USD, EUR, JPY flows: Steady picture, JPY still vulnerable

Steady picture but JPY risks on the downside ahead of Japanese CPI

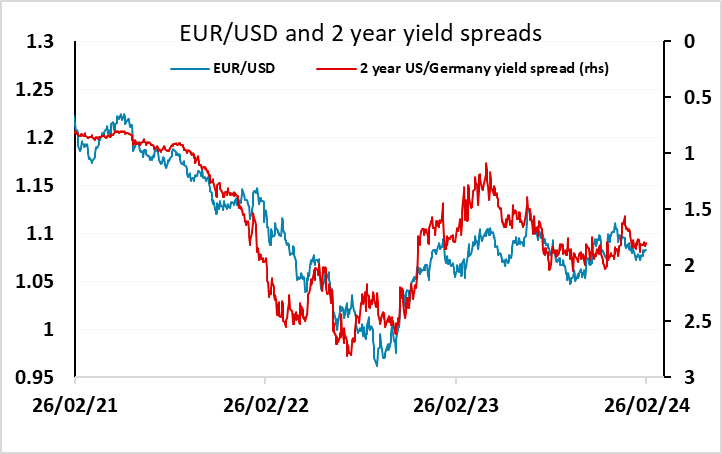

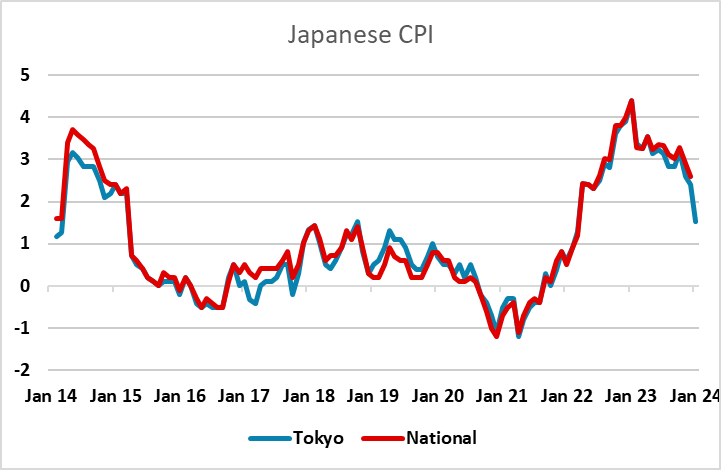

A quiet start to what is likely to be another quiet day in the FX market, with no data of any significance due. While yields are generally a little softer from Friday’s European close, spreads haven’t moved a great deal, so there is little reason for FX reaction. There is Japanese national CPI tomorrow morning, which is the next significant release, but following the weak Tokyo CPI already released, this is likely to support the lower yield profile, with risks to the low side of the market consensus.

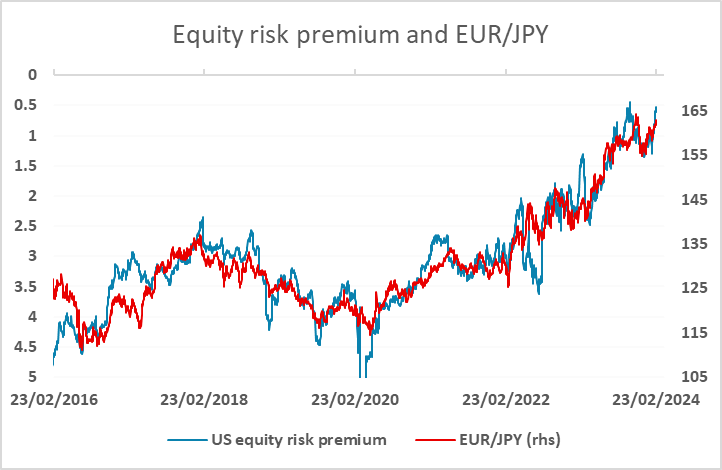

If anything, we still see risks as being towards a stronger EUR and stronger riskier currencies and a weaker JPY on the crosses in the current low vol environment. US equity risk premia remain at extreme lows, suggesting some scope for the JPY to soften based on the correlation of JPY cross movement with US equity risk premia. But the levels are extreme, so any negative equity news could trigger a significant reversal.