GBP flows: GBP softer after Labour market data

GBP softer after earnings data shows weakness and unemployment rises. Scope above 0.8550 in EUR/GBP

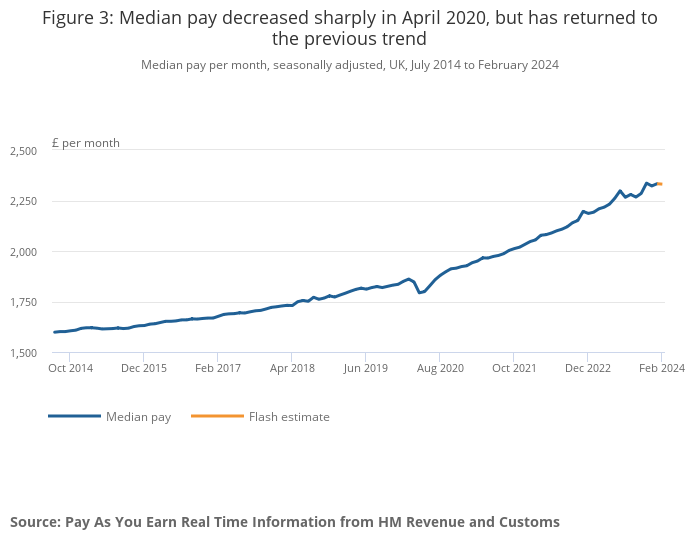

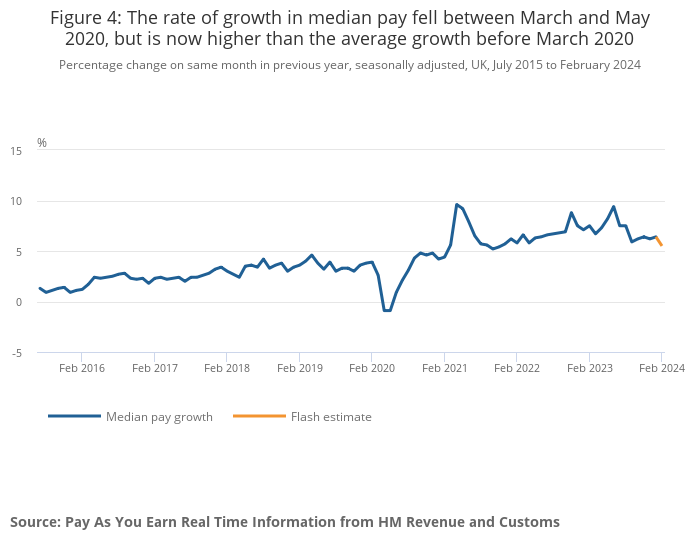

UK average earnings data was on the weak side of expectations, with the most up to data HMRC measure showing a decline in y/y payrolled earnings growth to 5.5% in February, with the ONS measure of earnings growth fell to 6.1% y/y in the 3 months to January. Importantly, pay levels on the HMRC measure have essentially been flat since November, with the y/y growth reflecting base effects rather than any recent increase. Employment data was also on the soft side of expectations. Although the HMRC data showed payrolled employment continued to rise in February, the ONS data showed a 3m/3m decline in employment in January, with the unemployment rate rising to 3.9%.

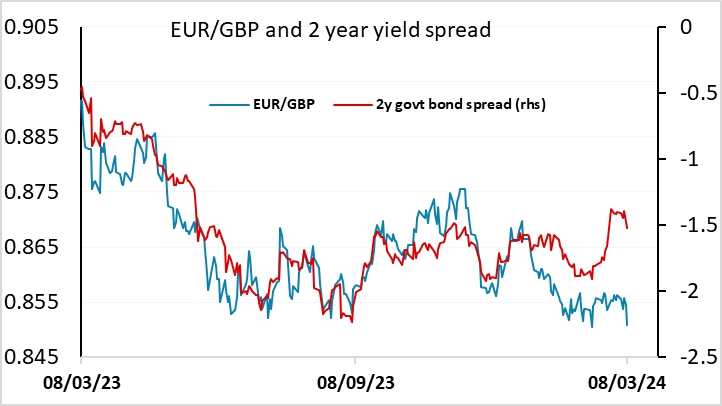

All in all, the labour market data was clearly on the soft side of expectations, and EUR/GBP has moved higher in response. Yield spreads were already at a level that suggested upside scope for EUR/GBP, so the data should ensure EUR/GBP returns to 0.8550 where it has been mostly hovering in recent weeks, and risks shift to the upside as a more dovish BoE take looks likely at next week’s meeting after this set of data.