Preview: Due February 14 - U.S. January Retail Sales - Weather to bring correction from Q4 strength

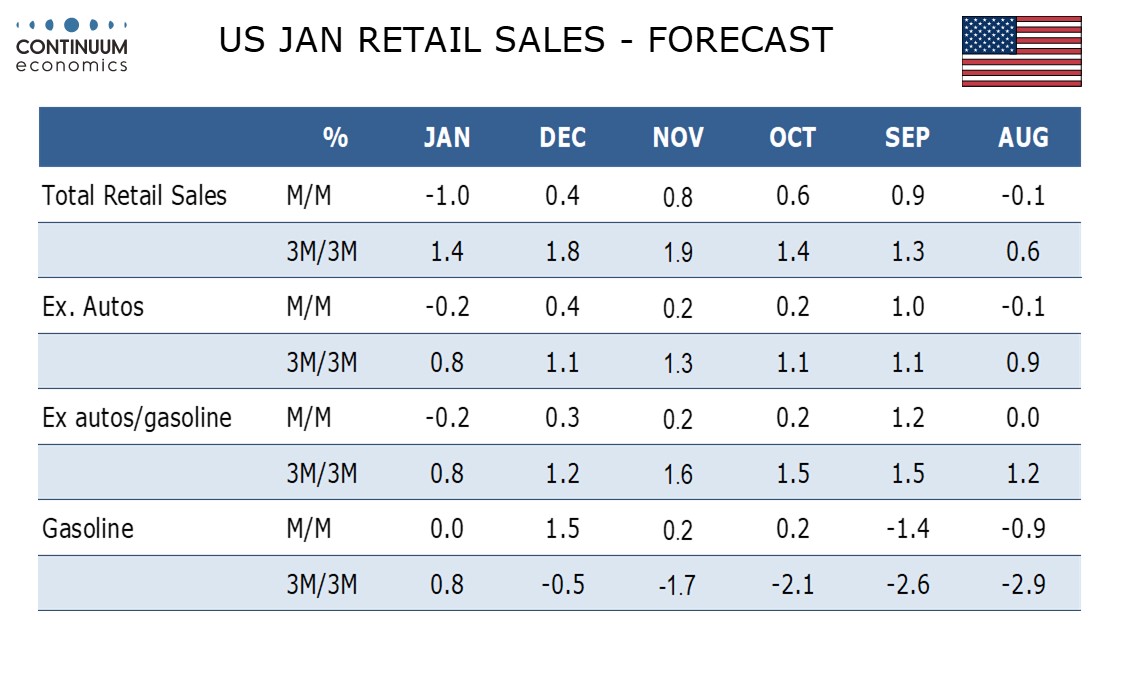

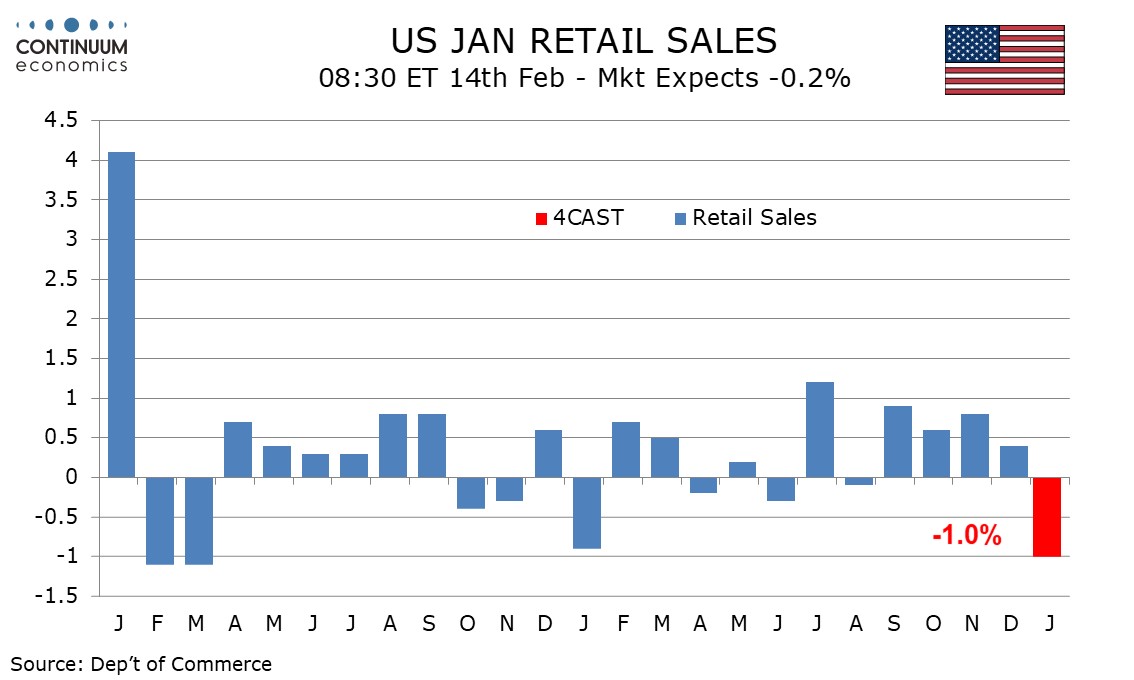

We expect US retail sales to fall by 1.0% in January with declines of 0.2% both ex autos and ex autos and gasoline. The monthly weakness is likely to be largely due to bad weather with potential for a correction from Q4 strength adding to downside risk.

January retail sales are sensitive to weather with a mild January 2023 producing a strong rise that was subsequently corrected and a harsh January 2024 seeing a decline that was subsequently reversed. January 2025 saw exceptionally cold weather in much of the country, as well as fires in Los Angeles.

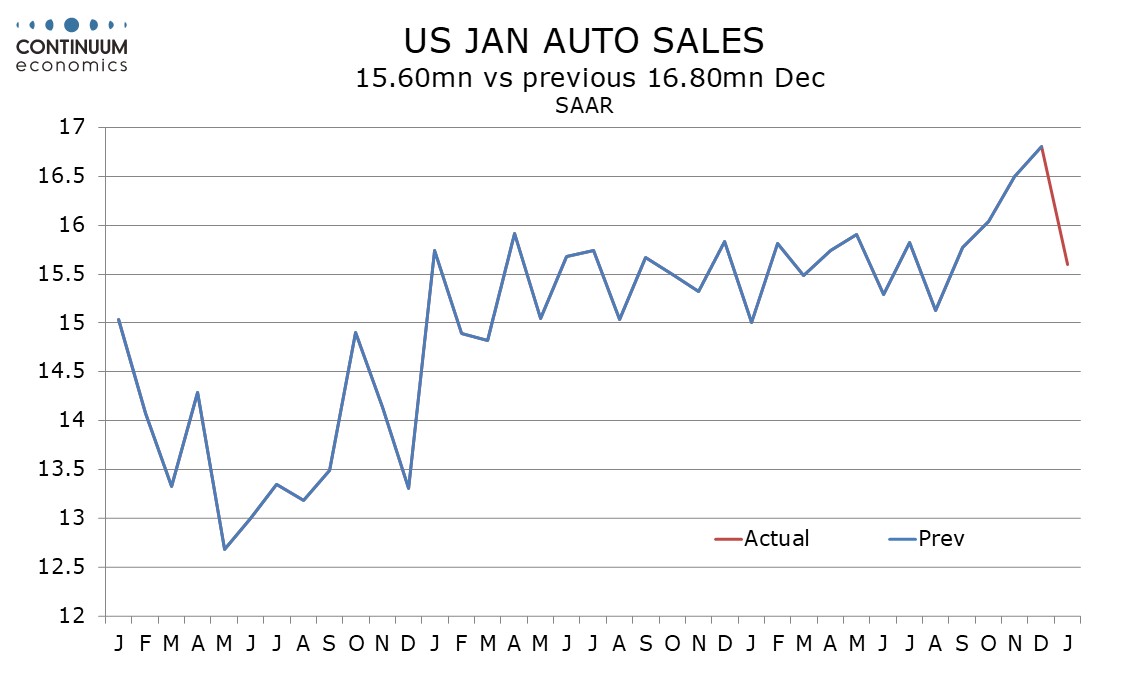

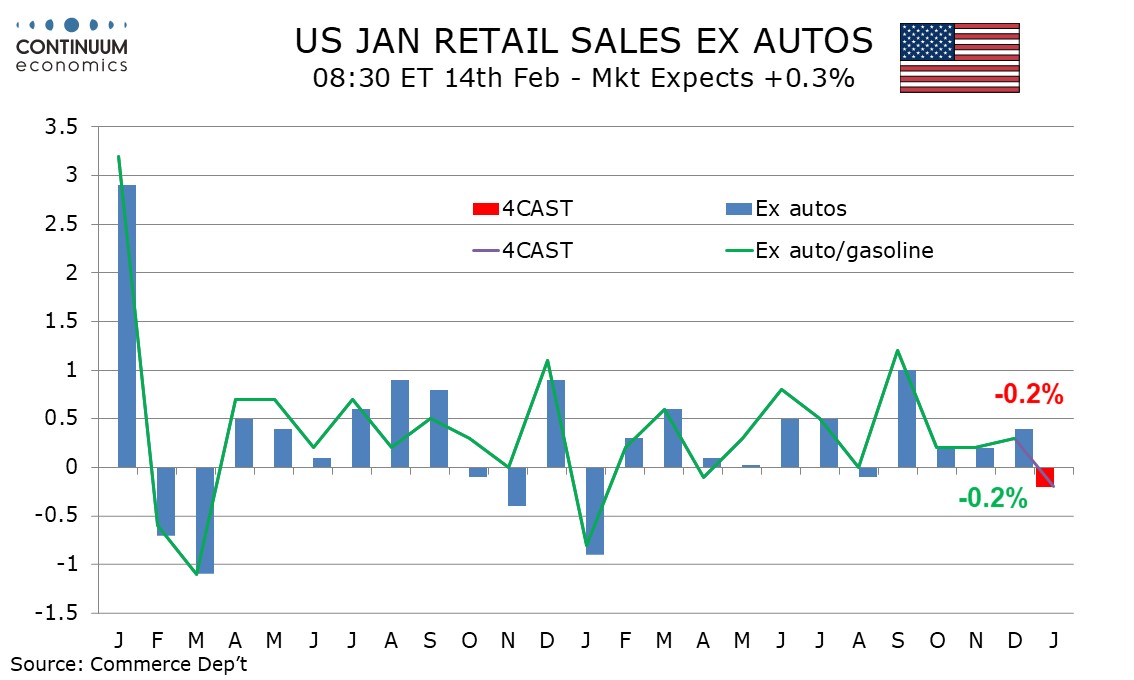

The main downside risk is in autos, where industry sales data reversed strength seen in Q4. Gasoline prices are unlikely to have a significant influence this month.

Q4 consumer spending was surprisingly strong and ran well ahead of real disposable income, suggesting risk of a correction in January. The Q4 strength was led by autos, which we expect to lead January’s dip.

Sales ex autos were less impressive in Q4 but were slightly stronger in December than in October and November and are likely to see some impact from weather. We expect sales ex autos to fall by 0.2% after a 0.4% December rise while sales ex autos and gasoline fall by 0.2% after rising by 0.3% in December.