Mexico GDP Review: Marginal Growth Points to Deceleration but the Outlook is still Bright

The Mexican Economy experienced a slight Q4 deceleration, growing 0.1%, with Agriculture leading at 1.1%. Services were stagnant at 0%, but annual growth was positive, reaching 3.1% in 2023. The industrial sector propelled growth by 3.6%, aligning with nearshoring trends. Despite potential economic challenges, Banxico faces decisions on interest rate cuts, influenced by a resilient currency and falling inflation. The 2024 outlook is optimistic, projecting a 2.4% growth, supported by strong U.S. demand and potential industrial expansion.

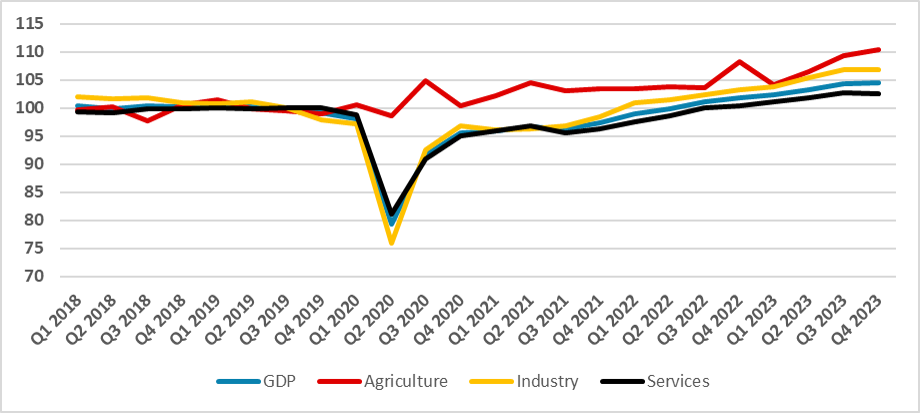

Figure 1: Mexico GDP (2019 = 100, Seasonally Adjusted) Source: INEGIThe Mexico National Statistics Institute has released the preliminary GDP figure for Q4 of 2023. After presenting robust growth in the past quarters, the Mexican Economy has finally decelerated, growing 0.1% (q/q) during the fourth quarter of 2023. Agriculture led the way in growth in Q4, as this sector grew 1.1% during Q4. Services were stagnant, growing 0% during Q4, while Services grew 0.1% (q/q) during the quarter. However, in annual terms, the news is good. Mexico is likely to have grown 3.1% during 2023, surpassing the 3.0% level for two consecutive years.

Source: INEGIThe Mexico National Statistics Institute has released the preliminary GDP figure for Q4 of 2023. After presenting robust growth in the past quarters, the Mexican Economy has finally decelerated, growing 0.1% (q/q) during the fourth quarter of 2023. Agriculture led the way in growth in Q4, as this sector grew 1.1% during Q4. Services were stagnant, growing 0% during Q4, while Services grew 0.1% (q/q) during the quarter. However, in annual terms, the news is good. Mexico is likely to have grown 3.1% during 2023, surpassing the 3.0% level for two consecutive years.

One possibility for the cooling down of the Mexican economy during the quarter could be related to the lagged effects of tight monetary conditions, which are finally kicking in on the Mexican Economy. A deceleration of exports to the U.S. could also be aligned with this slowdown during the quarter. The main driver of growth in the Mexican economy is concentrated in the industrial sector, which has been expanding during this first phase of nearshoring, in which demand from the Mexican industry started to grow in response to closer ties with U.S. enterprises. The Industrial sector grew 3.6% in 2023. Services also saw an important recovery during the year, growing 2.9%. The story for Services growth is much more related to the lagged recovery from the pandemic. Agriculture also saw an important 2.0% growth in 2023.

The deceleration will be some food for thought for Banxico, which will meet on Feb 8. With the economy clearly decelerating and the cuts on the radar, Banxico will need to decide whether to start the cut in the next meeting or rather wait for an additional meeting. With the Mexican currency showing strength and inflation falling, we believe there would be some room for cutting, although Banxico's stance has mostly been hawkish. We see now a 50/50 chance of Banxico cutting, but a low January CPI number could make Banxico push the cut trigger.