Published: 2024-01-31T14:04:51.000Z

EUR, USD, JPY flows: USD edges lower on softish US data

Senior FX Strategist

-

Weake than expected ADP employment and employment cost index have helped the USD a little lower, but USD/JPY looks to be the only pair where a big decline looks feasible

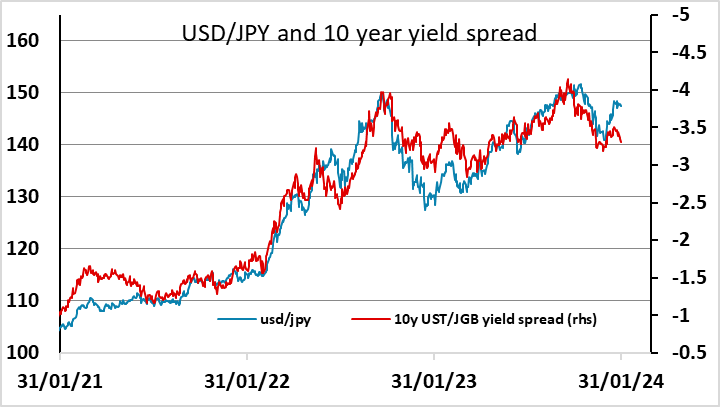

Softish US data, with ADP and the employment cost index both below consensus, have pulled the USD a little lower in early US trading. We doubt these numbers will make a great deal of difference to the Fed, and they were preceded by slightly softer than expected German preliminary CPI data, so there is still not much case for opposing the market pricing of an ECB rate cut in April. We consequently still see USD bears as likely to see most progress in USD/JPY, where yield spreads remain at levels that suggest scope for substantial decline towards 140. But such a decline is unlikely short term if the FOMC adopt a slightly more hawkish tone tonight.