JPY flows: JPY reverses Monday gains, but...

JPY gains on Monday largely reversed, but upside potential remains

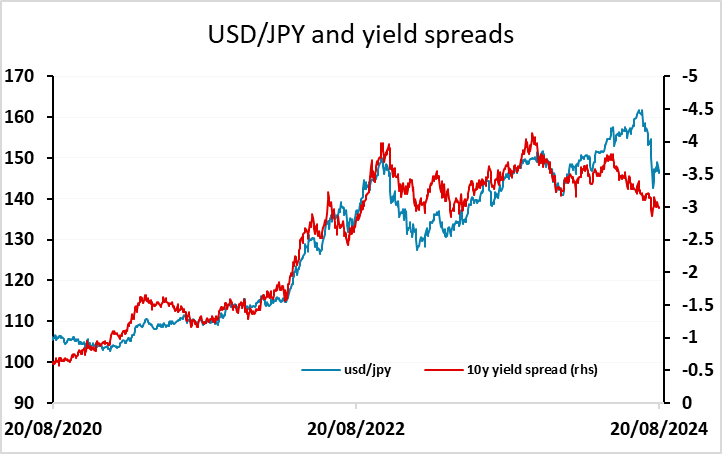

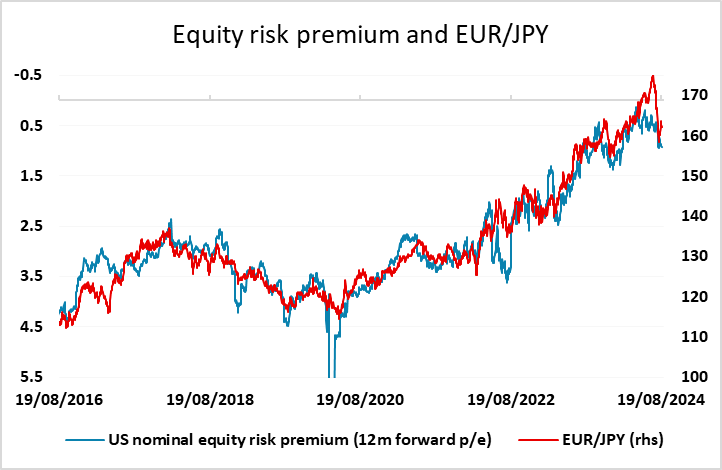

After dropping nearly 3 figures in the Asian session on Monday, USD/JPY has reversed most of the move in the last few session, with EUR/JPY now unchanged from Monday’s open. Despite various attempts to find a cause of the Monday dip in USD/JPY, there was never a good fundamental explanation beyond the fact that USD/JPY is still much too high both relative to long term value and relative to its correlation with yield spreads. The dip on Monday looked to be primarily technical. USD/JPY hit the Fibonacci retracement level of the move down from 161.95 to 141.70 at 149.40. and reversed off it. But it will be hard to restore the JPY’s upside momentum unless we see either lower yields or lower equities. We still see the JPY as significantly undervalued, and expect longer term gains, but as long as risk sentiment holds up, there are likely to be carry related sellers of the JPY both against the USD and on the crosses.

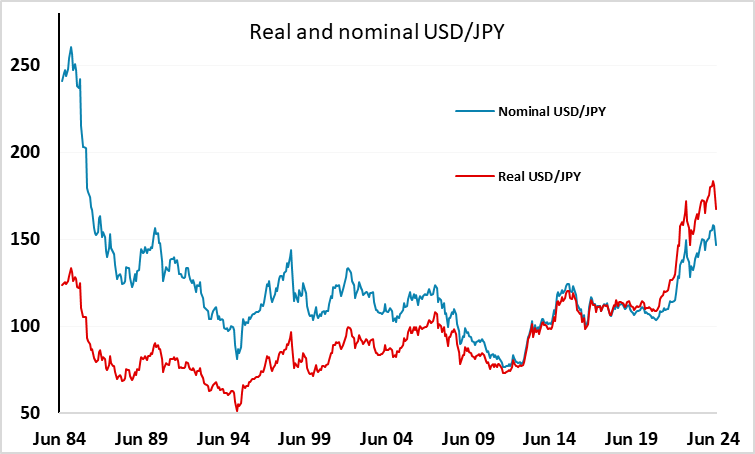

Relative to the relationship with nominal yield spreads, we have already seen the majority of the correction in the JPY, but there is still some more to come even based on current yields and spreads are likely to narrow further over time. Also, a much bigger correction is needed to realign real values. At the same time, there is still scope for the JPY to recover further on the crosses based on the correlation with equity risk premia. So we still see upside risks for the JPY, and we would not see a break back above 150 in USD/JPY unless we see a recovery in equities that comes at the same time as higher yields.