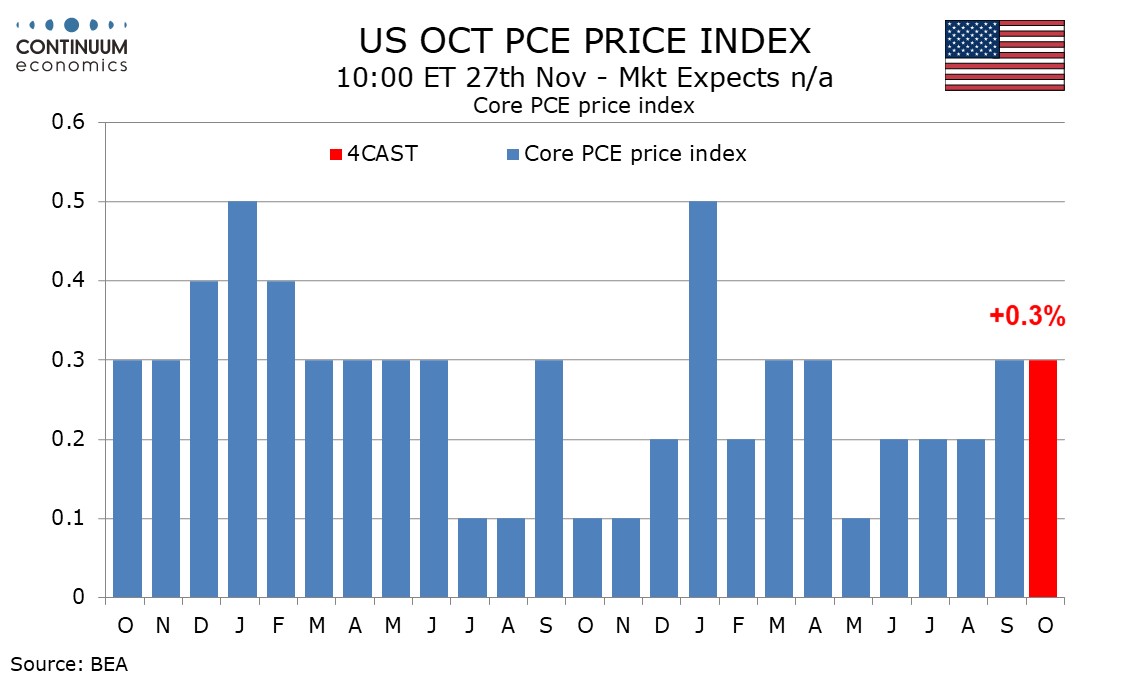

Preview: Due November 27 - U.S. October Personal Income and Spending - A second straight 0.3% from Core PCE Prices

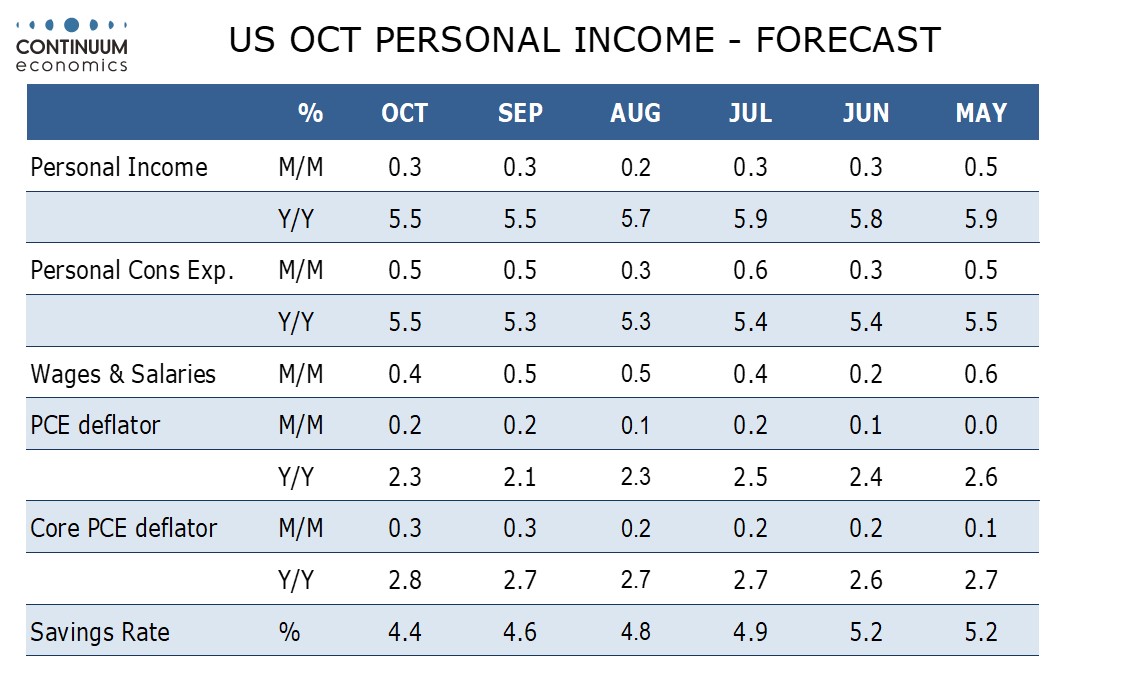

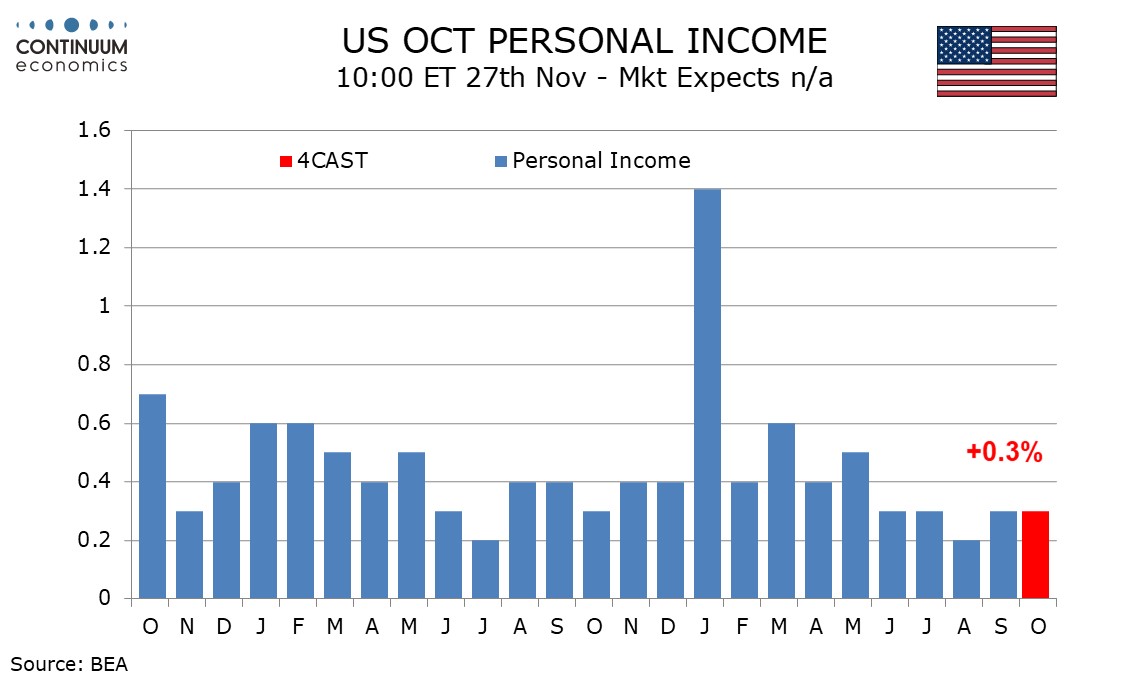

We expect October’s personal income and spending data to look similar to September’s, with gains of 0.3% in personal income, 0.5% in personal spending and a 0.3% rise in core PCE prices. A second straight 0.3% rise in core PCE prices would be a little high for comfort.

October’s CPI increased by 0.2% with a 0.3% rise ex food and energy, matching the gains of September. While PCE prices tend to underperform the CPI they matched the CPI in September and we expect they will again.

Forecasts from Fed’s Powell that yr/yr growth would pick up to 2.3% from 2.1% overall and to 2.8% after three straight months at 2.7% for the core rate are consistent with monthly gains of 0.2% overall and 0.3% for core PCE prices.

A near flat non-farm payroll (probably restrained by hurricanes) and an unchanged workweek suggest wages and salaries will match a 0.4% increase in average hourly earnings. Overall personal income tends to underperform wages and salaries, and here we expect a rise of 0.3%.

Retail sales rose by 0.4% but we expect a 0.5% rise in service consumption, leaving overall personal spending up by 0.5%. This will see the savings rate slip to 4.4% from 4.6%, reaching its lowest level since September 2023, but it is likely that personal income will be restrained by hurricanes, hitting savings.