USD, JPY, EUR, AUD flows: USD firm after stronger employment report

Higher than expected payrolls and earnings, and lower than expected unemployment support USD gains.

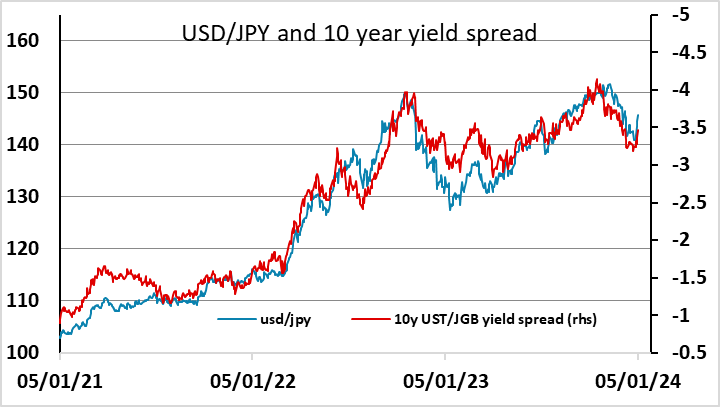

The US employment report is clearly on the strong side of expectations, albeit modestly, with non-farm payrolls 46k above consensus, but private payrolls only 34k above, and, probably more importantly, average hourly earnings at 0.4% m/m. US yields and the USD are consequently higher, with USD/JPY and AUD/USD leading the way. The rise in US yields is comparatively modest and USD/JPY continues to look a little overdone approaching 146, but momentum is with it, and a test of the 146-146.50 resistance area looks likely.

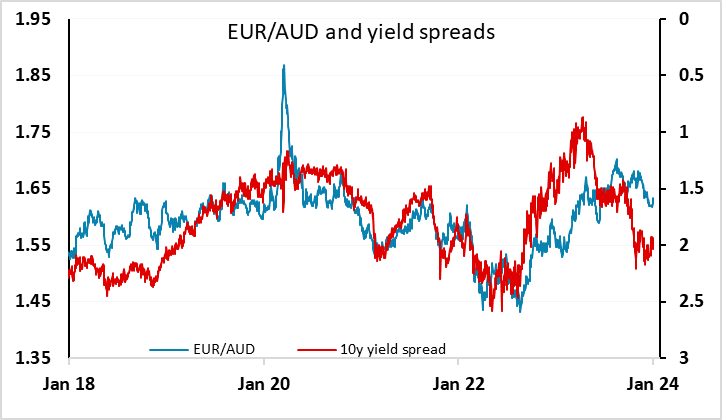

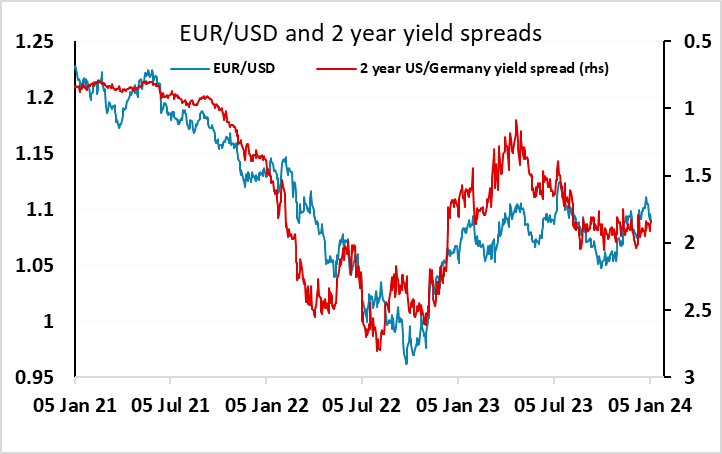

EUR/USD is also lower, but less substantially, with EUR yields also holding firm, although this looks less justified by the data. EUR/AUD continues to look like a clear case for medium term declines (along with EUR/JPY) but as long as equities weaken in the face of rising yields, the recent uptrend probably won’t reverse. For EUR/USD, there may be scope to 1.0850, but spread moves are modest and bigger declines will be hard unless we see EUR yields fall, while EUR/JPY could well need to print 160 before a turn.