USD, JPY, AUD, EUR flows: JPY reverses Monday's gains, USD generally firmer

JPY reverses Monday's gains, AUD the best of the riskier currencies

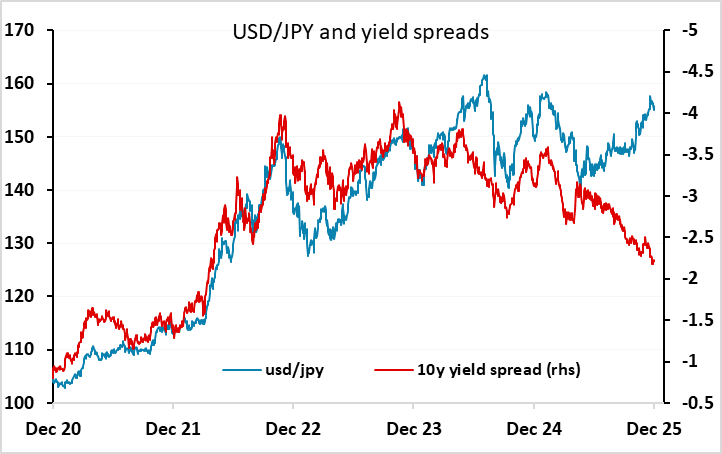

Monday’s JPY gains were much heralded as a reaction to a more hawkish tilt from BoJ governor Ueda, but the gains have been fully reversed overnight without any real trigger. Some of the JPY gains on Monday were due to weaker equities, but equities are little changed after the losses in Asia yesterday. JGB yields are slightly lower this morning, but still well upon Friday, but US 10 year yields also rose and there has been little net change in spreads since Friday. However, spreads have not been a good guide for USD/JPY in recent months anyway, and the rise in US yields is perhaps more significant because of the implied decline in US equity risk premia it creates. This is normally associated with a weaker JPY on the crosses, although this relationship has also broken down since the election of PM Takaichi.

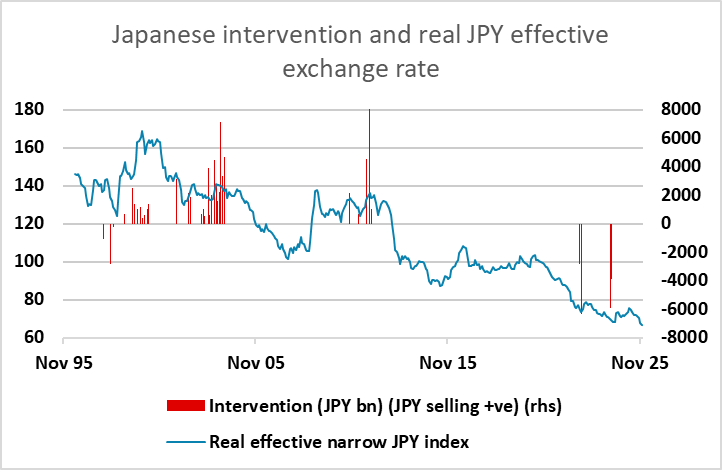

In the end, we still think it is likely that there will need to be a round of BoJ intervention to discourage the JPY bears and turn the JPY trend. Historically, BoJ intervention has been effective from a longer term perspective, marking the major highs and lows in the (real) JPY over the years. But another round is unlikely to be seen unless we see a break below the November JPY lows.

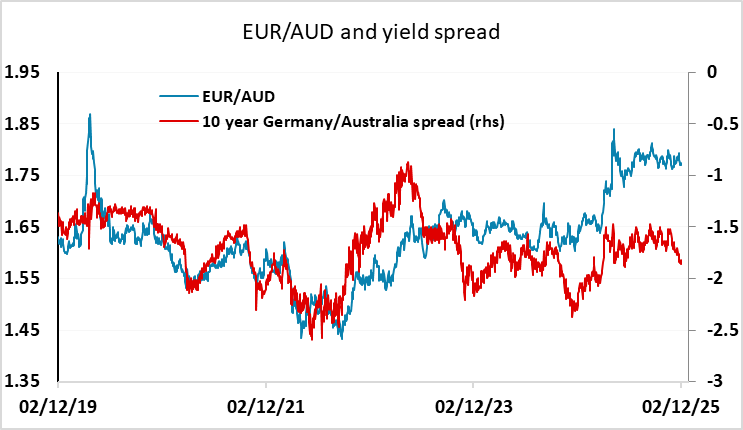

The USD also reversed most of its losses across the board overnight, but the AUD remains reasonably firm in spite of a higher than expected Australian current account deficit reported overnight. We continue to see the AUD as likely to be the best performer in risk positive markets. With little on the calendar today equities may be the main driver for currencies, as the preliminary November Eurozone CPI data due this morning has been well previewed by the national data released last week and is unlikely to trigger market reaction.