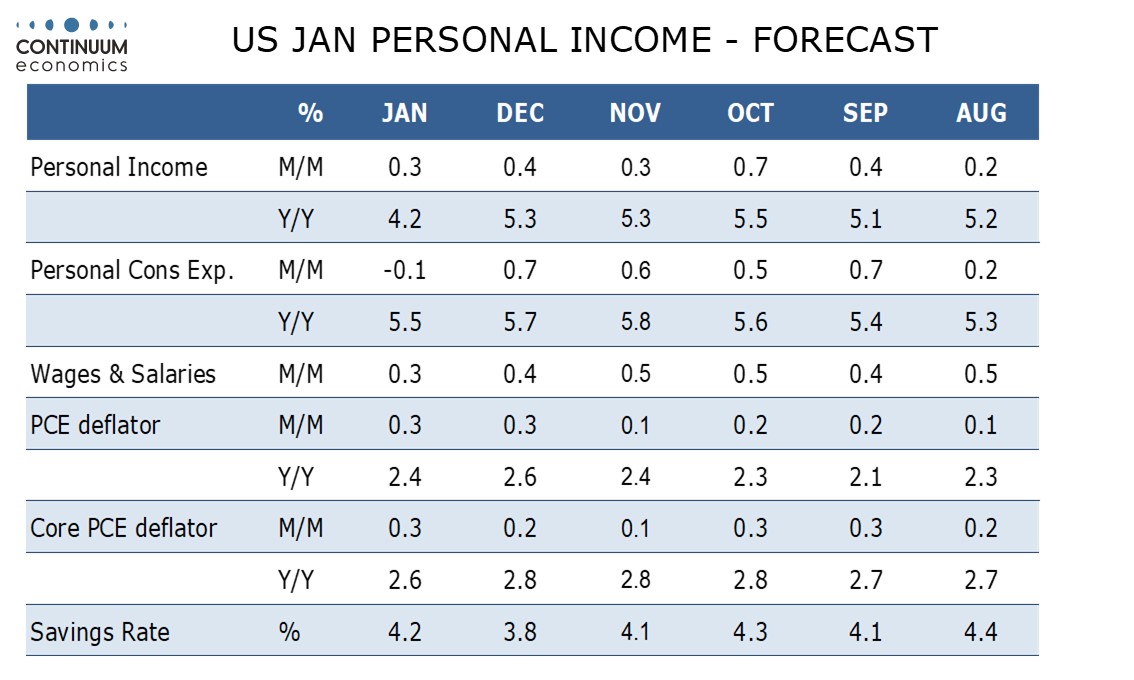

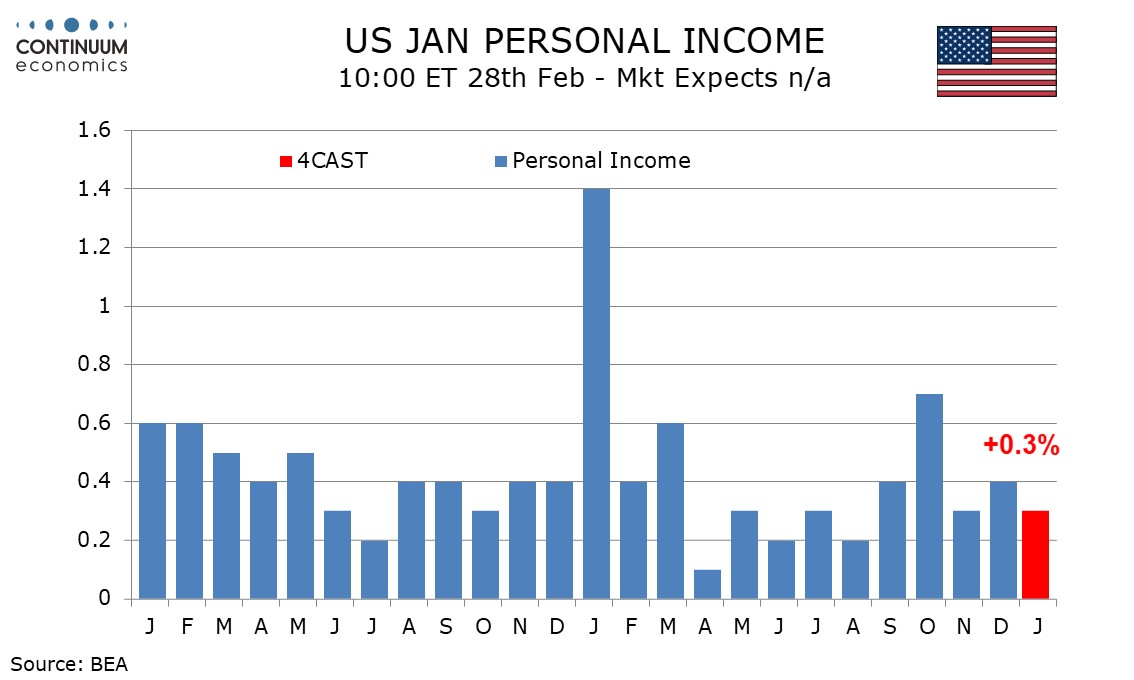

We expect a 0.3% rise in January’s core PCE price index, slower than the 0.4% seen from core CPI, while we expect a modest 0.3% rise in personal income to outpace an unusual 0.1% decline in personal spending.

Core CPI rose by 0.446% before rounding in January, but the components of PPI that contribute to core PCE prices were mostly subdued and core PCE prices usually underperform core CPI. Overall CPI rose by 0.5% but before rounding was similar to the core at 0.467%. We expect overall PCE prices to also rise by 0.3% in January.

This would see yr/yr growth slow to 2.6% after three straight months at 2.8% taking it to its slowest since June. Overall PCE prices would slow to 2.4% from 2.6%, reversing a December bounce.

We expect a 0.3% increase in personal income with a matching rise in wages and salaries. Average hourly earnings were above trend in January but the workweek fell and payroll growth was a little below trend. A key issue for the remainder of personal income will be the annual cost of living update for Social Security. This rose sharply in January 2024 but this year the gain should be moderate given slower inflation.

Retail sales fell by 0.9% in January which we believe was hit by bad weather. We expect this will marginally outweigh a 0.5% rise in services, in line with recent trend. This would see the savings rate bounce to 4.2% from 3.8% after slipping from 4.1% in November.