Bank of Canada Minutes Look to Gradual Easing, Divided on When to Start

Bank of Canada minutes from the April 10 meeting confirm a greater confidence on inflation falling, though there is disagreement within the Governing Council over when policy easing will become appropriate. There was agreement that easing would probably be gradual given the risks to the outlook and the slow path for returning inflation to target.

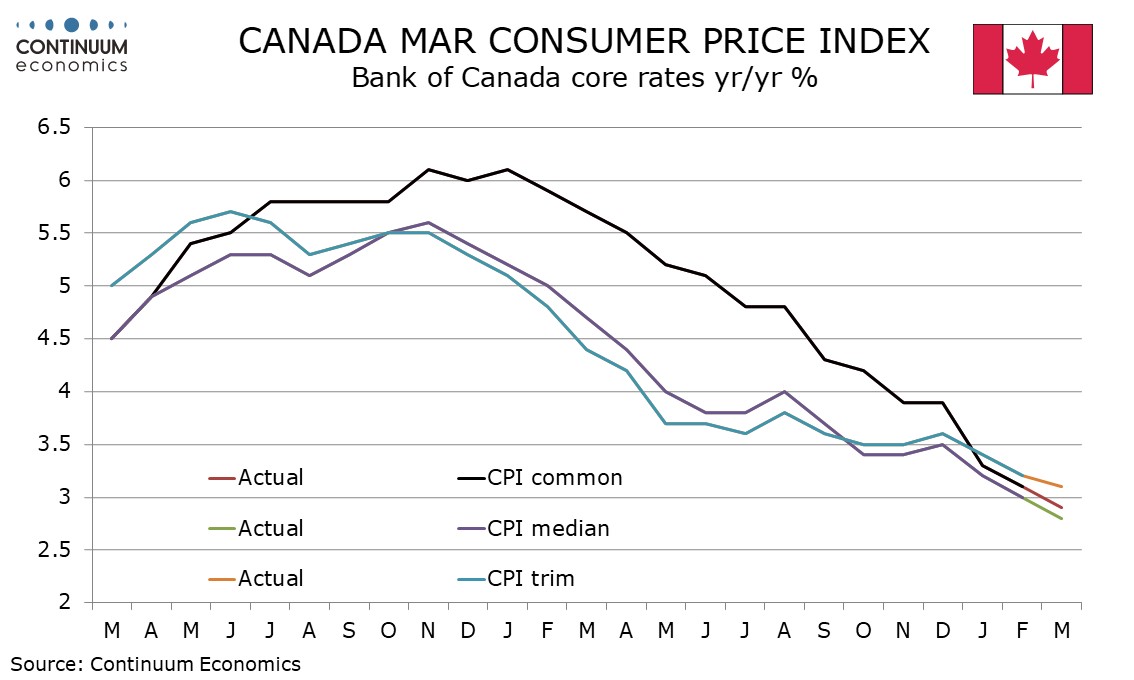

The discussion opens with the global economic outlook being seen as stronger than previously expected, with focus on the United States. Canadian GDP growth was expected to strengthen in early 2024 supported by population growth. Members were encouraged by recent progress on Canadian inflation and confident that their outlook for inflation was reasonably balanced. Factors seen as favorable to the inflation outlook were excess supply seen persisting through 2024, corporate price behavior normalizing, lower business’ inflation expectations and expectations of easing wage growth.

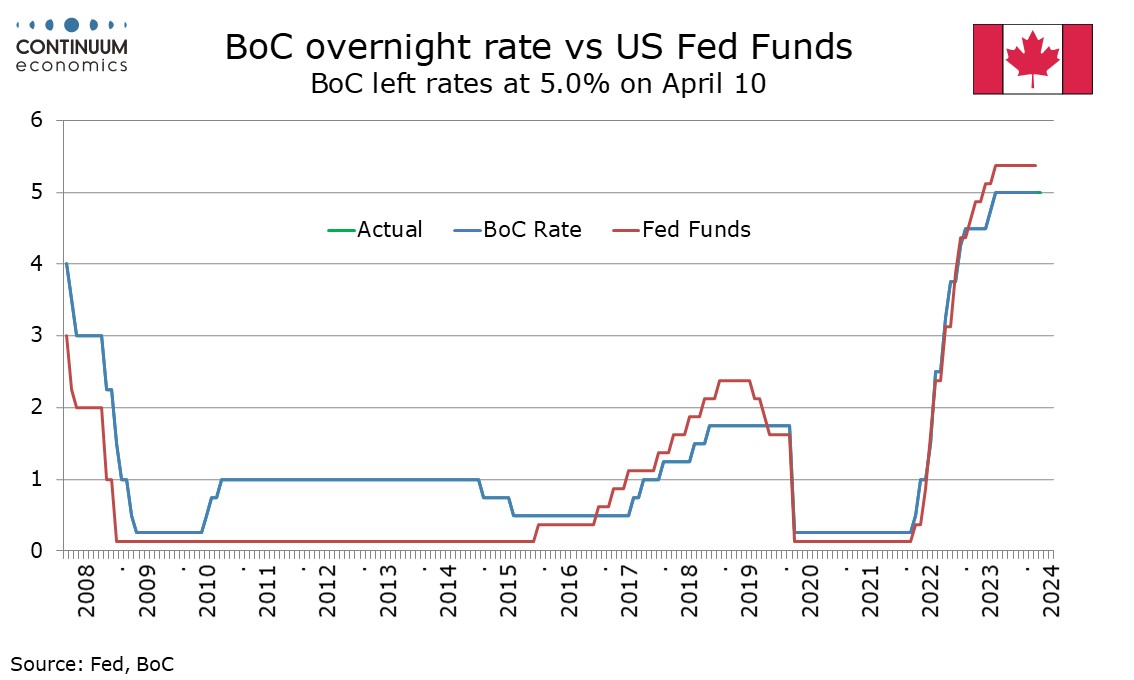

There was however a split on when easing would become appropriate. Some felt that stronger growth prospects reduced the risk of too tight policy slowing growth more than was necessary and more reassurance on inflation was needed. Others placed more emphasis on progress on inflation and felt there was risk in keeping policy too restrictive. They did however agree that inflation remained too high and were more concerned about the upside risks, though risks on both sides had become less acute. The previous two BoC statements had sought “further and sustained easing in core inflation". This meeting agreed that January and February data delivered further easing, but this still needed to be sustained.

After the April 10 meeting we felt that the BoC’s tone had become more dovish, focusing more on progress on inflation than improved growth prospects, and Governor Tiff Macklem stated a June rate cut was possible. The minutes do show that the improved growth prospects did get some attention too, and for some argued against near term easing. A June rate cut is far from a done deal, if still our central expectation. Since the meeting March CPI was seen by Governor Macklem as continuing to move in the right direction, despite being a little firmer on the month than January and February data. A June easing will require subdued data for April, and probably no unexpected strength in the Q1 GDP and April employment reports also scheduled ahead of June’s meeting.