Published: 2025-07-09T14:43:29.000Z

Preview: Due July 31 - U.S. Q2 Employment Cost Index - Returning to pre-pandemic pace

4

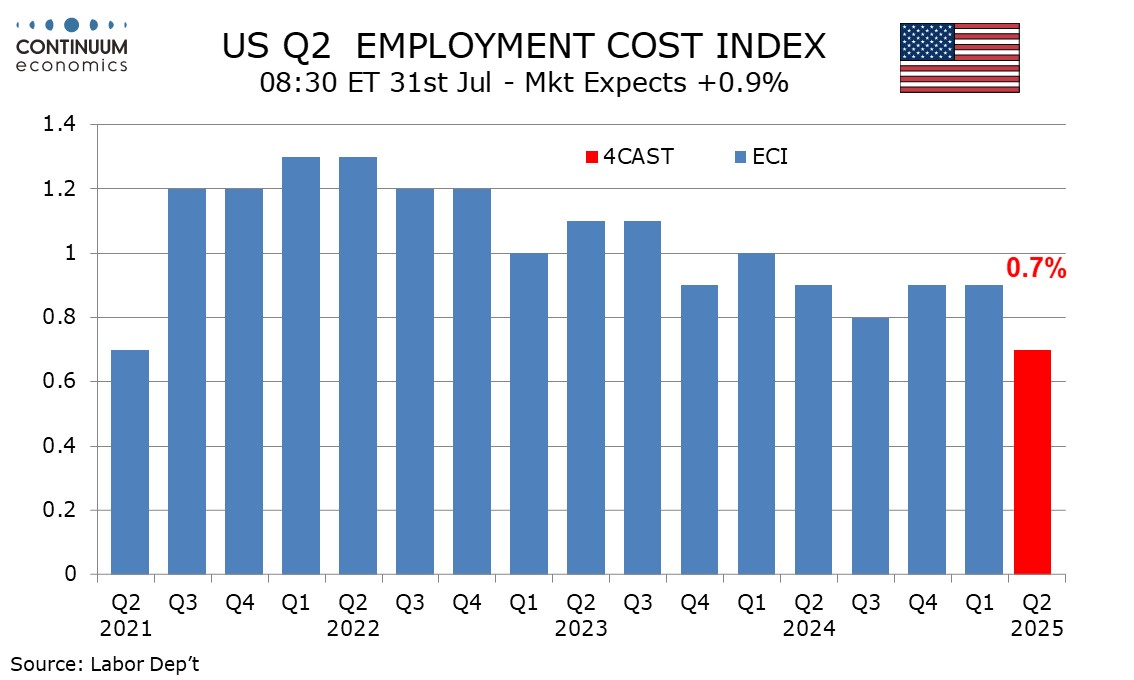

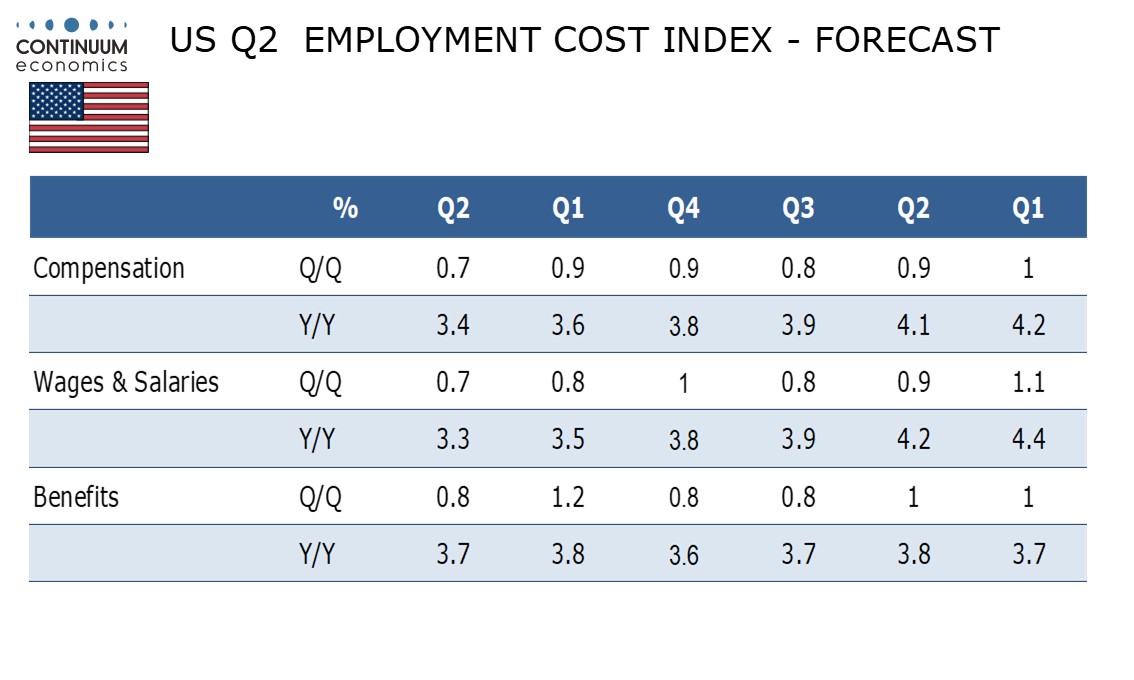

We look for the Q2 employment cost index (ECI) to increase by 0.7%, after two straight gains of 0.9% and the slowest since Q2 2021. A 0.7% rise would be consistent with trend returning to where it was before the pandemic.

We expect a 0.7% rise in wages and salaries, down from 0.8% in Q1 and the slowest since Q3 2020. Trend in non-farm payroll average hourly earnings continues to lose momentum.

We expect a 0.8% rise in benefit costs, matching the gains of Q3 and Q4 of 2024 but down from 1.2% in Q1, which was probably influenced by one-time adjustments for the new year.

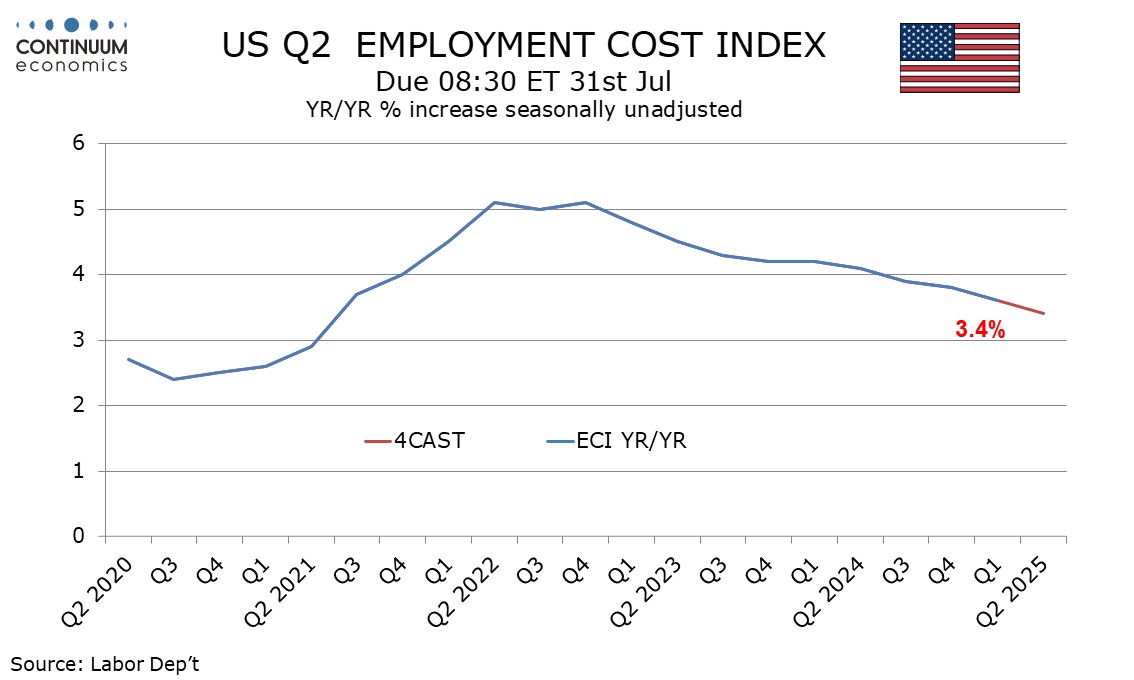

We expect yr/yr growth of 3.4%, down from 3.6% in Q1 and the slowest since Q2 2021. This will still be slightly above the pre-pandemic trend that was slightly below 3.0% but continued gains of 0.7% would be consistent with yr/yr growth slowing below 3.0%. We see wages and salaries up by 3.3% yr/yr with benefits at 3.7%.