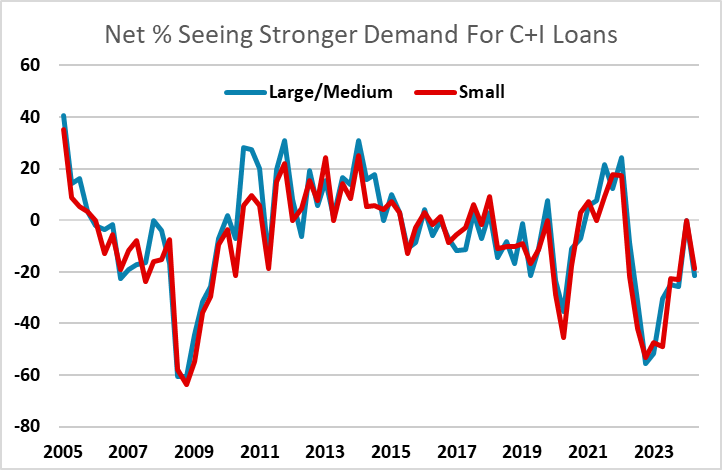

Fed SLOOS on Bank Lending shows weaker demand for C+I loans

After showing an improved tone in Q3, the Fed’s Q4 Senior Loan Officer Opinion Survey of bank lending practices is mixed, with demand for commercial and industrial loans taking a step back. This suggests that strength in business investment, in particular equipment, which supported Q2 and Q3 GDP gains will not be matched in Q4.

In Q3 the net percentages of respondents reporting stronger demand for C+I loans reached neutral in the strongest finding since Q3 2022. For Q4 the results were back to negative, at -21.3% for large and medium firms and -18.6% for small firms, both only marginally less weak than the findings of Q1 and Q2.

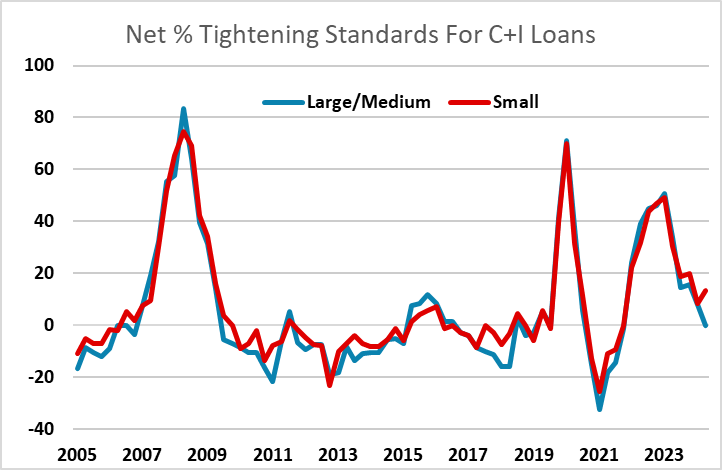

The net percentage tightening standards for C+I loans slipped to neutral from 7.9% for large and medium firms but was higher at 13.3% from 8.2% for small firms.

The net percentage tightening standards for C+I loans slipped to neutral from 7.9% for large and medium firms but was higher at 13.3% from 8.2% for small firms.

Findings for commercial real estate showed a slightly smaller proportion tightening lending standards with demand signals slightly less negative. Standards on mortgage lending were slightly tightened but demand signals were on balance less negative than in Q2. For consumer loans both demand and supply signals were little changed from Q2. Overall it is a mixed report with the weaker demand for C+I loans the most important feature.

Findings for commercial real estate showed a slightly smaller proportion tightening lending standards with demand signals slightly less negative. Standards on mortgage lending were slightly tightened but demand signals were on balance less negative than in Q2. For consumer loans both demand and supply signals were little changed from Q2. Overall it is a mixed report with the weaker demand for C+I loans the most important feature.