USD, JPY, EUR flows: USD better bid after Trump assassination attempt

USD firmer, higher yielders likely more vulnerable with risk appetite a little weaker

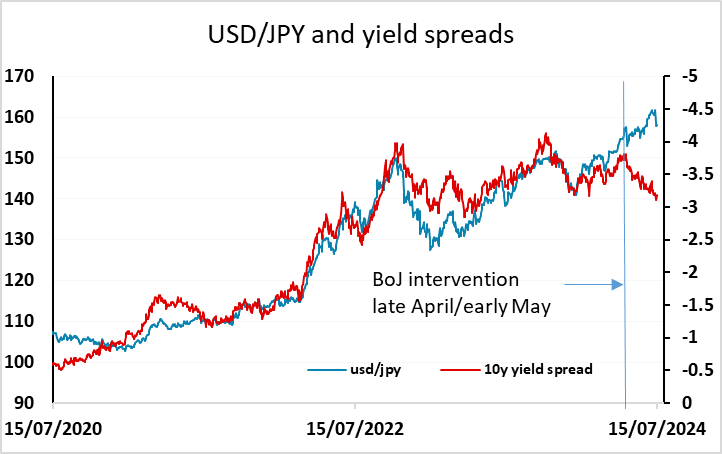

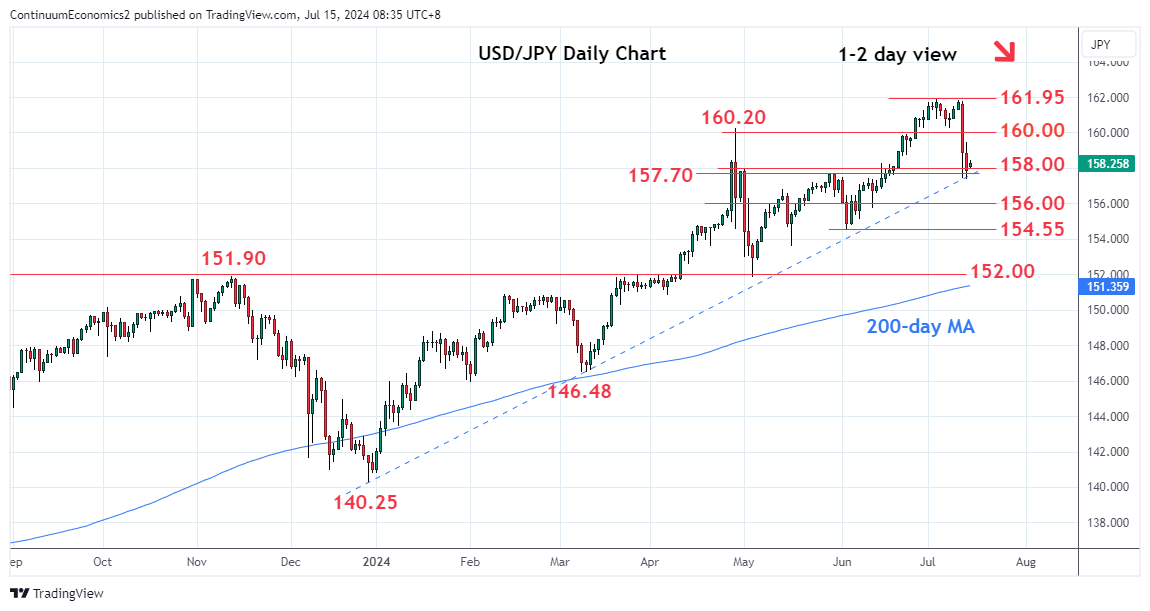

The USD gained a little in the Asian session, helped by the increased expectations of a Trump victory after the assassination attempt at the weekend, and somewhat weaker regional risk appetite after the softer than expected Chinese Q2 GDP data. Weakness was evident in domestic demand, with retail sales up only 2.0% y/y in June, against 3.3% expected. Helped by the generally stronger USD, USD/JPY has bounced from trendline support at 157.36 reached on Friday. From here the JPY bears may see a buying opportunity, as this trendline stayed intact after the last BoJ intervention in late April/early May. While there has been no confirmed BoJ intervention this time as yet, there is a suspicion of BoJ involvement in the post US CPI JPY strength.

However, the case for JPY weakness on the crosses is less clear, with the softer risk tone overnight normally favouring the JPY over the higher yielders. The same trendline support that was effective after the April/May intervention doesn’t come in in EUR/JPY until the 169 area. So if we see any USD strength today it looks more likely to be against the higher yielders, with the JPY gaining on the crosses. In practice, there isn’t any data of any note today so it will probably be a fairly quiet session. The USD rally on the Trump assassination attempt is unlikely to extend too far, as Trump was already a strong favourite to win the election.