Preview: Due December 5 - U.S. September Personal Income and Spending - PCE prices to match CPI, but downside risk

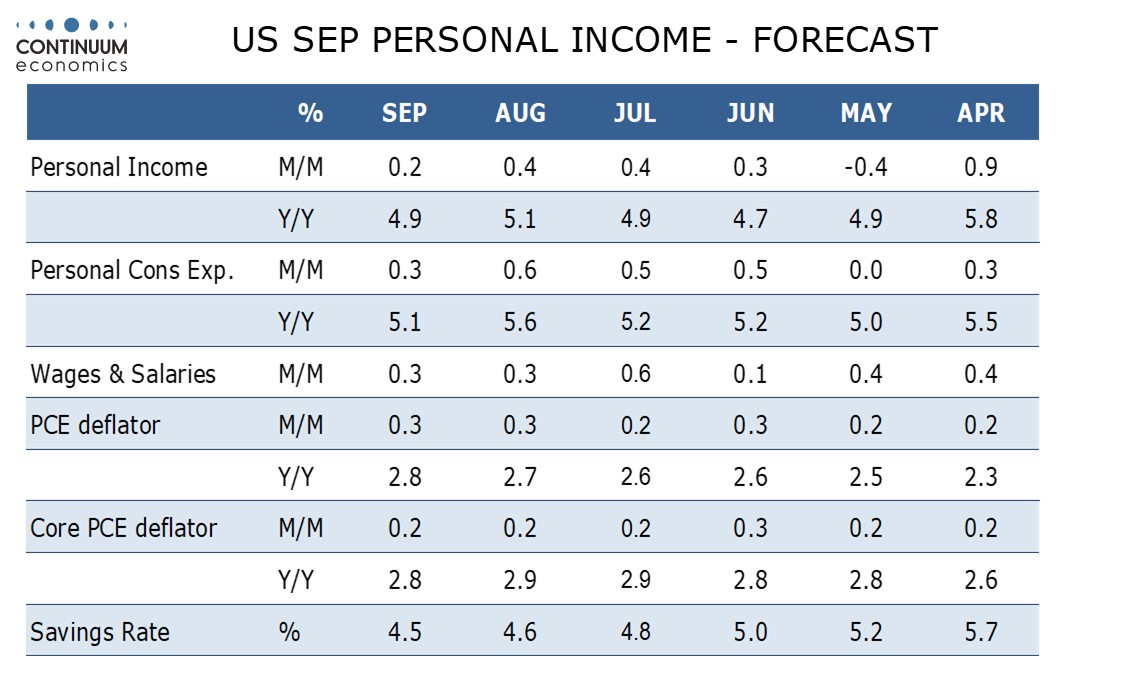

We expect September to show gains of 0.2% in personal income, 0.3% in personal spending sand 0.2% in core PCE prices. This would, assuming no revisions, leave core PCE prices up by 2.8% annualized in Q3, with real disposable income unchanged, well below a 3.1% rise in real personal spending.

Usually the personal income and spending report in the last month of the quarter is of limited interest with quarterly GDP usually released the day before, but this report will give useful insight into the quarterly data which has been delayed by the government shutdown.

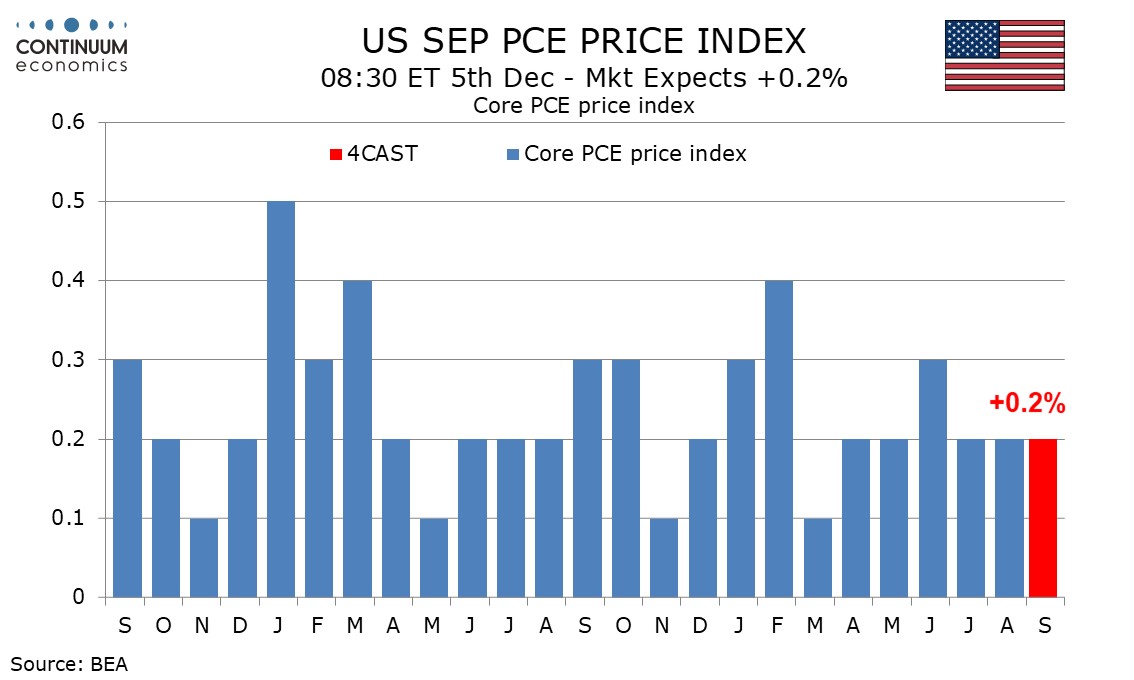

September CPI rose by 0.3% overall and 0.2% ex food and energy and we expect similar gains in PCE prices, with the overall pace at 0.3% and core rate at 0.2%, though a subdued core PPI suggests risk leans to the downside. Our forecasts would leave yr/yr growth in both overall and core PCE prices at 2.8%, the former up from 2.7% but the latter down from 2.9% in August.

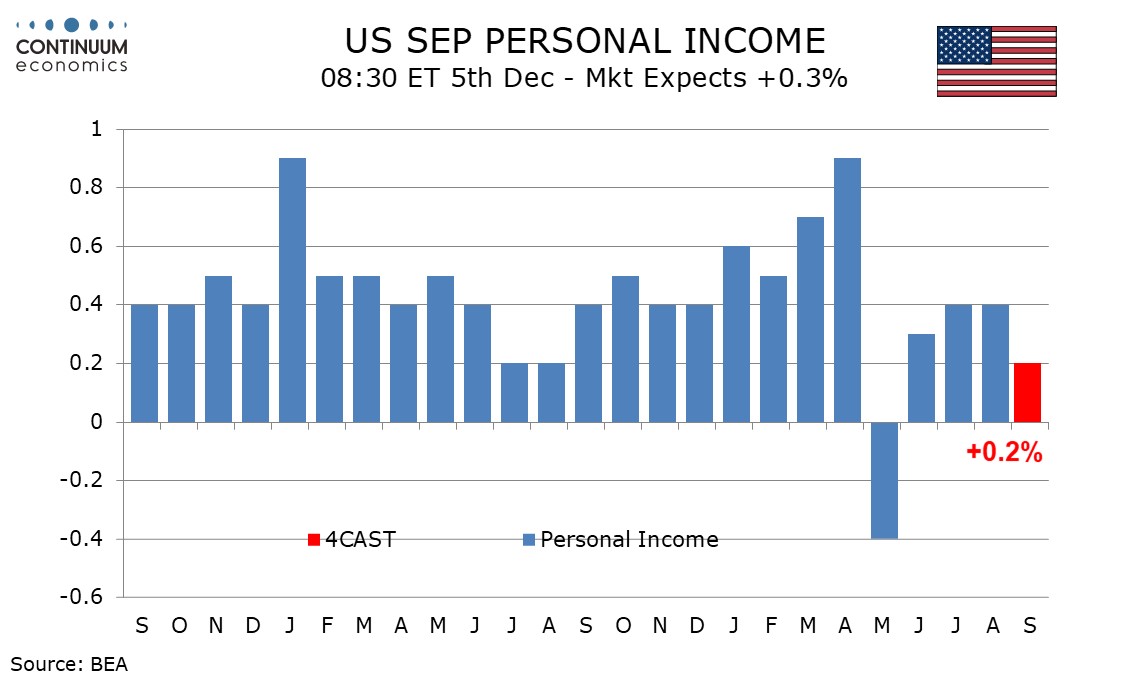

The non-farm payroll breakdown, where job growth picked up but average hourly earnings slowed, implies a second straight moderate 0.3% rise in wages and salaries. We expect overall personal income to rise by only 0.2% as other components correct from an above trend increase in August which lifted overall personal income to a 0.4% rise.

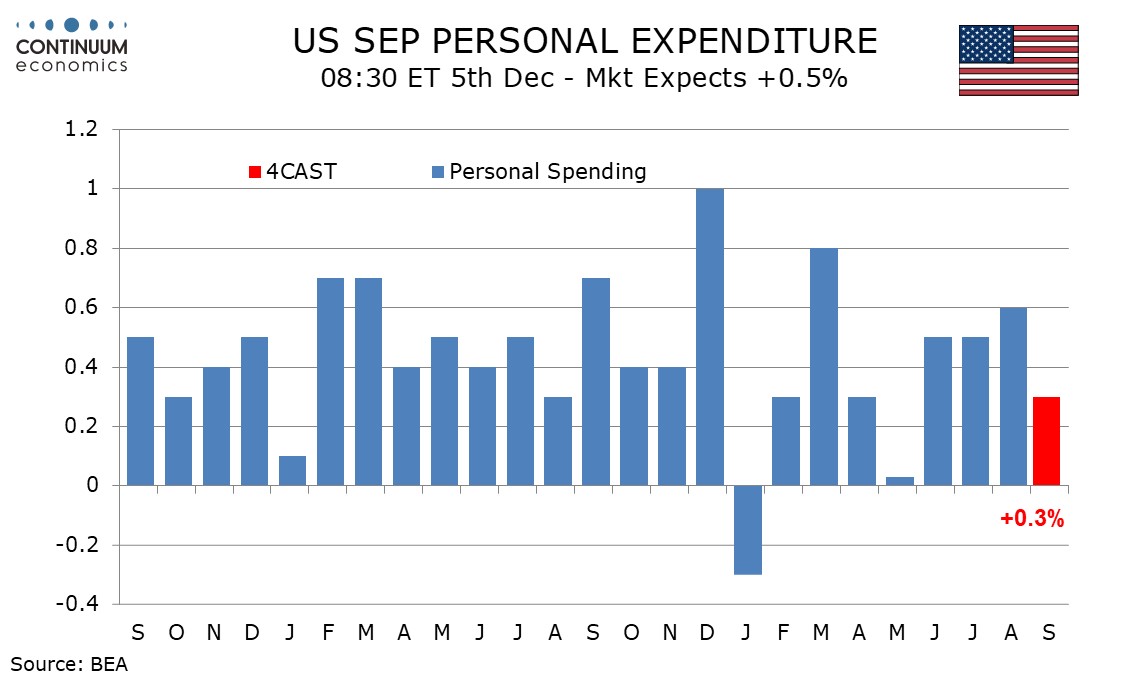

September retail sales rise by a subdued 0.2% but we expect a 0.4% rise in services, slightly slower than gains of 0.5% in July and August, to leave overall consumer spending up by 0.3%. October spending is likely to slow with auto sales softer after a tax credit for electric vehicle purchases expired.