Preview: Due April 15 - U.S. March Retail Sales - Up again on the month but weaker in Q1

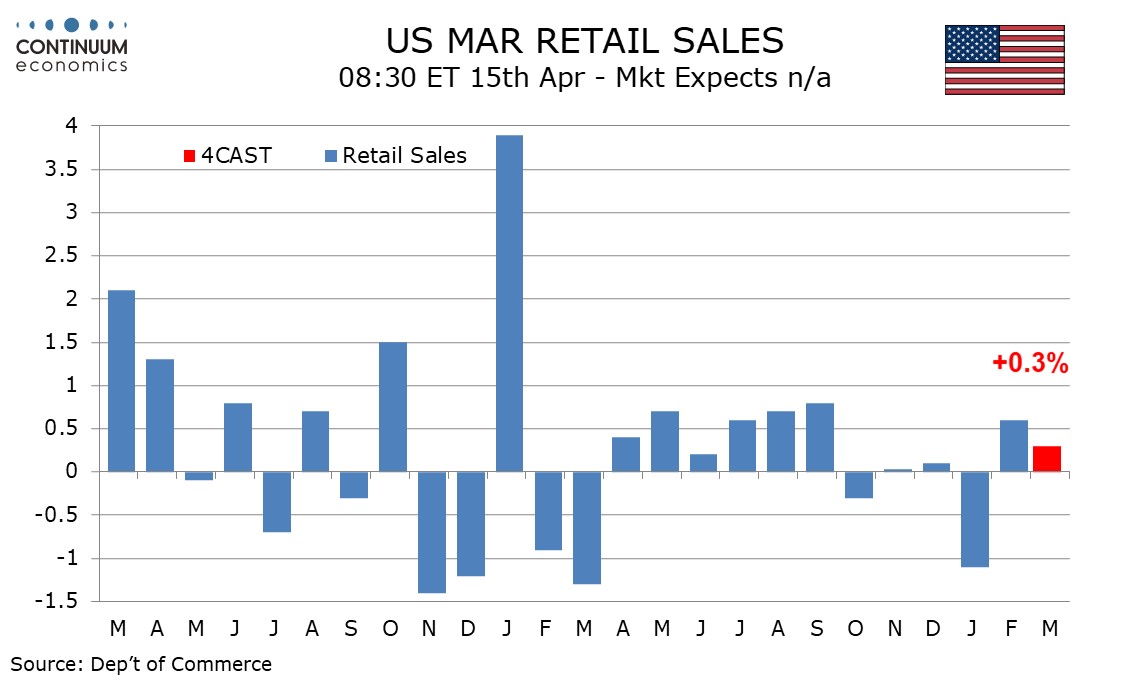

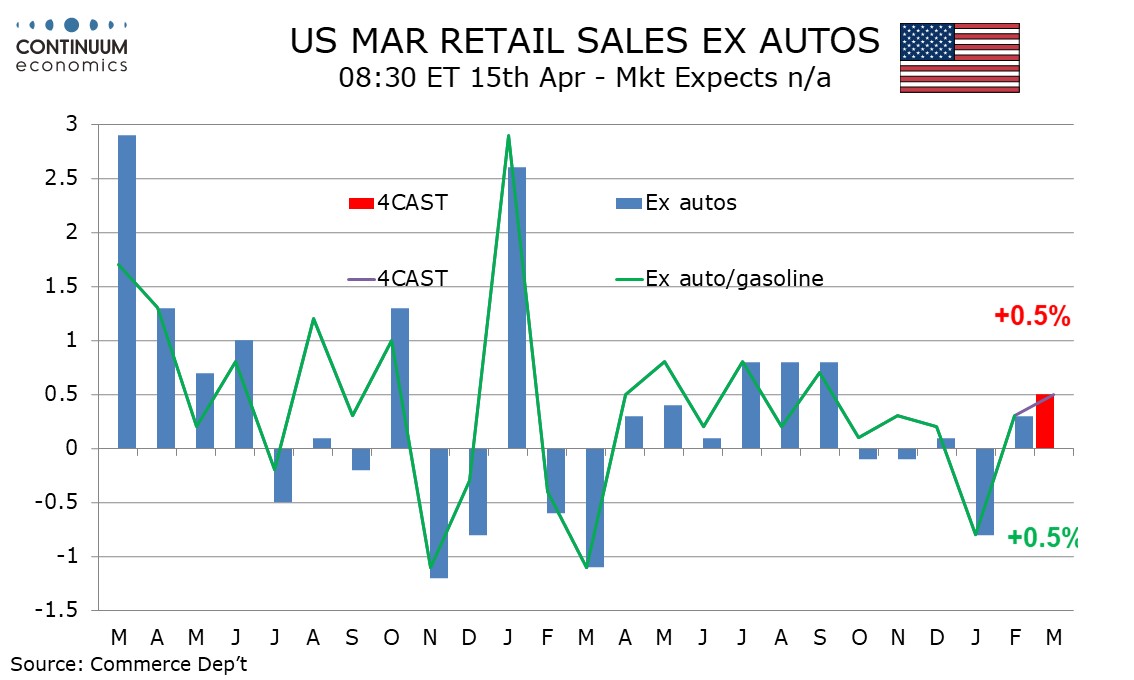

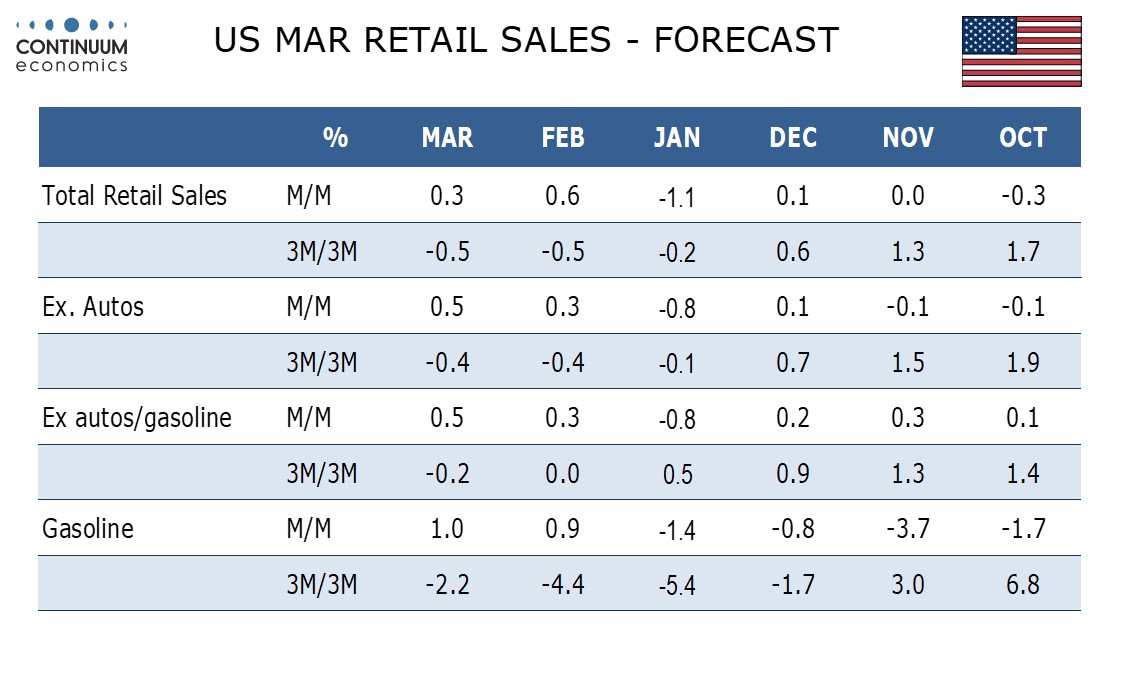

We expect a 0.3% increase in March retail sales, which after a 0.6% February increase would not fully erase January’s 1.1% decline that was blamed on bad weather. Ex autos however we expect a rise of 0.5%, which after a 0.3% February increase would complete a reversal of a 0.8% decline in January.

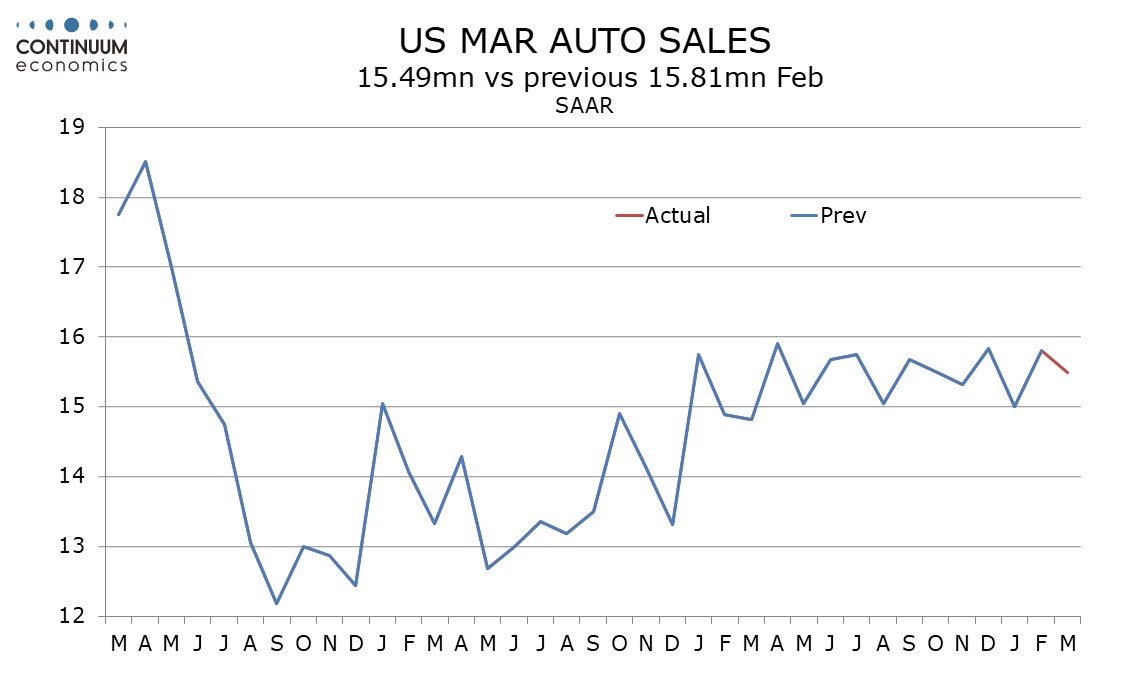

Industry data shows a modest decline in auto sales after a February rebound from a weak January, though trend in auto sales continues to lack direction.

Gasoline is likely to show a second straight modest increase after declining in each month of Q4, though we expect sales ex auto and gasoline to match the 0.5% increase we expect ex autos. This would be the third straight month in which the ex auto change matches that ex autos and gasoline.

Real disposable income was near flat in both January and February after a moderate 2.0% Q4 annualized increase that fell short of consumer spending. Some loss of momentum in consumer spending in Q1 overall looks likely and with services looking strong retail may underperform.

Given the weak January our forecast would leave Q1 retail sales declining in each of the three main series, overall, ex auto and ex auto and gasoline. This would be the first quarterly decline overall and ex autos since Q2 2023. Ex autos and gasoline, we have not seen a negative quarter since the pandemic-hit Q2 2020.