Preview: Due December 20 - U.S. November Personal Income and Spending - Core PCE Prices to underperform Core CPI

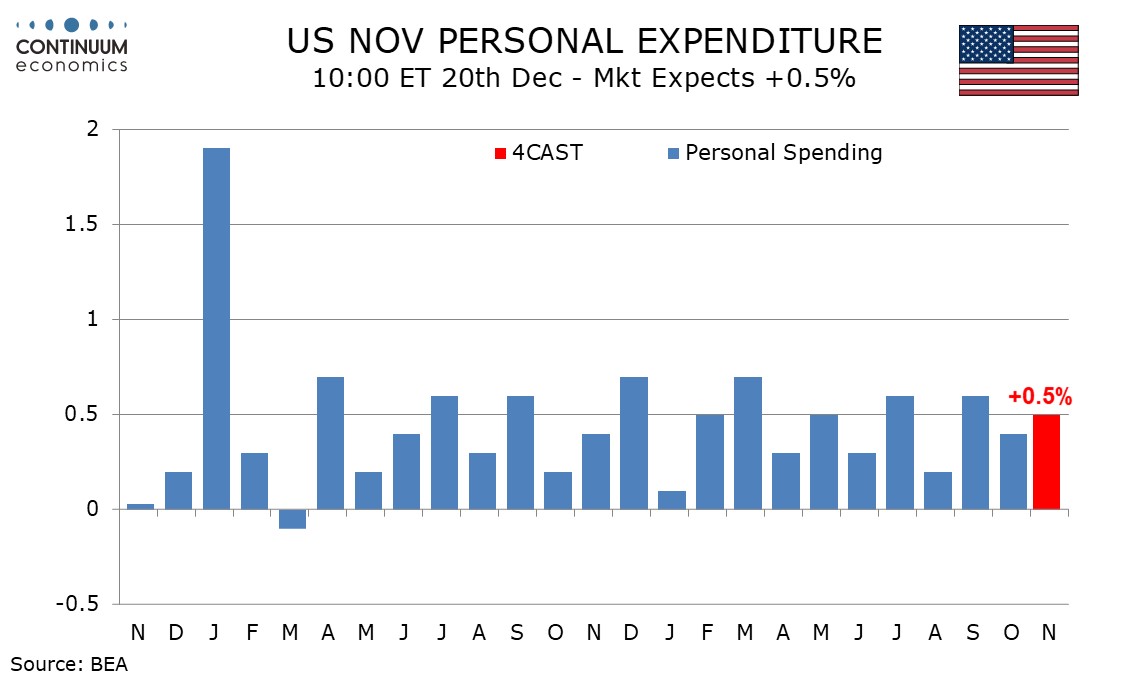

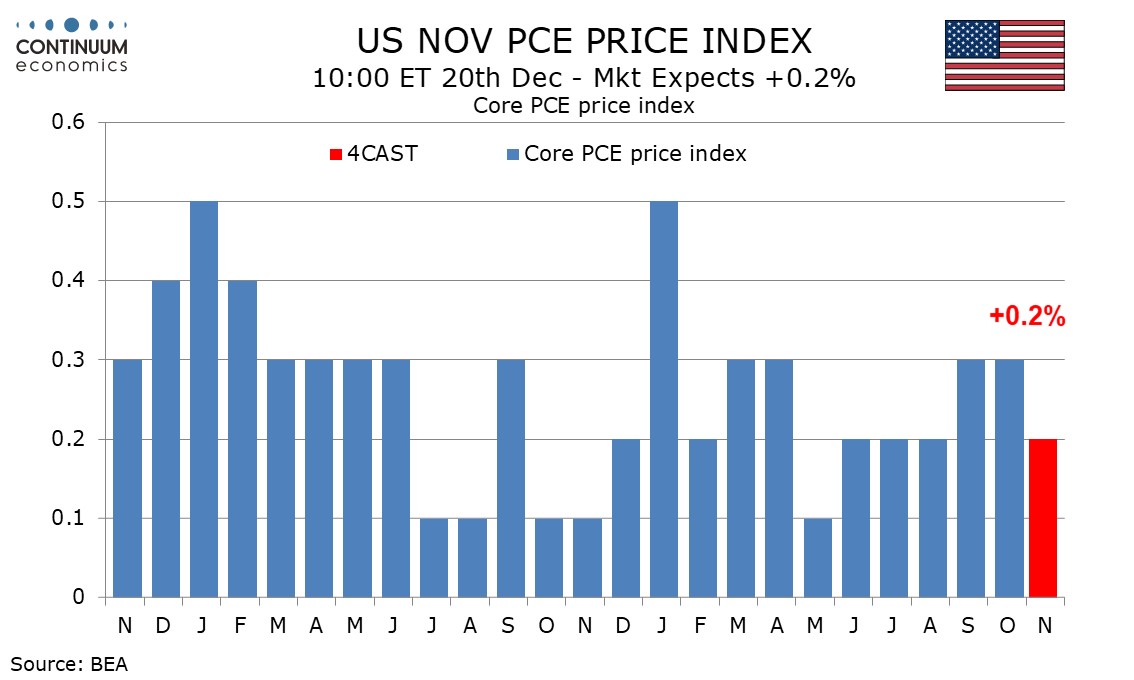

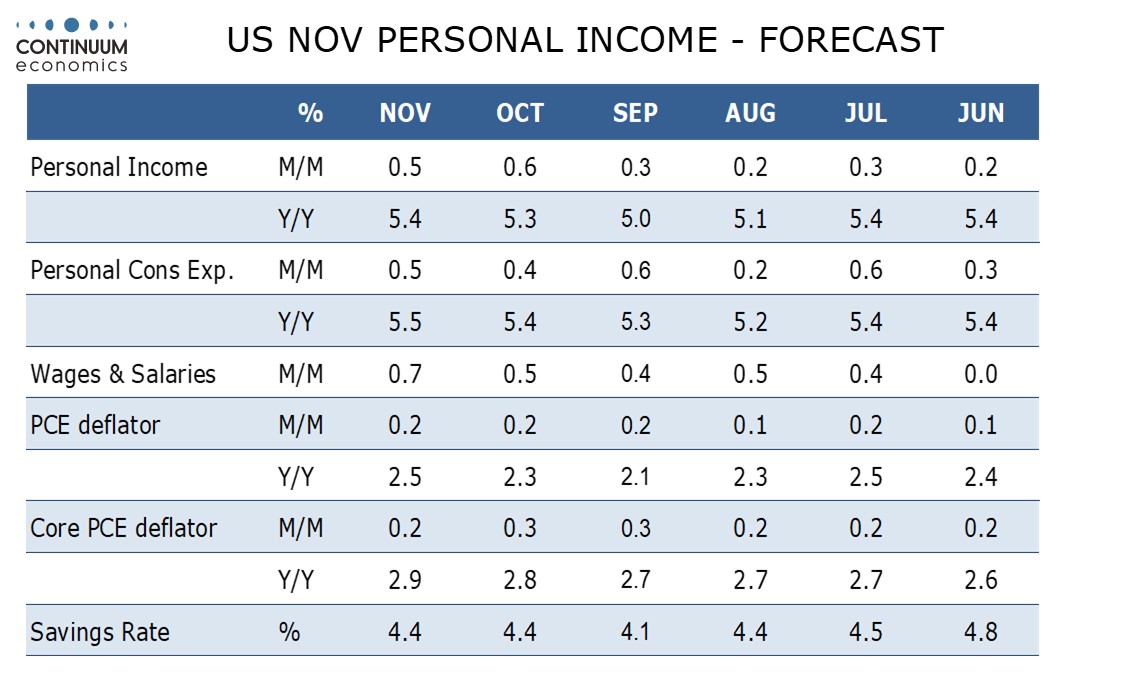

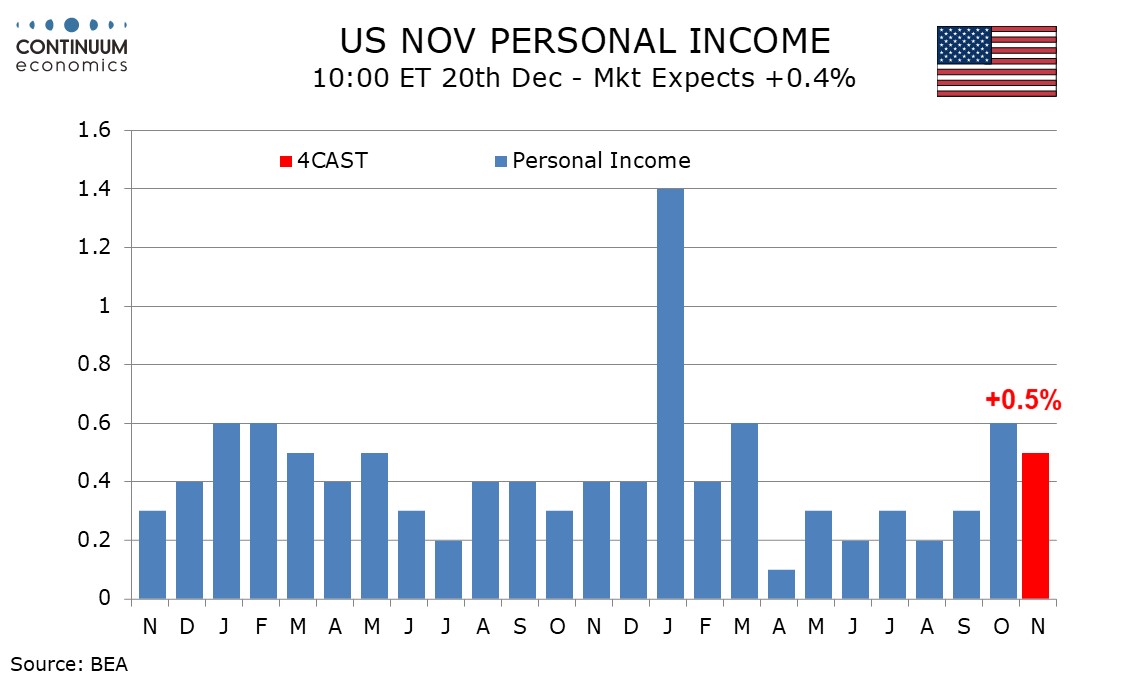

We expect November to see a 0.2% increase in the core PCE price index, underperforming a 0.3% core CPI as is usually the case but was not so in September and October. We expect 0.5% increases in personal income and spending.

Core CPI has seen four straight gains of 0.3%. While September and October saw the core PCE price index match the CPI (though marginally underperforming before rounding) August saw only a 0.2% rise in core PCE prices, and lower still before rounding. We expect core PCE prices to underperform the core CPI in November.

We expect overall PCE prices to also rise by 0.2%, also underperforming a 0.3% overall CPI. This will see yr/yr growth rise to 2.5% from 2.3% for overall PCE prices and to 2.9% from 2.8% for the core rate. Yr/yr CPI rates are higher at 2.7% overall and 3.3% for the core.

Gains in employment, the workweek and average hourly earnings in November’s non-farm payroll imply a stronger 0.7% increase in wages and salaries. However, the other components of personal income are unlikely to match unusual strength seen in October, and we expect overall personal income to rise by 0.5%.

Retail sales rose by 0.7% in November, led by autos. We expect service spending to be below trend at 0.3% in November, with the retail sales breakdown showing a dip in sales at eating and drinking places, which are considered as services in the personal income and spending report.