U.S. October ISM Services - Healthy, if probably a little overstated

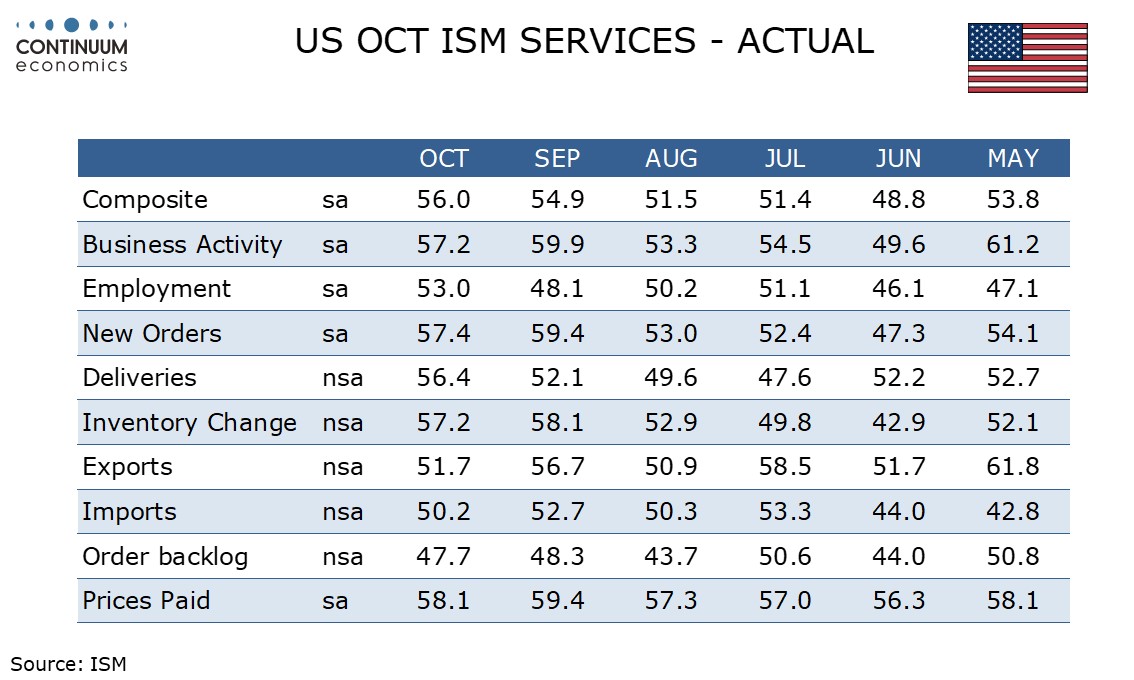

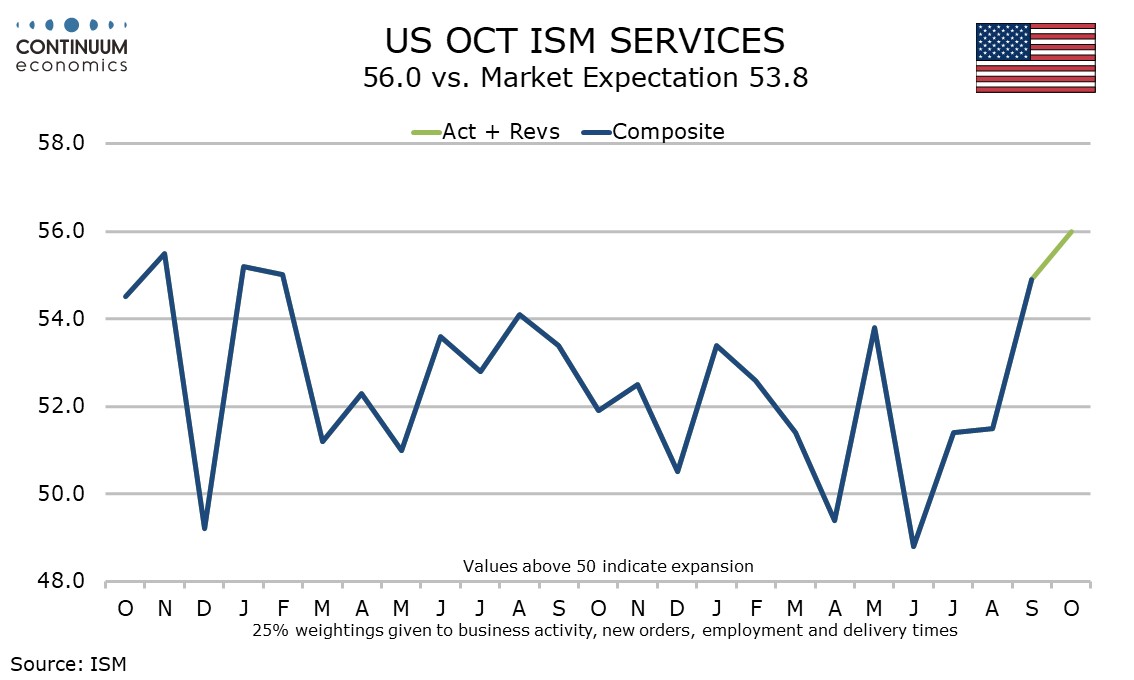

October’s ISM services index at 56.0 from 54.9 is the strongest since August 2022 and while probably a little overstated, particularly a surge in the deliveries index, suggests a healthy underlying economic picture entering Q4.

The data is consistent with the S and P services PMI which has been close to 55 for six straight months, but a little stronger than most regional service sector surveys had suggested, though most of them did improve in October.

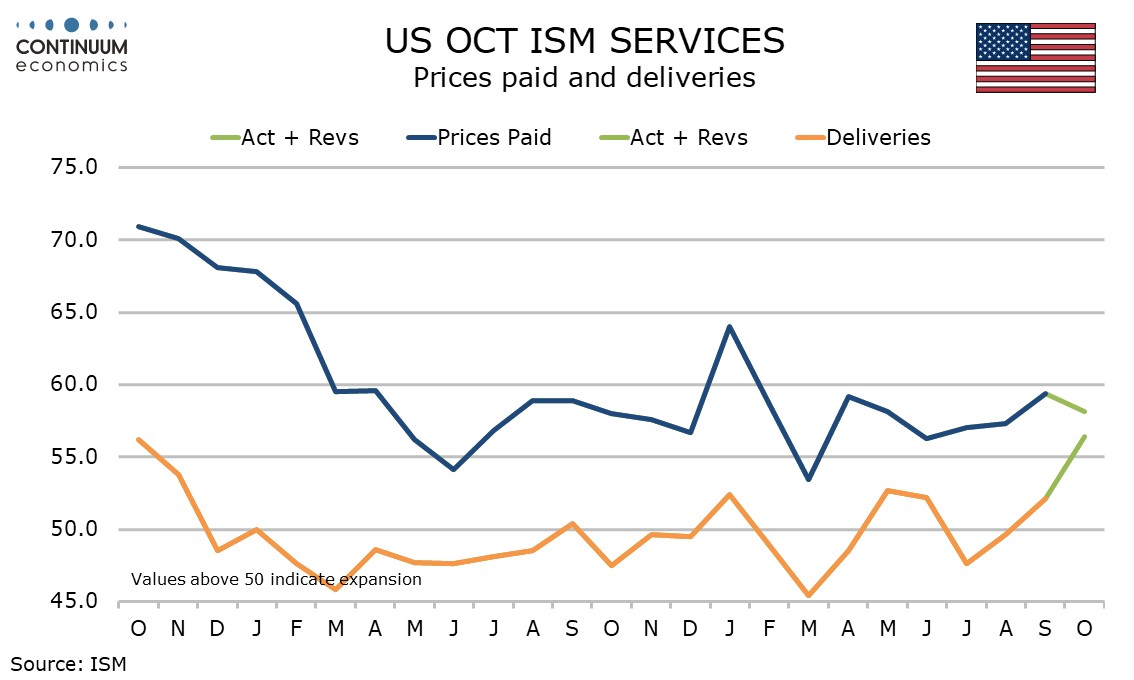

Looking at the four components that make up the composite, the strongest advance was in delivery times, to 56.4 from 52.1, and this may be inflated by the impact of hurricanes and a strike at East coast ports at the start of the month.

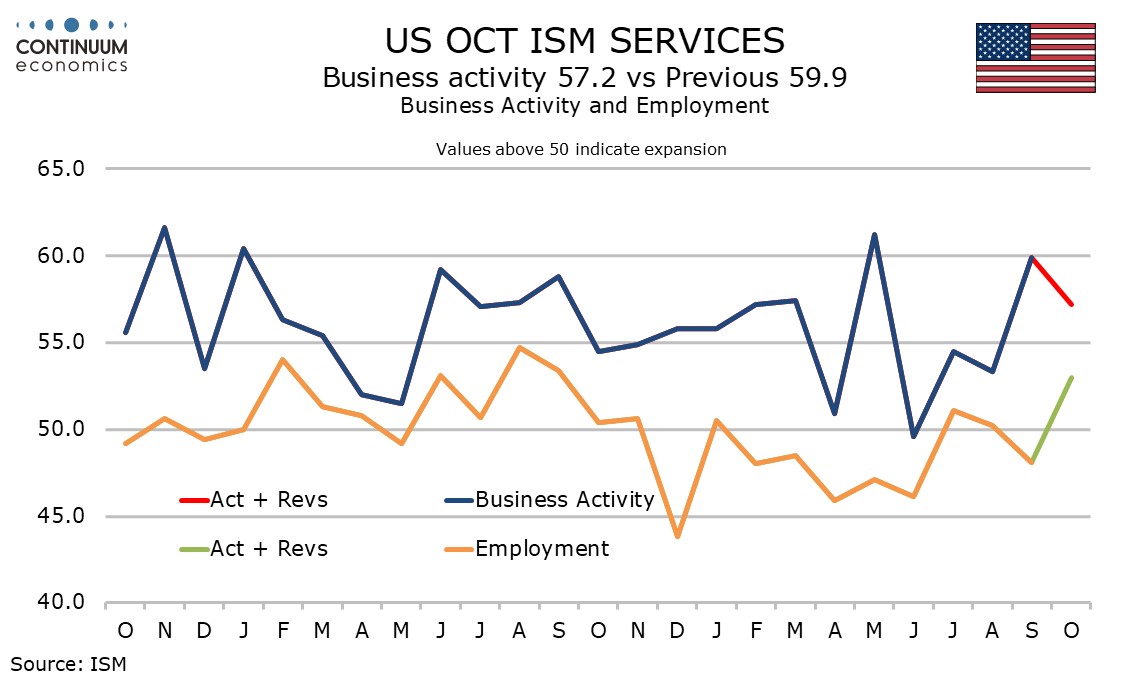

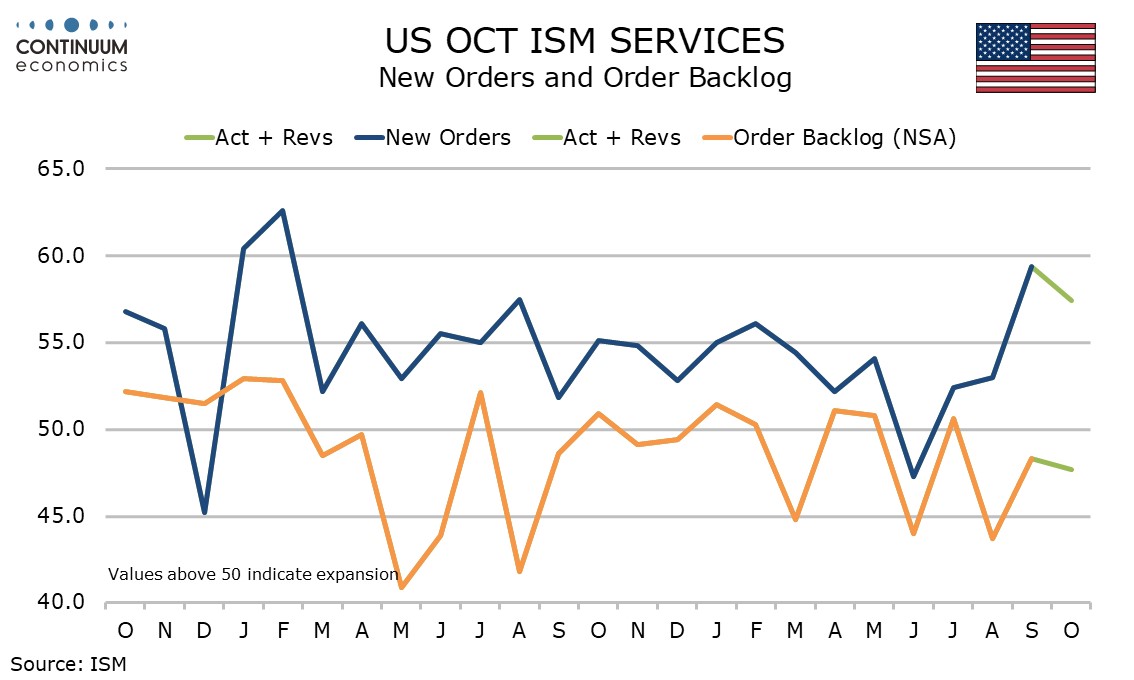

New orders at 57.7 from 59.4 and business activity at 57.2 from 59.9 did correct from sharply improved September readings, but remain healthy and well above those of August.

Employment at 53.0 saw a surprisingly sharp improvement from September’s 48.1 and suggests weakness in October’s non-farm payroll saw a significant negative impact from hurricanes.

Prices paid, which do not contribute to the composite, at 59.1 corrected from September’s 8-month high of 59.4, and remain in a tight range.