FX Daily Strategy: Asia, February 25th

EUR/USD likely to hold the range with risks weighted to the downside

JPY has upside scope but requires an event to break key levels

Market in general awaits news on tariffs to determine risk sentiment

AUD/CAD looks biased higher in most scenarios

EUR/USD likely to hold the range with risks weighted to the downside

JPY has upside scope but requires an event to break key levels

Market in general awaits news on tariffs to determine risk sentiment

AUD/CAD looks biased higher in most scenarios

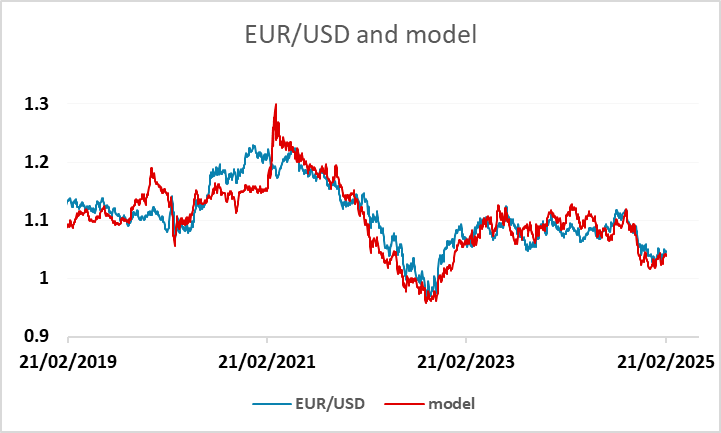

There’s very little of any note on Tuesday’s calendar. The revised Q4 German GDP data will provide some more detail around the release but probably won’t be revised from -0.2% q/q, and even if they are -0.1% or -0.3% will still be seen as a weak performance. In the end, there hasn’t been much net impact from the German election, with the somewhat weaker than expected IFO survey crushing any nascent optimism. Our models still suggest EUR/USD will hold close to 1.04 with risks slightly more on the downside than the upside.

There was a generally softer tone to equities on Monday, due to a combination of Friday’s softer US PMI data and some continued concerns about US tariffs and their likely impact on the global economy. There is also now much less expectation that we are going to see expansionary fiscal policy under the Trump administration. The tax cuts most were anticipating look like struggling to get through Congress, and while the spending cuts being made by DOGE may not be large, they are likely having some effect in both business and consumer confidence. All of this suggests the softer tone to US equities will continue. Whether this can be ameliorated by easier US yields will depend on the tariff outcomes. If tariffs turn out to be more bark than bite, we may see equities being supported by easier Fed policy expectations. But if tariff increases mean that higher inflation risks prevent significant Fed easing, there are downside risks for equities and riskier currencies.

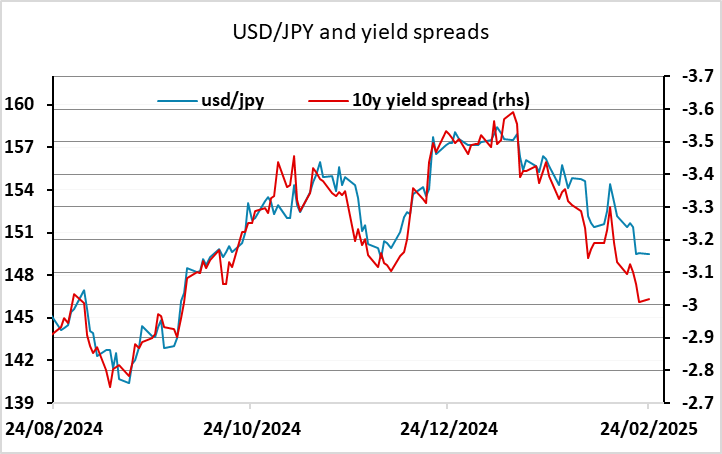

USD/JPY continues to look biased lower, as even with current yields spreads suggests scope for declines. However, there are significant technical support levels in both USD/JPY and EUR/JPY to overcome, which may require some event to break. There is nothing on Tuesday’s calendar that looks significant enough to trigger such a move, so for now JPY bulls may have to be patient.

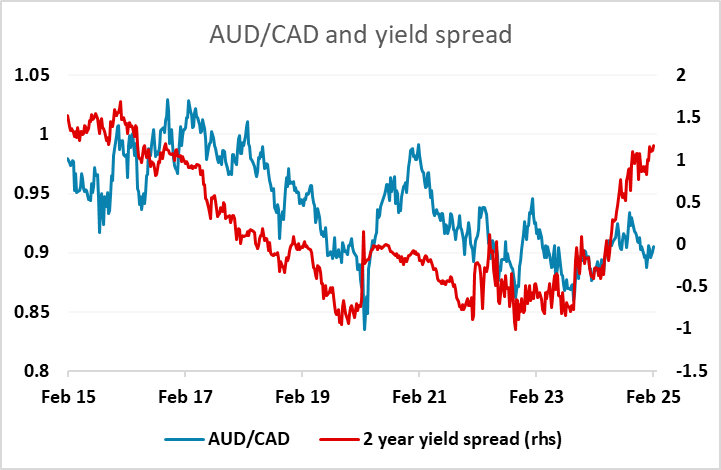

Of the riskier currencies, we still see upside scope for the AUD, but there is significant resistance in AUD/USD at 0.64, and AUD/USD gains will also depend on a reasonably positive risk tone. Inasmuch as this depends on tariffs, AUD/CAD may be a better trade for AUD bulls. There isn’t much real risk of tariffs priced into the CAD, which continues if anything to outperform current yield spreads. If tariffs are imposed, Canada will likely suffer most of the major countries, so while there may be some negative impact on AUD/USD, AUD should outperform CAD, and already looks cheap against CAD based on yield spread correlations.