FOMC leaves rates unchanged, more positive on economy, two dovish dissents

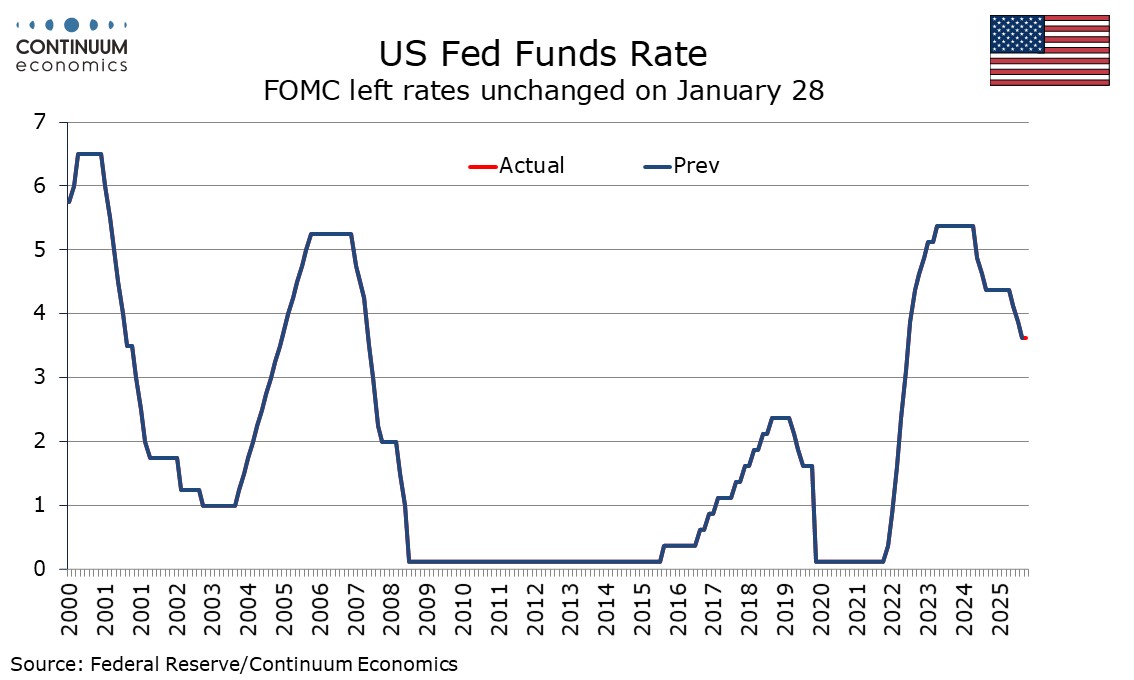

The FOMC has left rates unchanged at 3.5-3.75% as expected, with two dissents for a 25bps easing, from Miran, as was widely expected, and Waller, which was less so. The statement takes a slightly more optimistic view of the economy than the last one in December.

Economic activity is now seen as expanding at a solid pace rather than a moderate one, reflecting an upside surprise in Q3 GDP. the release of which came after December’s meeting, as well as positive signals for Q4. The unemployment rate, previously seen as edging up, is now seen as showing signs of stabilization, and a reference to downside risks to the labor market having risen is removed. They do however state that job gains have remined low, rather than having slowed. On inflation, a reference to it having moved up since earlier in the year is removed but it is still described as somewhat elevated. The change is likely to reflect softer CPI outcomes in Q4 as well as the start of a new year.

A dovish dissent from Stephen Miran was to be expected and it is notable that this time he is only calling for 25bps, with his previous dissents having been for 50bps. A similar dissent from Christopher Waller is less expected but not a major surprise given that he had shifted in a dovish direction in 2025. What is notable is that while Waller did dissent Michelle Bowman did not. We had felt that Bowman had taken a somewhat more dovish stance than Waller in 2025. Both had been seen as contenders for Fed Chair. It may be that Waller is still in the running, but Bowman is not.