CHF, JPY flows: CHF strength approaching limits

CHF gains against the EUR reflect some weakening in risk sentiment but the JPY remains the preferred safe haven

The decline in EUR/CHF in the last couple of weeks suggests that there has been a general decline in risk appetite as well as a decline in yields across the board over the period, and some of this decline in risk sentiment is responsible for the strength of the JPY and CHF. However, we would still argue that the JPY has a lot more upside scope than the CHF.

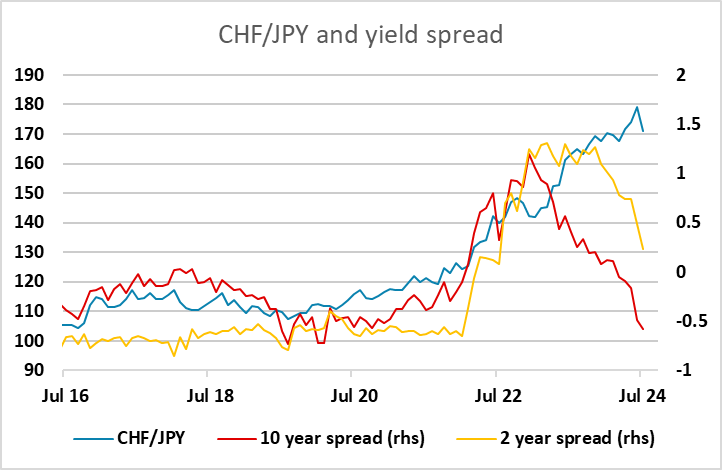

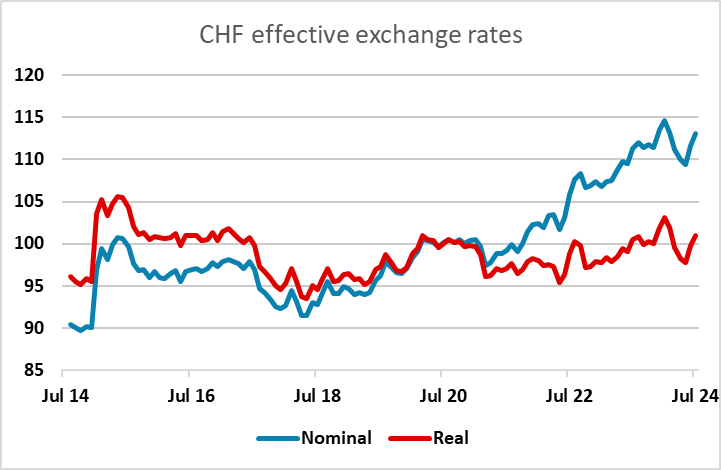

First of all, from a simple value perspective, CHF/JPY remains at hugely overvalued levels, with the recent decline still leaving it 47% higher over the last 4 years. From a yield spread perspective, there is little to choose between the CHF and JPY, and the latest BoJ meeting makes it clear that spreads are likely to move in favour of the JPY going forward. The recent strength in the CHF also takes it to levels where the SNB may be less comfortable. While it is still below the highs seen at the beginning of the year, it is approaching those levels, and while it is un an unremarkable place in real terms, the SNB have made it clear that they would prefer a weaker CHF with inflation now back under control.

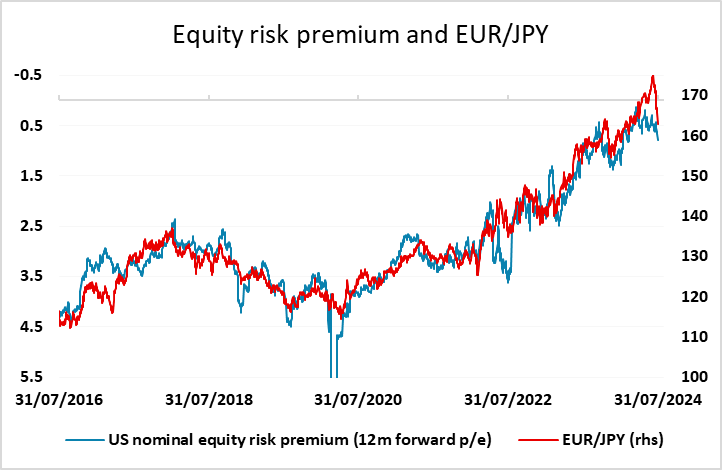

The combination of the decline in yields we have seen in the US and the correction in equities means the correlation with equity risk premia still suggests some downside risks for EUR/JPY, and we would expect that to be mirrored in CHF/JPY and GBP/JPY.