Awaiting the Semi-Annual Testimony from Fed's Powell

Fed Chairman Jerome Powell will give his semi-annual testimony to Congress this week, speaking to the House on Wednesday and the Senate on Thursday. The message looks sure to be consistent with that given by most Fed speakers and Friday’s Monetary Policy Report, a cautious optimism that falling inflationary pressures will persist but no urgency to cut rates.

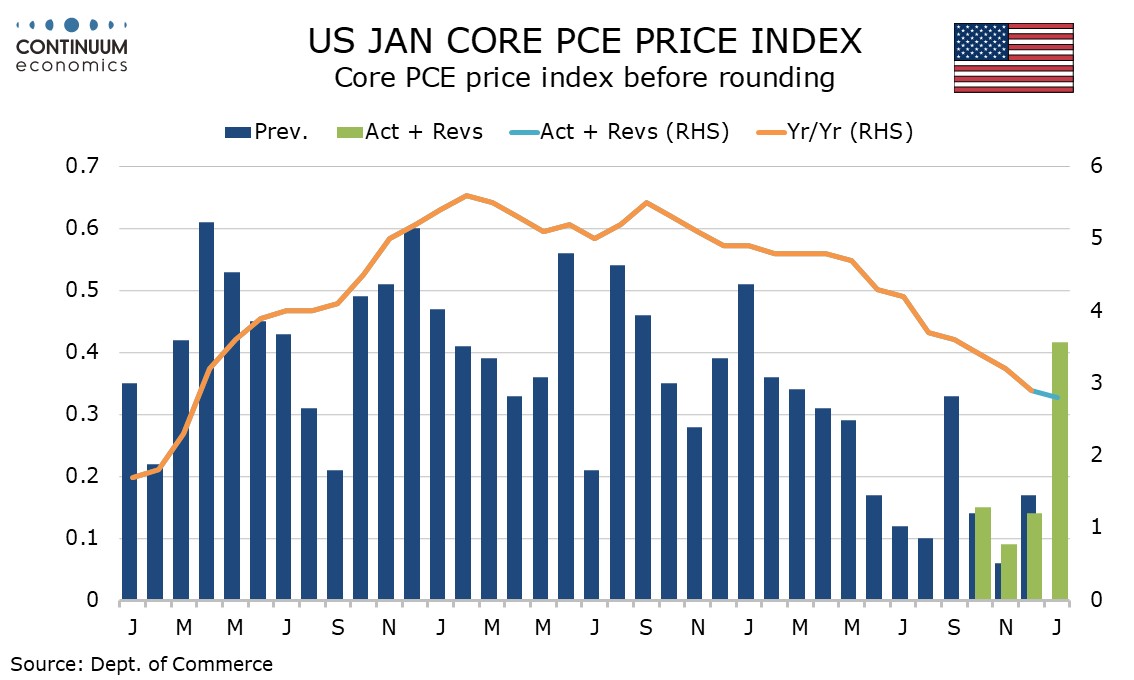

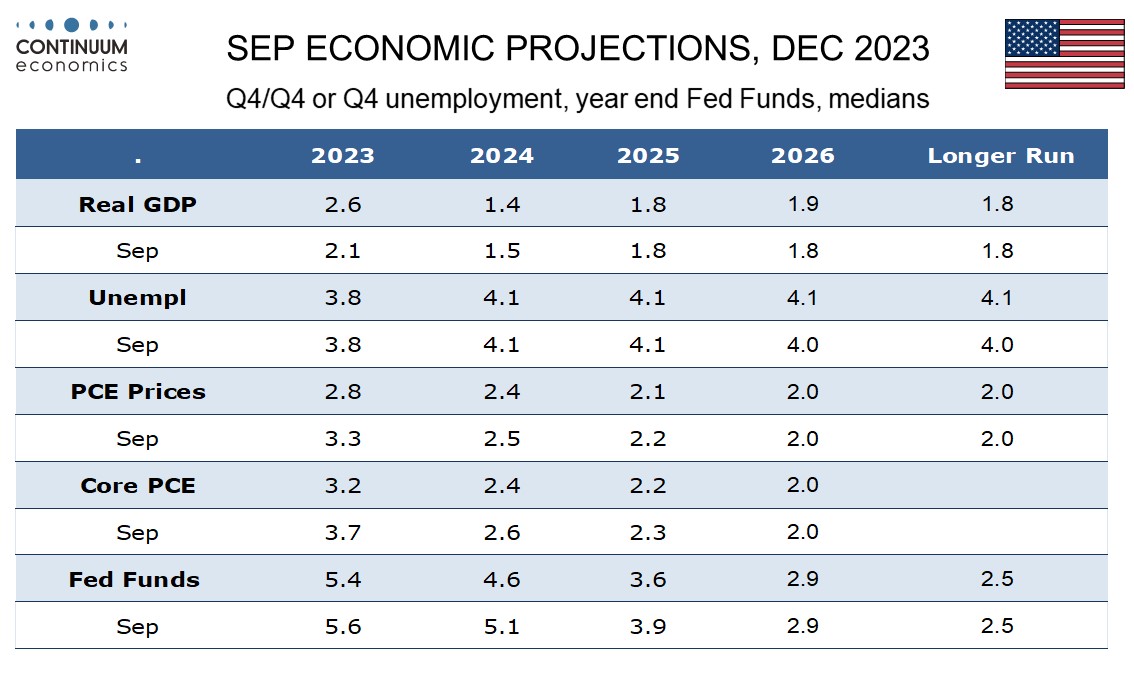

Friday saw the Fed’s Monetary Policy report, prepared in advance of Powell’s testimony, released, and the lack of market response showed few were surprised by its content. It noted that core PCE inflation had risen by a 2.5% annualized rate over the six months ending in January, which incorporates both the strong January and the preceding six months which ran at a pace close to the 2.0% target, putting January’s data in perspective. It saw the labor market as relatively tight and noted 2023 GDP growth exceeded that of 2022, with solid consumer spending but slowing business investment. Banking stress was seen as having receded since March of 2023, but a few areas of risk were seen as warranting monitoring.

Moving onto monetary policy, while seeing risks to achieving the Fed’s inflation and employment goals as having moved into better balance the report stated that the Committee does not expect to reduce rates until it has gained greater confidence that inflation is moving sustainably to target. The FOMC intends to slow and then stop reductions in its securities holdings when reserve balances are somewhat above the level that the FOMC judges to be consistent with ample reserves. Both easing and slowing the pace of balance sheet reduction look plausible later this year.

These looking for clues on timing from Powell may be disappointed. Powell will stress that decisions will be data-dependent rather than calendar-dependent. Inflation data will matter most of all. Currently the Fed is taking a cautiously optimistic stance with Fed speakers mostly downplaying the strong January data, seeing it alongside the subdued data seen in the second half of 2023. A strong February release, due on March 12, would however generate some alarm, and would probably rule out a move before the June 12 meeting, a day which will also see the release of May’s CPI.

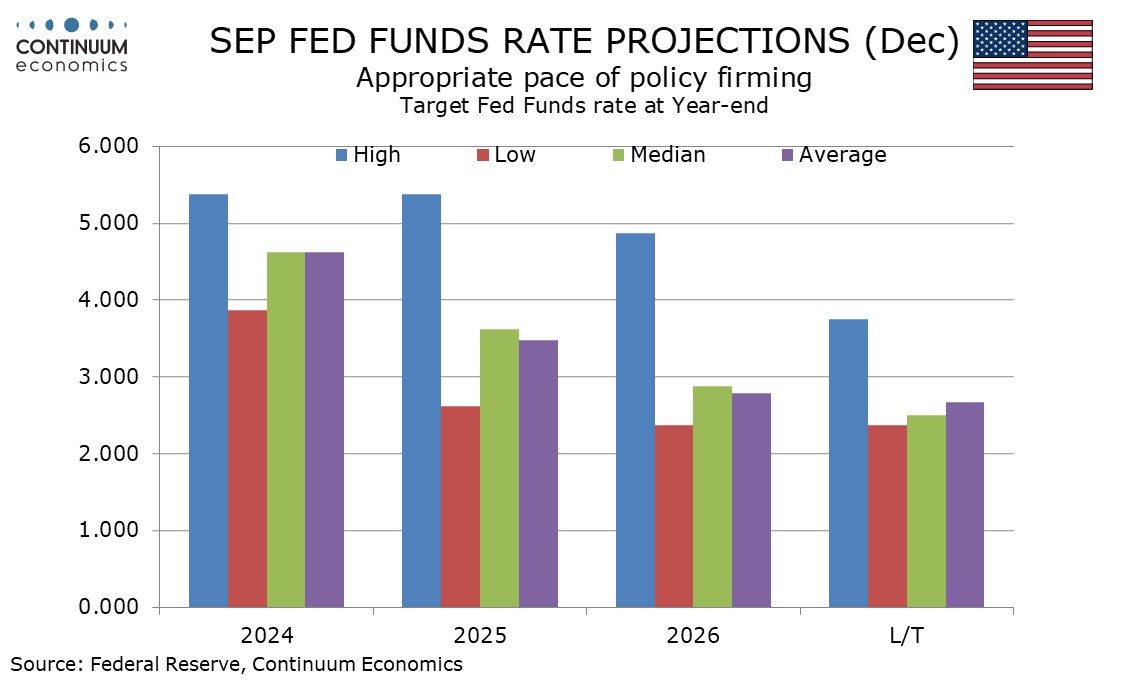

If Powell is asked on magnitude he would probably, like several recent Fed speakers, say that 75bps of easing this year, consistent with December’s FOMC dots, remains reasonable. That is now our central view. Some may feel 75bps would mean one rate cut per quarter starting in Q2, and that would be the likely pace of easing if inflation is acceptably subdued but economic growth remains healthy enough to prevent unemployment starting to rise. However a Q2 rate cut may require no more disappointing monthly inflation outcomes, and we project the first easing to come in July, with two moves in Q4 by when economic growth is likely to have lost momentum. We expect the economic slowdown to be quite brief however. For 2025 we expect the economy to combine near potential GDP growth with near target inflation and the Fed to deliver one 25bps easing in each quarter. December’s FOMC dots also saw 100bps of easing in 2025.