JPY flows: More new lows, levels are extreme

JPY declines continue with no BoJ opposition

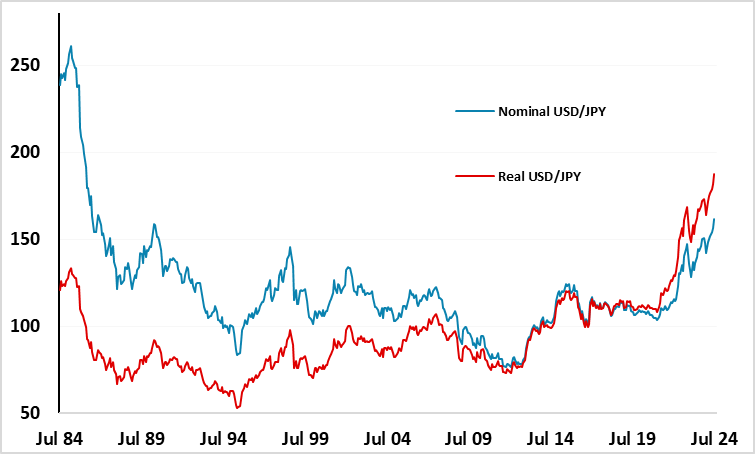

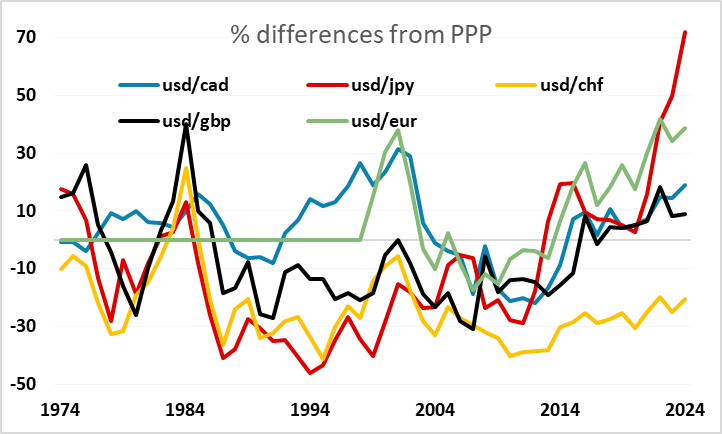

The JPY remains the only game in town, with new 38 year highs in USD/JPY, 32 year highs in EUR/JPY, 34 year highs in AUD/JPY and 16 year highs in GBP/JPY overnight. GBP/JPY is also seeing its 13 consecutive day of gains, which has never happened before. On top of all this, the new JPY lows are actually much, much more extreme than this suggests, as – for instance – US CPI has risen 184% in the period since the November 86 high, while Japanese CPI has risen only 29%. USD/JPY has consequently risen 154% in real terms since the last time it was at this level in nominal terms. The JPY is the weakest relative to PPP that any developed market currency has ever been against the USD.

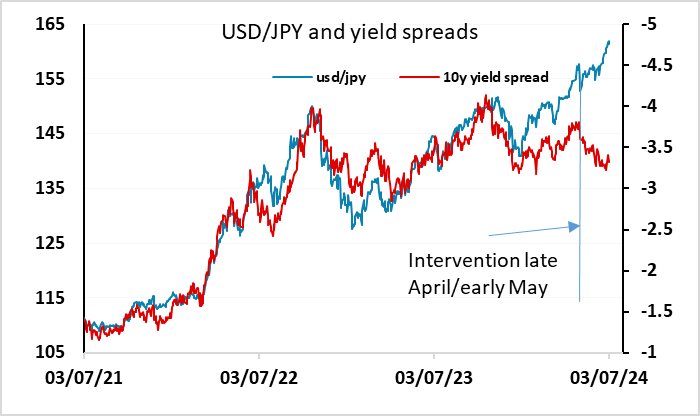

It’s therefore hard to understand what is preventing the Japanese authorities from intervening. The JPY’s decline is huge and the market is very one way, and is not responding to the normal yield spread drivers. Are they waiting until the market is exceptionally short JPY and consequently vulnerable? Because it’s hard to imagine that they can be much shorter. Or have they lost confidence in their ability to influence the market, given the decline in the JPY after their last intervention? Or do they believe that it will turn on its own, given the move in yield spreads in the JPY’s favour we have seen in the last month? Or is there some international pressure not to intervene, reflecting the comments from Yellen in May restating the G7 commitment to only intervene in very rare circumstances? None of these explanations seems entirely satisfactory. But Kanda has been replaced as the top FX diplomat by Mimura, which may indicate a change of policy.

The overnight downward revision in the Japanese services PMI is a further negative indicator for the economy after the downward revision in Q1 GDP earlier in the week, and such news could be discouraging expectations of monetary tightening, but this isn’t being reflected in JGB yields, which have been rising steadily. A BoJ tightening this month remain priced as close to a 50-50 chance. But the March tightening didn’t halt the JPY’s decline, so there is little reason to suppose that a tightening this month would. If the Japanese authorities truly want to halt the JPY’s decline (and recent lack of action means this isn’t any longer 100% clear despite the protestations from Suzuki and others), their best hope is to intervene with the support of the Fed and others. Failing that, they need to step in on their own. Because at the moment the market is seeing the lack of action as a green light for JPY declines.