FX Daily Strategy: Europe, July 11th

US CPI the main focus

Some USD downside risk after recent yield declines

GBP and AUD may be the biggest beneficiaries

GBP to gain further support from GDP

US CPI the main focus

Some USD downside risk after recent yield declines

GBP and AUD may be the biggest beneficiaries

GBP to gain further support from GDP

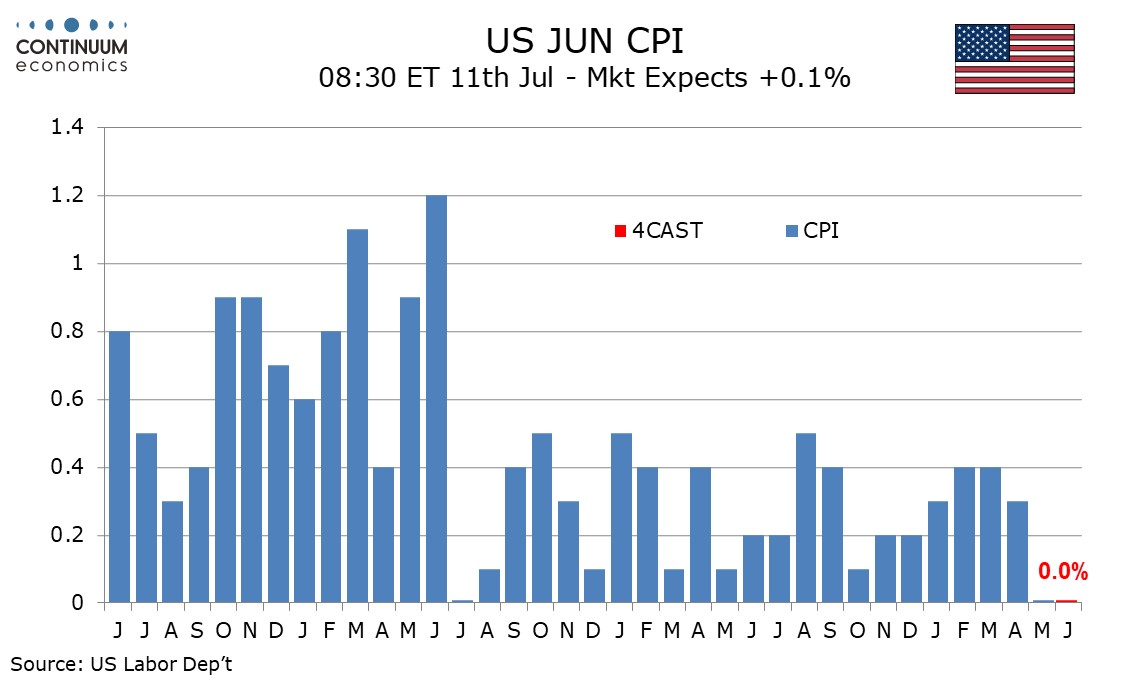

Thursday sees the main data of the week in the form of US June CPI. We expect June’s CPI to look similar to May’s, with an unchanged outcome overall and a 0.2% increase ex food and energy. Before rounding we expect gains of 0.04% overall and 0.19% ex food and energy, up from 0.01% and 0.15% respectively in May, but both May and June would still be softer than any month in 2023 in each series. Our forecast is marginally below the market consensus of 0.1% and 0.2% for headline and core. It is still unlikely to make any significant difference to market expectations of Fed policy, but the USD risks are on the downside on the basis of our forecasts, especially since it has somewhat outperformed yield spreads in the last week or two.

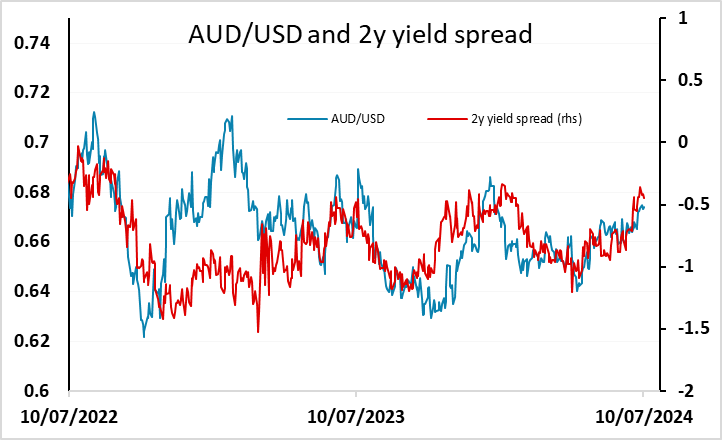

Downside risks for the USD should come mainly against those currencies where there is less scope for easing. The most obvious of these ids the JPY but the JPY remains a different animal to the rest, with the market unwilling to abandon the big uptrend we have seen in recent years even though the rising US yields that triggered it are going into reverse. Yield spreads have been suggesting a lower USD/JPY for more than a month, but it remains close to the highs. The story is complicated by weak Japanese data, the lack of tightening in June from the BoJ and uncertainty about the prospects for intervention. But despite all this it remains very hard to find a fundamental justification for extreme JPY weakness. Nevertheless, in the absence of BoJ intervention it is hard to forecast a convincing turn lower in USD/JPY. The AUD may therefore be a more favoured vehicle for USD bears, with less reason to expect RBA easing and attractive yields. The year’s highs above 0.68 may be achievable if US CPI is on the weak side.

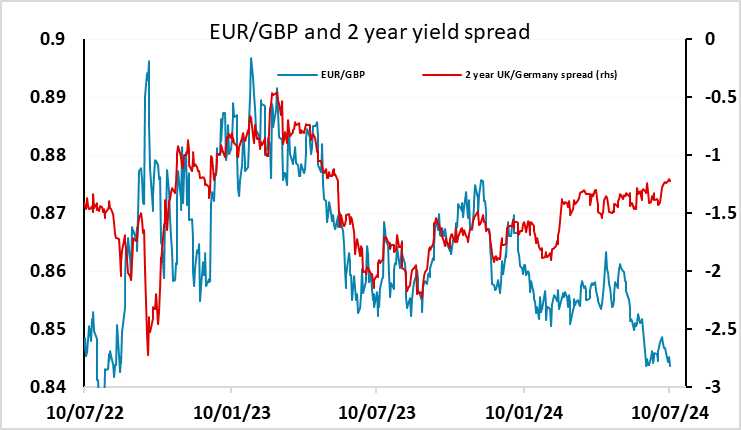

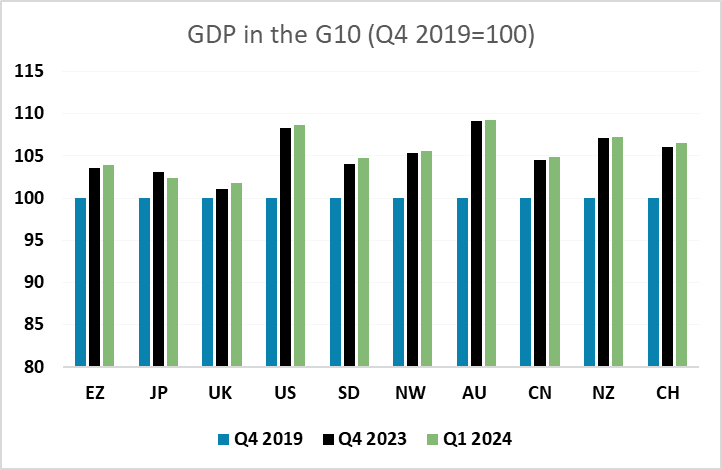

GBP also performed well on Wednesday after what were perceived as hawkish comments from BoE chief economist Pill, although there was little reaction in the money markets, which continue to see the August MPC meeting as close to a 50-50 call. Yield spreads also don’t suggest a strong case for GBP strength, but the pound appears to be gaining some benefit from optimism around the new UK Labour government and prospects for a growth rebound. We would be cautious on this, as while growth may pick up, the UK is starting from a position as having been the weakest of the G10 economies since Q4 2019 (the last quarter pre-pandemic), and GBP has not lost ground to the EUR over the period.

Thursday sees May UK GDP data. We see a 0.1% m/m rise while the market consensus is for a 0.2% gain. We also expect upward revisions to the Q1 backdrop. As a result, this would be consistent with a circa-0.3% Q2 q/q-plus outcome, building on the strong but possibly misleading Q1 jump but would also be below BoE thinking for the last quarter. But the apparent resilience, in the GDP data contrasts increasingly with employment weakness and is partly a result of public sector gains. So while we wouldn’t currently oppose GBP strength, the market may be jumping the gun.