BoE Review: Gradualism Still the Order of the Day

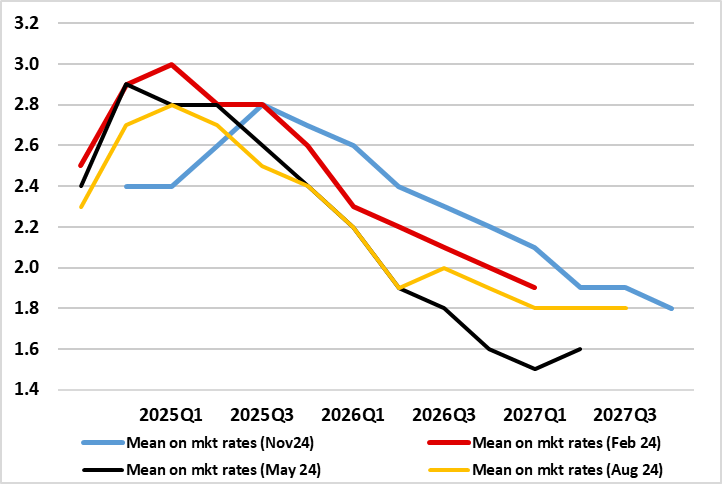

In what was something of a more hawkish assessment and outlook, the BoE nevertheless delivered the expected further 25 bp Bank Rate cut to 4.75% with only one (expected dissent against. But after what had been hints of a possibly more policy activism from Governor Bailey last month, the MPC instead adhered to its the gradualist approach, thereby conforming with the cautious approach long advocated by Chief Economist Pill. In contrast to our thinking, it does seem that the recent Budget boost has had a material impact on MPC thinking, to a degree that despite recent soft data and higher market rates, an inflation target undershoot is projected only from mid-2027 onwards (Figure 1). This is a full year later than previously projected and, as such, would suggest that the 3.7% rate markets assumed into 2026 may be a little inconsistent with meeting target. All of which makes it unlikely that the December MPC meeting will see more easing. Regardless, given the below-consensus outlook we still envisage for both growth and inflation, we still see an additional 125 bp of easing by end-2025.

Figure 1: A Later and Smaller Inflation Undershoot on the Cards?

Source: BoE MPR

Amid its continued uncertainty, the BoE has more formal scenarios for the inflation outlook, an upside and downside and a central case, the latter used as the basis for the MPR projections and encompassing more price pressures than envisaged in August. Indeed, there is no upside risks premium in these in the updated Monetary Policy Report (MPR) forecasts as the mode and mean CPI projections have coincided this time around. This embodies that a period of economic slack may be required in order for pay and price-setting dynamics to normalise fully.

But it is clear that the Budget has had an impact, alongside revisions to GDP data and perhaps even more clear cut worries about price persistence. What is puzzling is that the while he Budget boost the level of GDP by almost 1 ppt, the next upward revisions to GDP growth out to 2027 is minimal, ie around 0.25 ppt. Yet there is an even larger revision (ie higher) in the output gap. Otherwise, it is notable that the Budget measures (unlike OBR thinking) is see boost wage growth on a more persistent basis.

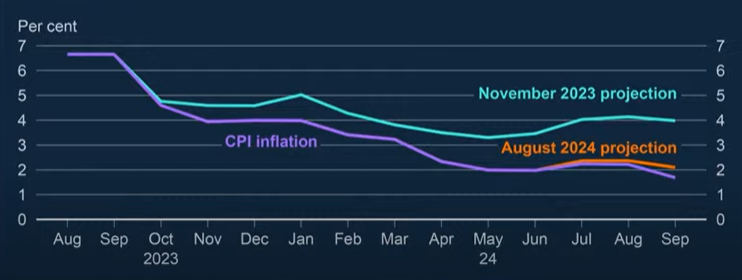

Figure 2: Inflation Undershooting BoE Projections?

Source: BoE

Overall we think that the BoE is a little too optimistic about growth and pessimistic about inflation, the latter even after the Governor started the press conference showing how the latter has undershot MPR expectations in the short and medium-term (Figure 2). Indeed, this is evident in shorter-term dynamics, something we have emphasized in gauging the extent to which underlying inflation has fallen.

Downside Risks Persist

In this regard, other considerations will be important, not least the extent and speed to which other DM central banks may ease policy. This is linked to downside growth risks, which according to business surveys, may be spilling over to the UK somewhat sooner and more sizably than the BoE has expected; the labor market is clearly slowing both in terms of becoming less tight and where the drop in private sector jobs questions the validity of the apparent upbeat GDP backdrop. The fiscal backdrop is also uncertain; while the recent Budget was certainly stimulative. Indeed, it could be argued that boost in government spending may be more neutral as the hike in employer National Insurance contributions (NIC), through which they are largely funded, dents already weak employment and then weighs on average earnings growth. Such a different interpretation to the NIC impact has already been flagged by the Institute for Fiscal Studies which suggests that the increase in employers’ NICs would not raise anything like the £ 25 bn stated on the Treasury’s expected fiscal arithmetic because it would result in lower wages and profits, reducing its net revenue to about £ 16 bn.