USD flows: USD slumps on report tariffs to be delayed

The WSJ reports that Trump won't immediately introduce tariffs, triggering a 1% USD decline

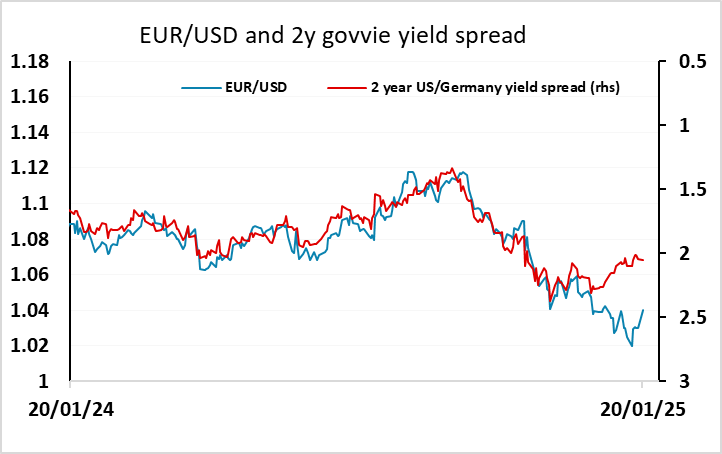

The USD has lost around 1% on a report in the WSJ that Trump will not immediately impose tariffs on trading partners, but will rather investigate unfair trade practices and trade imbalances. USD losses have come across the board, but the riskier currencies have outperformed, with the JPY and CHF both lagging gains elsewhere, with the report also boosting global equities.

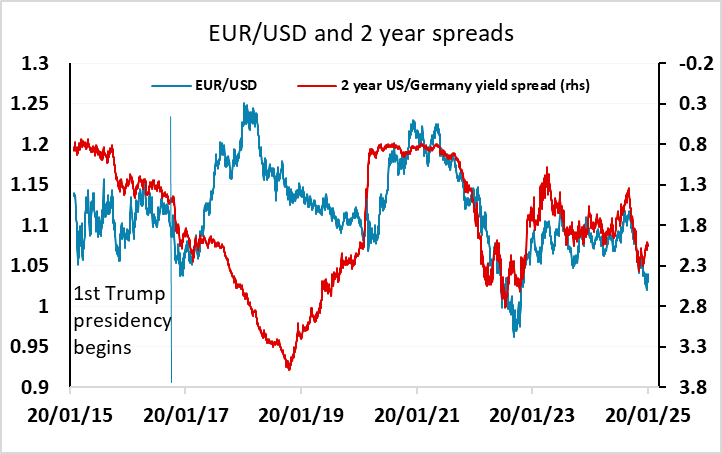

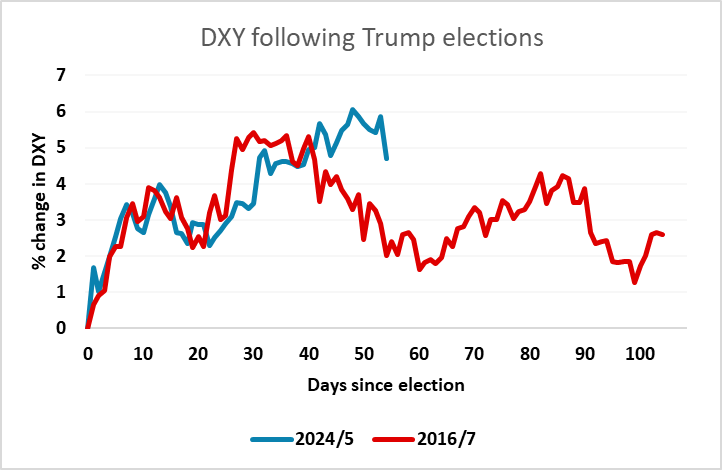

Of course, Trump may still introduce tariffs, and the Eurozone and China might be seen as the most likely targets given their big trade surpluses. But it should also be remembered that the introduction of tariffs in 2017/8 in the first Trump administration didn’t finish up boosting the USD, with the USD weakening quite sharply relative to yield spread movements over the period. As it stands, the USD is following the playbook from the first Trump election victory fairly closely, and the risks look to be towards further USD losses.