EUR, GBP flows: Data supportive of EUR and GBP

Strogn UK retail sales and upward revision in German GDP should underpin EUR and GBP

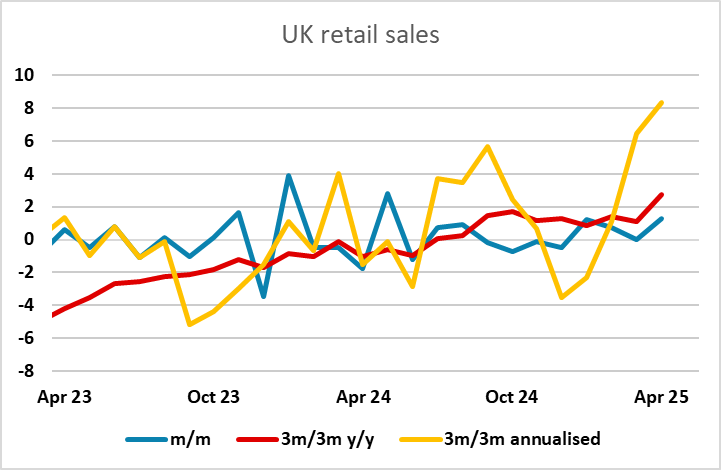

Europe kicks of with a set of significantly stronger than expected numbers. UK retail sales showed another sharp rise in April, and although March was revised down slightly, and the strength of April sales was seen as partly due to weather, the underlying trend seems to have improved significantly in recent months. Nevertheless, GBP is not much changed, with the market possibly seeing the weather effects as reducing the significance of the data.

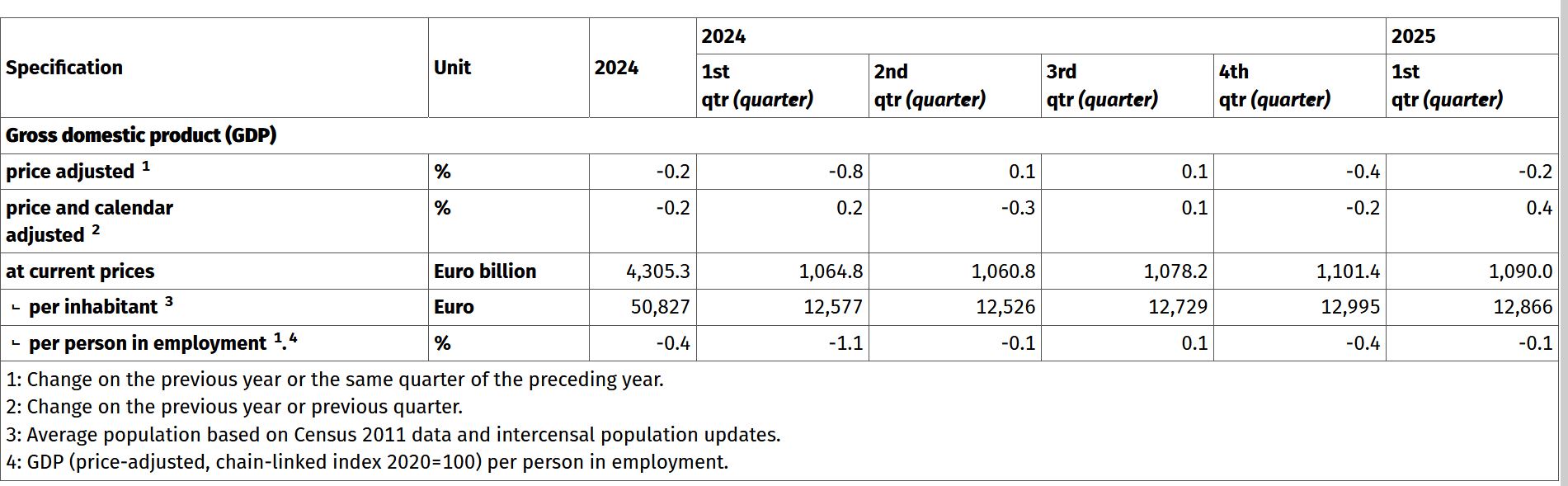

At the same time, we have had a surprising upward revision in the German GDP data to show a 0.4% q/q rise in Q1 from a previously reported 0.2%. This was due to surprisingly strong March data on manufacturing and exports. There is, however, a suspicion that this may relate to the US tariff introduction and the consequent rush to push exports into the US.

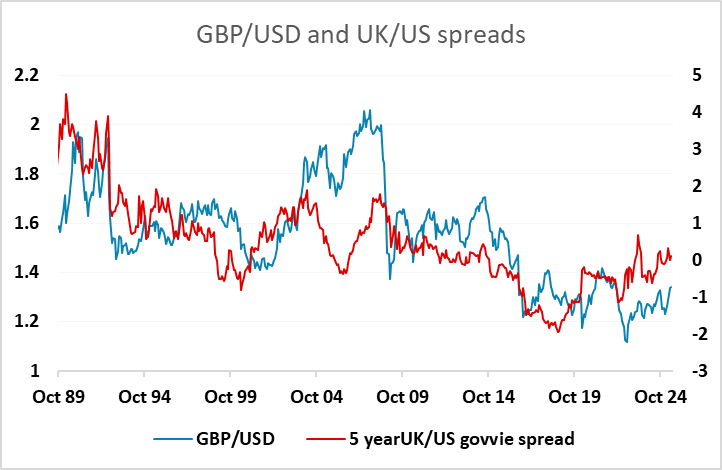

So there are caveats and uncertainties in both the UK retail sales and German GDP data, but despite this they should be supportive for European currencies and risk. There hasn’t been any significant initial reaction in FX markets, with EUR/USD and GBP/USD if anything dipping slightly, but the data should ensure there are buyers on the dip and we would favour the upside in both GBP/USD and EUR/USD today.